Market Snapshot: Asia Pacific 2024

Transactions in the Asia Pacific

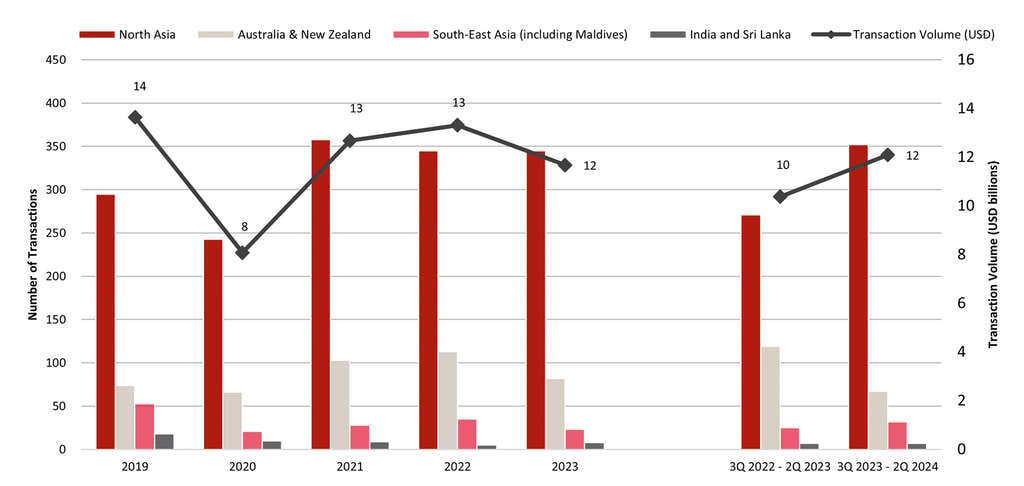

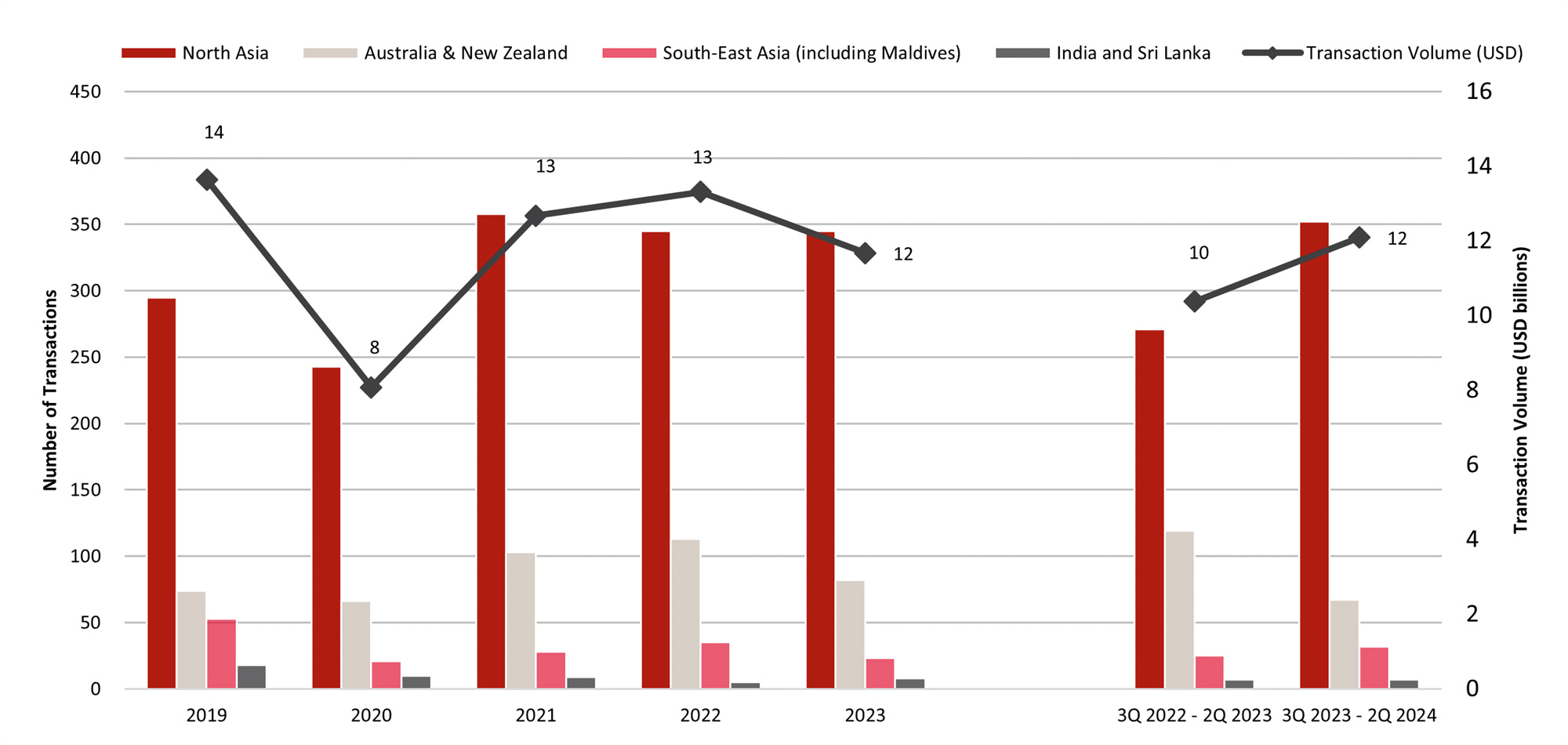

In 2023, hotel transaction volume in the Asia Pacific recorded approximately USD11.7 billion, a 12% decrease from USD13.3 billion from the previous year. The decline in transaction activity can be attributed to the high interest environment, buyer and seller price expectation gap, and a lack of suitable or available hospitality assets in the market. Australasia (Australia and New Zealand), as well as Southeast Asia, observed decreases of 20% and 56% in transaction volume, respectively. However, the trailing 12 months have shown positive signs, with total transaction volume recording a 17% increase, reaching approximately USD12.1 billion. This is fueled by the resurgence in travel demand and strong investor appetite for hotel assets. As the US Federal Reserve begins its easing cycle, the market may continue to see increased transaction activity in the coming year.

Transaction History in the Asia Pacific (2019 - 2Q 2024)

