CEO Pay in Gaming 2024

Co-authored by Emily Whitmore - Associate - AETHOS Consulting Group

The last time we did our Gaming CEO pay study it was pre-pandemic, a landscape very different from the one we know today. The pandemic caused widespread uncertainty and disruption across the globe, with the gaming and entertainment industries being particularly hard hit. This year’s figures, however, reveal a broader trend of recovery and adaptation within the industry, as well as evolving dynamics in executive compensation in the post-pandemic world. Operators are fewer but more global. Much of the casino real estate is owned by REITs and technology is driving innovation and new platforms for customers to access.

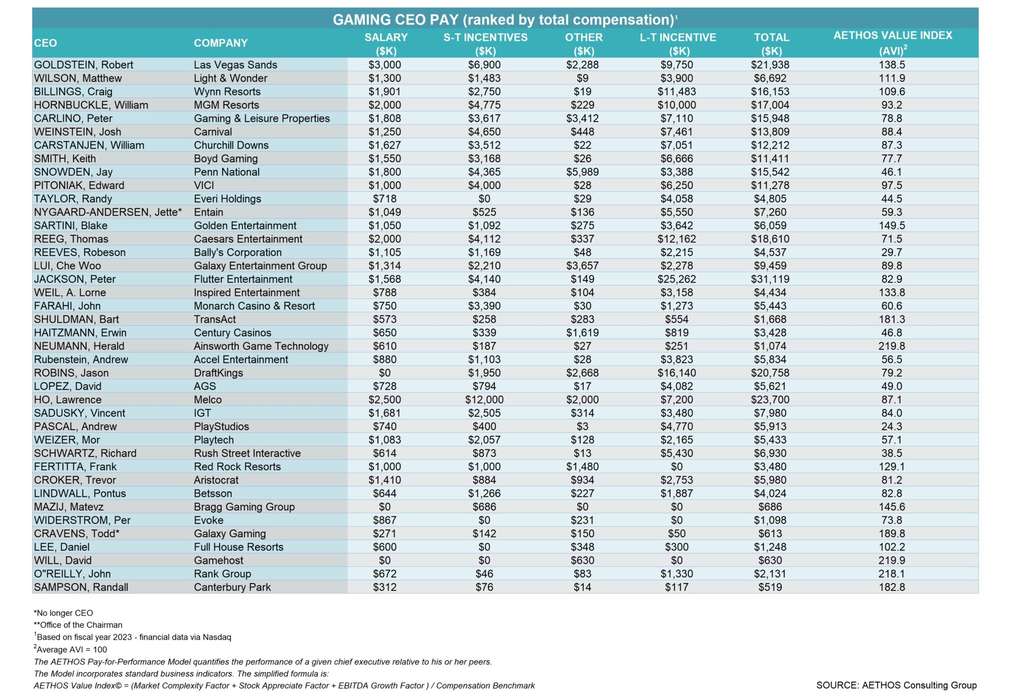

In 2023, Gaming CEO compensation trends closely followed those that we observed in our Hotel CEO study. Long-term incentives accounted for nearly 55% of Gaming CEO pay, while annual bonuses comprised over 24%. Salaries made up only 12.7% of total CEO compensation. Additionally, “other compensation” represented 8.3% of Gaming CEO pay, compared to just 4% for their hospitality counterparts. The average total compensation for a Gaming CEO reached USD $8.6 million, up from USD $6.1 million in 2019. Reflecting stability in a niche industry, Gaming CEOs had an average tenure of 10.2 years, rising well above the 7 years average at all Fortune 500 companies.

Among the CEOs in the gaming industry, Peter Jackson of Flutter Entertainment was the highest paid in 2023, with a total of USD $31.1 million. This year, all ten of the highest-paid gaming CEOs received over USD $13.5 million, compared to USD $10 million in 2019. But as always, it is about whether a CEO earned their pay or not. Our pay-for-performance analysis reveals that David Will of Gamehost and Herald Neumann of Ainsworth Game Technology provided the most value to their shareholders, each achieving the highest AETHOS Value Index (AVI) scores of 219. This performance indicates that both Will and Neumann delivered substantial value relative to their compensation. Specifically, Neumann could have received an additional USD $1.2M and still been deemed appropriately compensated, while Will could have been paid an extra USD $755,000. Other notable executives who demonstrated strong value-for-pay ratios include John O’Reilly at Rank, Todd Cravens, former CEO at Galaxy Gaming, Bart Shuldman at TransAct, Blake Sartini at Golden Entertainment, and Robert Goldstein at LVS.

In terms of market capitalization, gaming companies averaged USD $7.4B in 2023. Maintaining parity with pre-pandemic figures, Las Vegas Sands leads the pack with a substantial market cap of USD $37B. EBITDA figures have shown recovery from the pandemic lows, rising from an average USD $370M in 2021 to USD $891M.

On the investment front in the gaming and entertainment industry, Ainsworth Game Technology, Golden Entertainment, and Full House Resorts have shown impressive stock appreciation, averaging 123.9% over the 2020-2023 period. Conversely, Rush Street Interactive, PlayStudios, Penn Entertainment and Bally’s saw significant erosion of their stock values. It’s no surprise that Bally’s is considering going private, and Penn dumped Barstool.

Overall, while the gaming industry has faced challenges over the past few years, there are clear signs of recovery and growth. We anticipate further expansion, particularly with technology players like SciPlay, Jackpocket, PointsBet entering the market. We also foresee younger players spending more time online and becoming more involved in sports-oriented play. The intersection of gaming, sport, social and entertainment is hard to miss, with the continued growth of Las Vegas serving as a clear testament to this trend.

Keith Kefgen

Managing Director & CEO

+1 718 313 9149

AETHOS Consulting Group