Myth busting 2: Corporate Social Responsibility Directive (CSRD) vs Sustainable Finance Disclosure Regulation (SFDR)

There's a common misconception that the Corporate Sustainability Reporting Directive (CSRD) and the Sustainable Finance Disclosure Regulation (SFDR) are interchangeable or always need to be discussed together. While both regulations aim to enhance transparency and sustainability in business practices, they serve distinct purposes and target different audiences. The CSRD focuses on corporate sustainability reporting, applying to a broad range of companies across sectors. On the other hand, the SFDR is specific to financial market participants and advisers (Figure 1), ensuring transparency in how sustainability risks are considered in financial products. Although they complement each other in the EU’s broader sustainability agenda, their scopes and requirements do not inherently overlap, and one does not automatically necessitate mention of the other. There is never enough myth-busting. Therefore, in this article, I will explain what you need to know about the Sustainable Finance Disclosure Regulation (SFDR).

In the previous part, I explained how the CSRD is related (or not) to SMEs. If you missed that episode, you may want to click here and read it first. Hence you already know that the CSRD is about reporting. In general terms the CSRD applies to companies meeting at least two of the following criteria: more than 250 employees, a turnover of over €40 million, or a balance sheet total of more than €20 million. And the companies which are publicly listed or considered public interest (regardless of their legal form and size: large, medium and small, such as banks, insurers etc) or large entities[1][2] CSRD sets the legal framework for the European Sustainability Reporting Standards (ESRS). (Stay tuned for some myth-busting related to the ESRS. I have noticed some very common misunderstandings there too, which I want to address.) So, you have already learnt that CSRD is about firms, and it describes the way of reporting. Both CSRD and SFDR are about reporting, but….

The Sustainable Finance Disclosure Regulation (SFDR) primarily governs how financial entities (like banks, investment firms, and insurance companies) disclose sustainability-related information. It aims to enhance transparency on how financial institutions (Figure 1) integrate Environmental, Social, and Governance (ESG) factors into their investment decisions and advisory processes. It is reasonable that financial firms are regulated more strictly due to their role in systemic risk, and financial stability, while non-financial firms may have different reporting and regulatory obligations.

While SFDR itself does not directly regulate the loan approval process for banks, its principles have a significant indirect impact on how banks approve loans to companies, particularly when ESG factors are involved. The UN has estimated that achieving the Sustainable Development Goals (SDGs) by 2030 will require global investments of €2.8 trillion to €4.7 trillion annually. After the COVID-19 pandemic, this figure has increased by an additional €1.9 trillion annually. These funding gaps highlight the need for innovative financial strategies and a more substantial alignment between corporate investments and the SDGs. As the world and the EU face the consequences of climate change, resource depletion and other sustainability‐related issues, urgent action is needed to mobilise capital not only through public policies but also by the private financial services sector. Therefore, financial market participants and financial advisers in the EU must disclose specific information regarding their approaches to the integration of sustainability risks and the consideration of adverse sustainability impacts. In a Communication of 8 March 2018 entitled ‘Action Plan: Financing Sustainable Growth, the Commission set out measures to achieve the following objectives:

- Reorient capital flows towards sustainable investment to achieve sustainable and inclusive growth,

- Manage financial risks stemming from climate change,

- Manage resource depletion,

- Manage environmental degradation,

- Manage social issues,

- Foster transparency and long-termism in financial and economic activity, and

- Governs how financial market participants and financial advisers are to disclose sustainability information to end investors and asset owners.

Meanwhile, both the CSRD and SFDR are about reporting, but the latter focuses on:

- Direct capital towards more sustainable activities.

- Ensure that investors are not misled by false claims.

- ESG transparency in financial market disclosures and sustainable investment practices.

- Leverage data from sustainability reports.