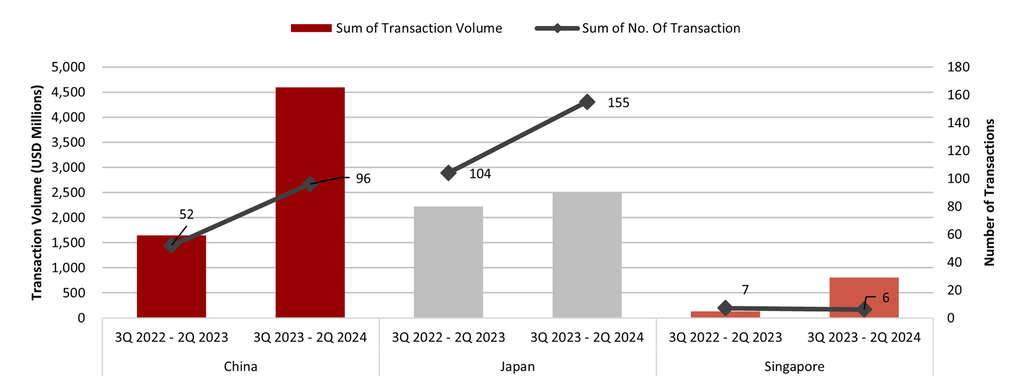

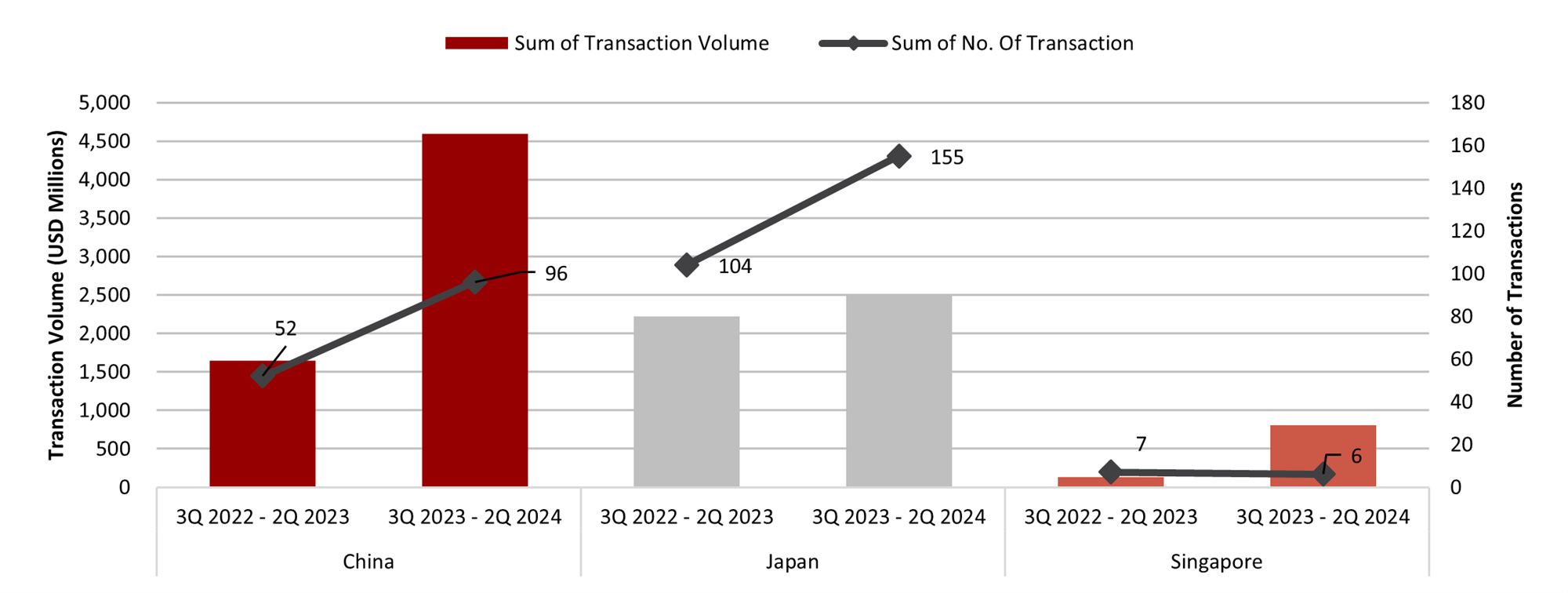

Top Three Most Active Markets (3Q 2023 to 2Q 2024)

Both transaction activity, measured by the number of completed transactions, and transaction volume for hospitality assets have increased over the last four quarters (3Q2023 – 2Q2024) in China, Japan and Singapore. In particular, China recorded a 180% increase in transaction volume compared to the same period last year, reflecting a recovery in the hospitality real estate market, with the majority of support coming from domestic investors. Japan has attracted strong international investor appetite due to robust tourism demand, a weak currency, and low interest rates. Singapore's hotel market has also proven its resilience during the pandemic, supported by a stable and well-established macroeconomic and political environment.

Transaction Volume in Top Three Most Active Markets (3Q 2022- 2Q 2024)

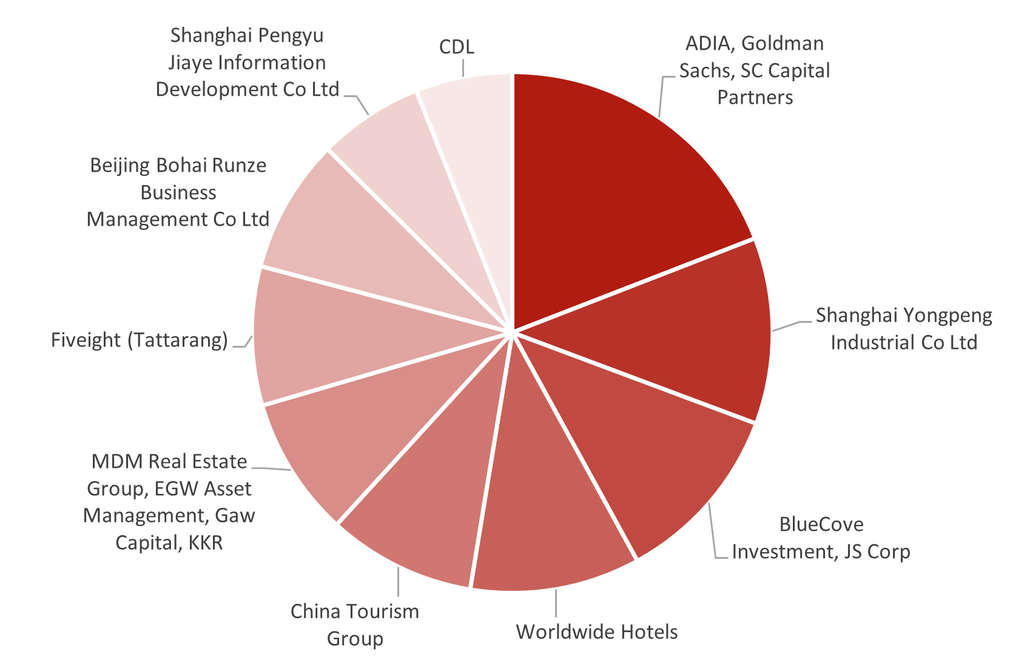

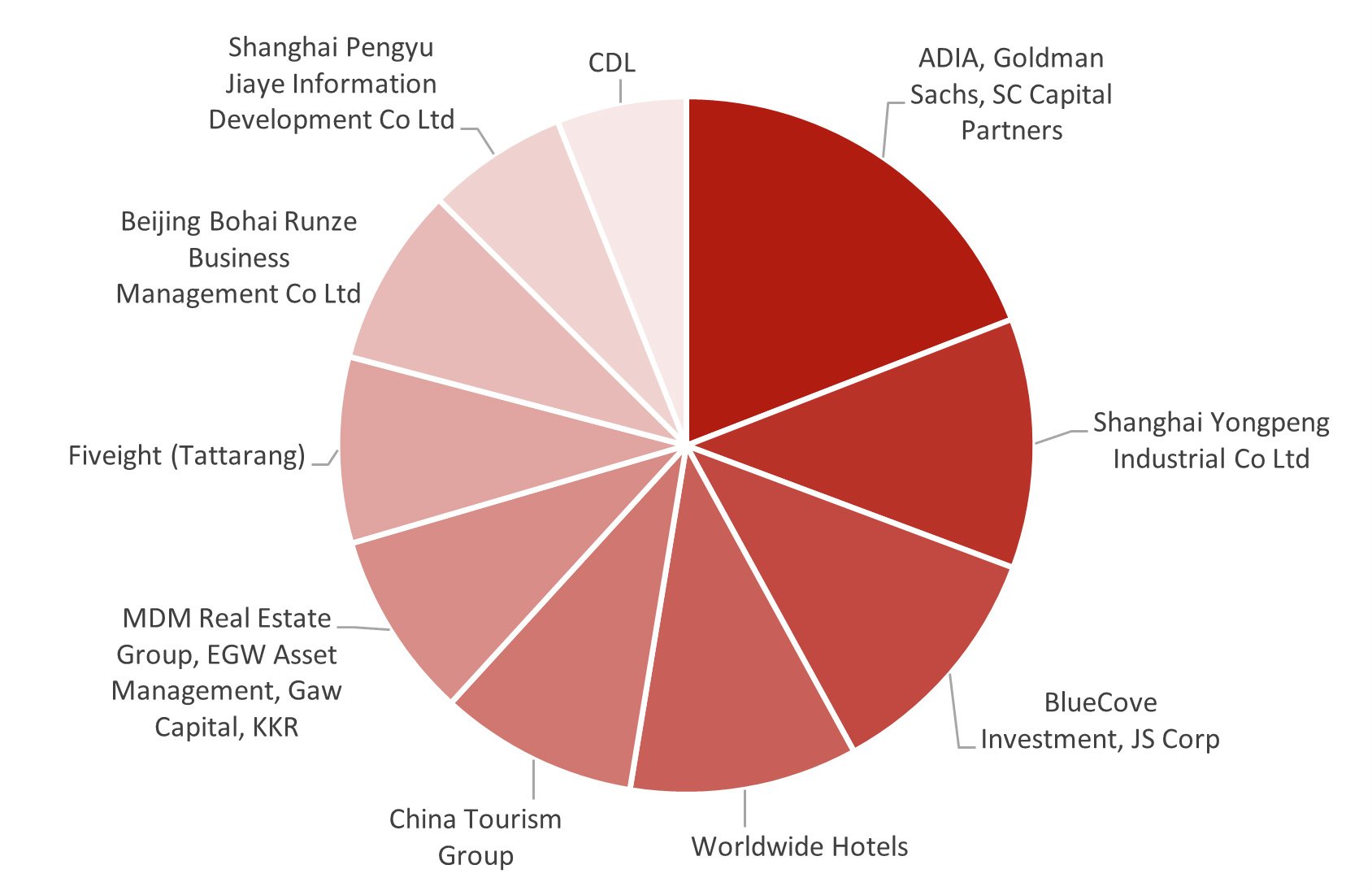

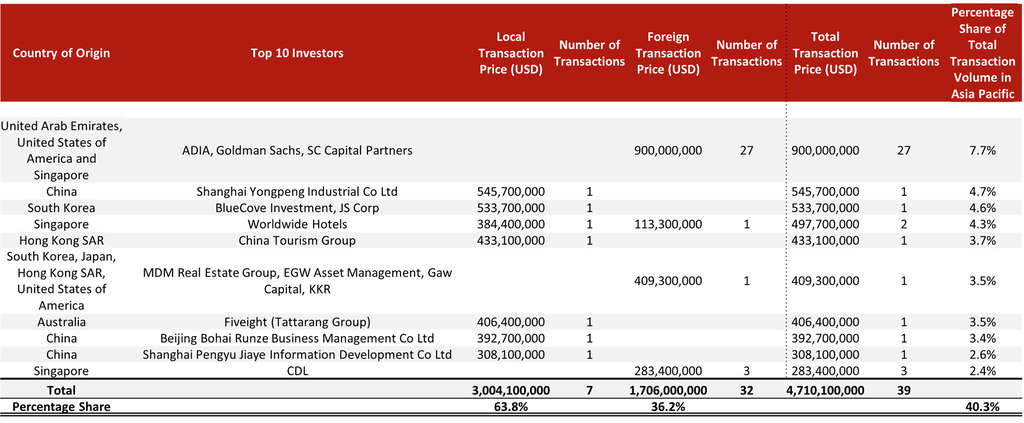

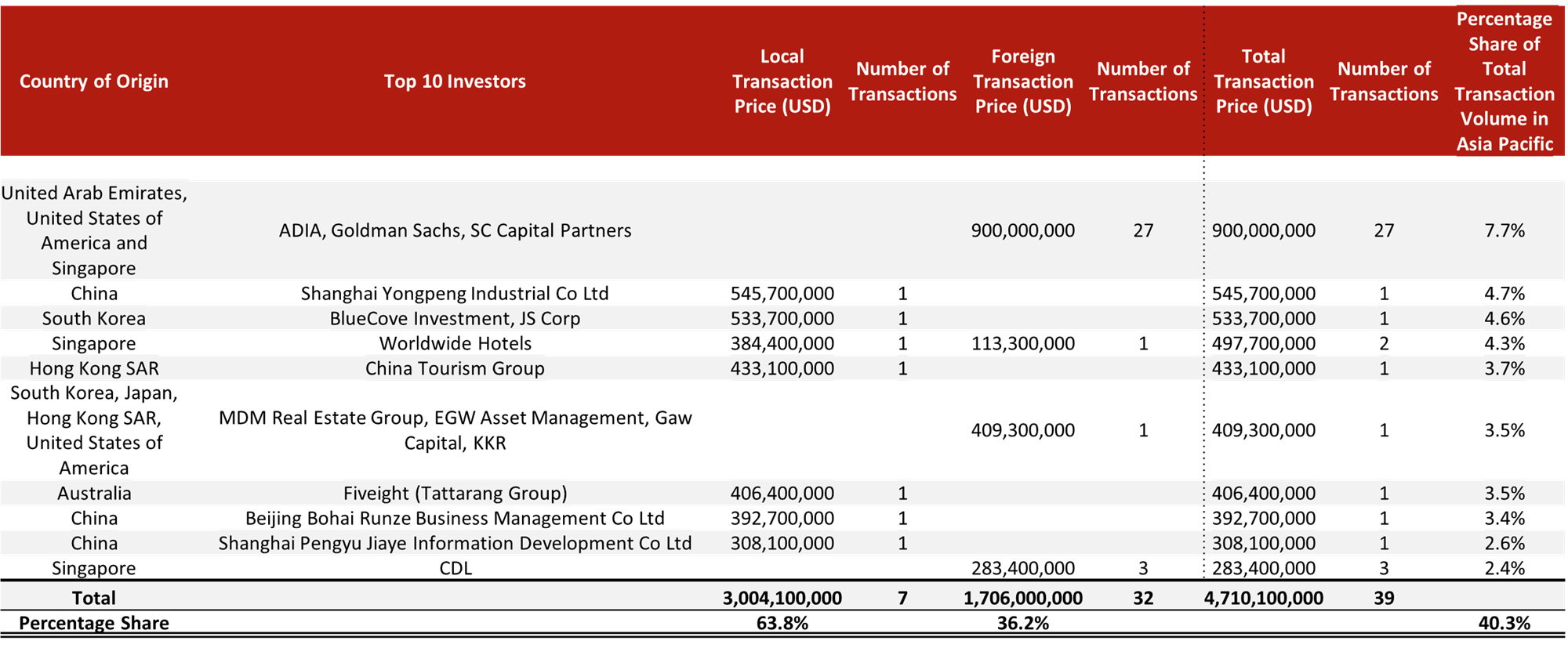

Major Investors in the Asia Pacific

In 2023, transaction activity from the top ten investors in the Asia Pacific accounted for approximately USD4.7 billion or 40% of total transaction volume.

In 2023, we have observed a mix of local and foreign investments, partially contributed by the depreciation of local currency against USD. In terms of the transaction activity by the number of transactions, the consortium formed by UAE-based ADIA, US-based Goldman Sachs, and Singapore-based SC Capital Partners tops the list with the 27-property Daiwa House portfolio deals in Japan, while Japan-based Polaris Holdings recorded 14 with the Red Planet Hotel portfolio deals. Australia-based Salter Brothers took over the third place with the acquisition of 13 properties in Australia.

Top Ten Investors

Hotel Performance in the Asia Pacific (2024)