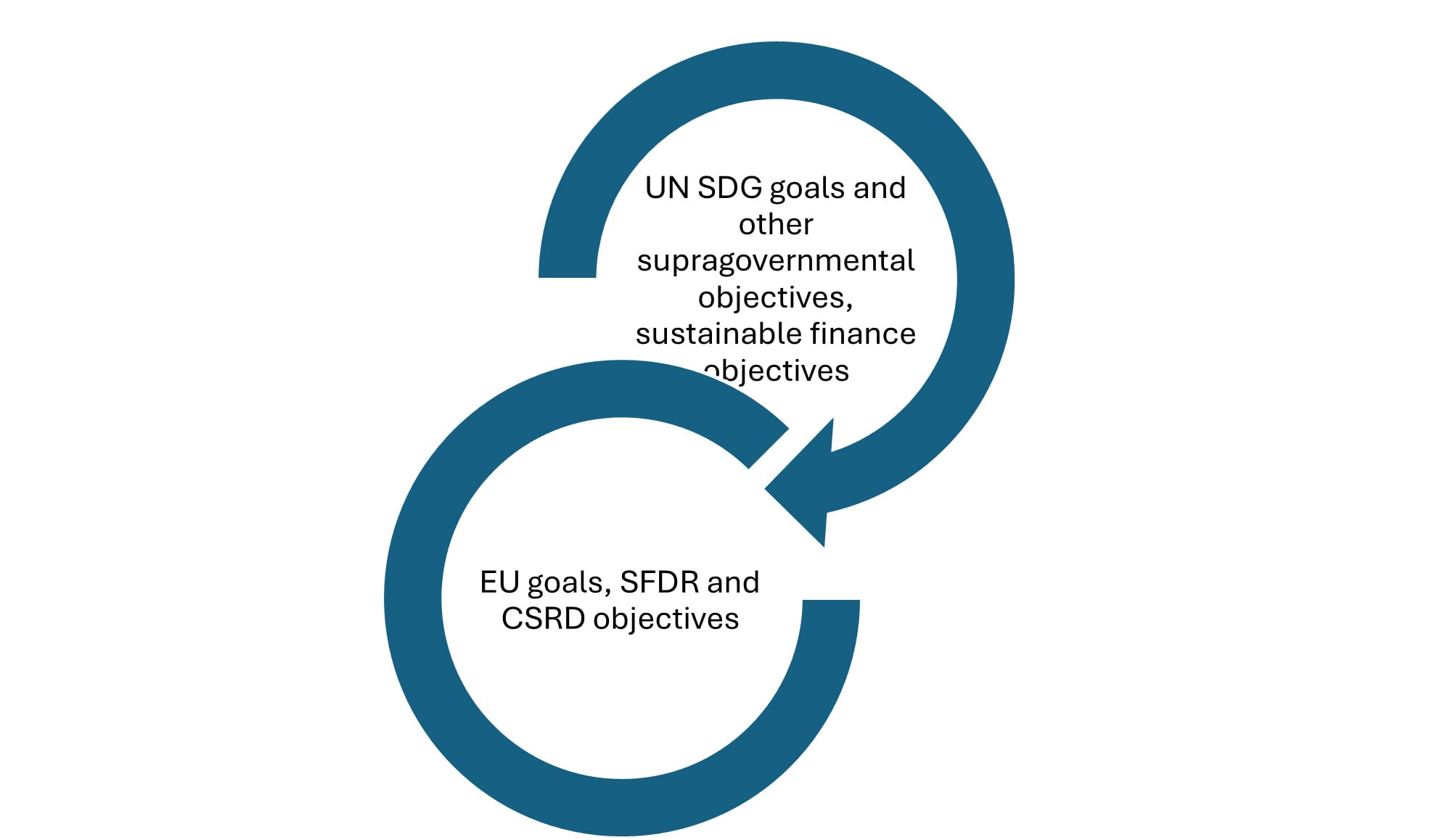

As you can see, the scopes and objectives are different, but they both support a comprehensive and integrated approach to enhancing corporate sustainability and sustainable finance through this interconnected regulatory approach (Figure 2). Meanwhile, the supragovernmental objectives (such as the UN SDG goals) are not legally binding, but countries are expected to cooperate and voluntarily integrate the goals into their national strategy, the EU-created CSRD and SFRD are legally binding obligations. In one of the next articles, we will see how the Action Plan on Financing Sustainable Growth, the EU Green Deal and others are connected. Stay tuned for the next episode.

[1] 1. large private limited companies, public limited companies, general partnerships (in Dutch: vennootschap onder firma) and limited partnerships (in Dutch: commanditaire vennootschap) whose partners are fully liable to their creditors are incorporated under foreign law (see article 1 paragraph 1 draft implementation decree directive sustainability reporting), 2. public interest entities (in summary, banks, insurers and listed companies); 3. medium- and small-sized public interest entities; 4. certain non-EU undertakings. See article 1(1) of the CSRD and its included references for the scope of the CSRD for large undertakings, public interest entities and listed medium- and small-sized enterprises. See article 1(14) of the CSRD for non-EU undertakings. See also articles 2,4 and 6 of the draft implementation decree directive sustainability reporting.

[2] Undertakings from outside the EU are required to publish a sustainability report if the non-EU undertaking meets one of the following conditions:

- realised more than 150-million-euro net turnover within the EU for two consecutive fiscal years

- has a subsidiary that qualifies as a large-, medium- or small-sized listed entity, and/or;

- has a branch with a net turnover of more than 40 million euros for the previous fiscal year.