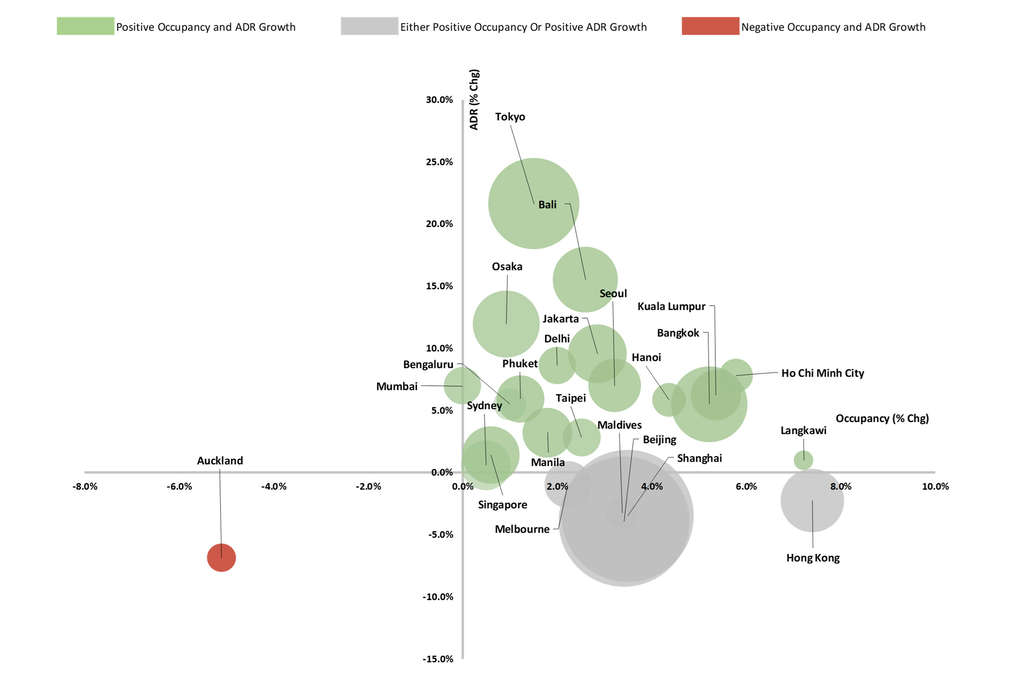

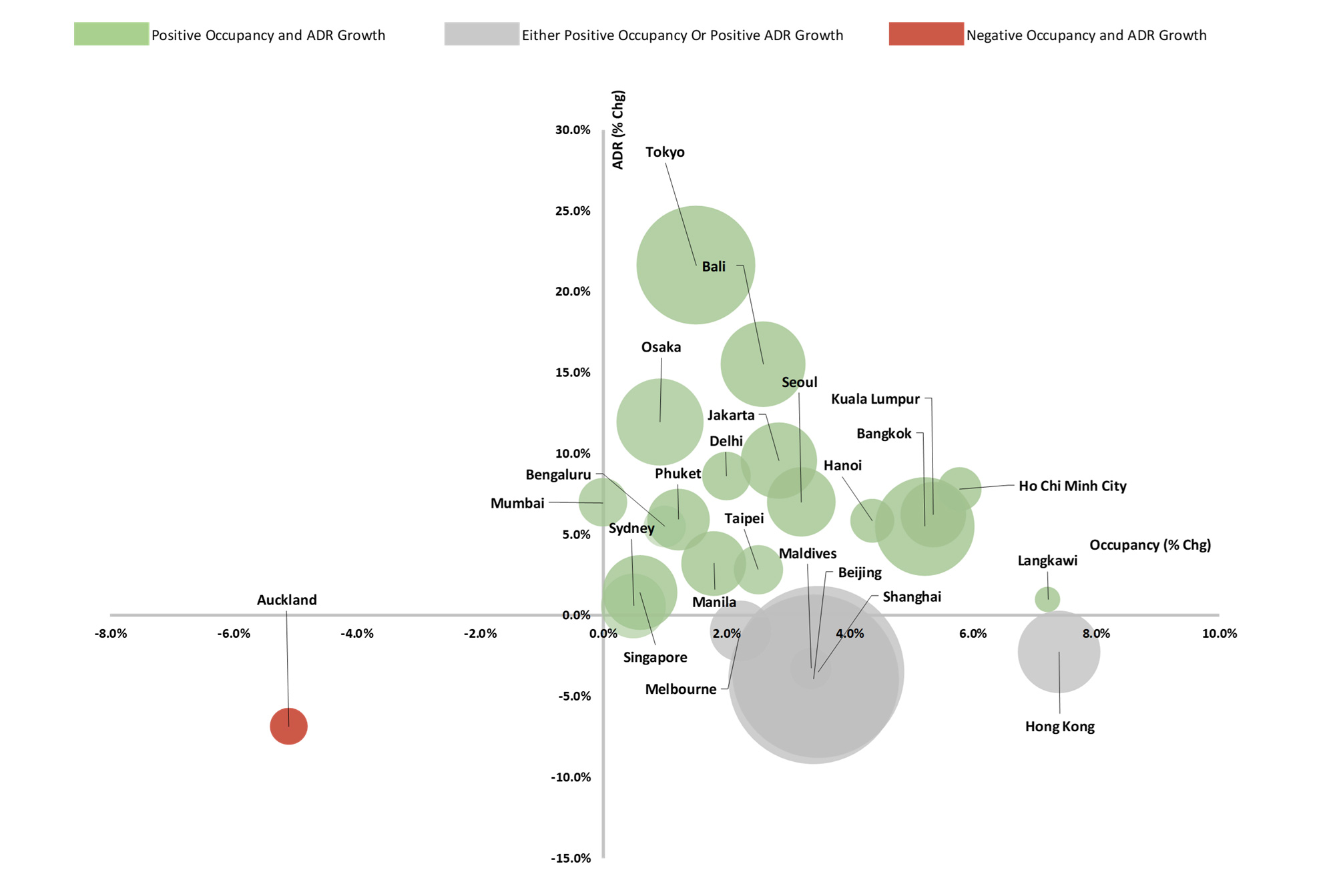

Overall hotel performance across the tracked markets in 2024 is anticipated to continue its recovery. While most markets have not yet reached pre-Covid levels of tourist arrivals, the surge in travel demand has greatly improved market-wide occupancy compared to 2023. ADR has also continued to improve, benefiting from the strong USD and the revenge travel trend. Looking ahead, market occupancy is expected to continue improving, as outbound travel from China has not yet recovered to pre-Covid levels, and air traffic capacity remains restricted by a lack of manpower and aircraft. Markets that saw a significant surge in ADR over the past two years, such as Singapore, the Maldives, and Australia, have observed a more stabilized ADR trend while still gradually recovering in occupancy.

The top five market growth in hotel performances are Tokyo, Bali, Ho Chi Minh City, Kuala Lumpur and Jakarta. In general, hotel performance in Asia Pacific is forecasted to continue its growth trajectory in 2024. Auckland market is expected to register notable decline in hotel performance metrics due to lower domestic demand, lack of major events and increased hotel supply.

Hotel Performance in the Asia Pacific (2024)

Read the full article here.