Travel 2040: 2.4 billion reasons to get excited about the future of travel

Hany Abdelkawi leads global innovations within the travel sector at Google. He recently partnered with Deloitte and industry experts, including the CEO for Europe, the Middle East, and Africa (EMEA) of Barceló Hotel Group, on new research that shows what the travel industry will look like by 2040.

The travel industry has faced its share of challenges, but history shows us that it's remarkably resilient. Even in the face of unforeseen events, people’s desire to explore and experience new cultures remains undimmed. In fact, new research from Google and Deloitte predicts a staggering 60% increase in international travellers by 2040.1

We analysed billions of Google Search queries and over 90,000 external data points from the past five decades for this new study on the global mobility trends. It reveals the strong economic correlations and long-term trends that will shape the travel landscape.

In this “travel 2040” vision we see the number of international trips worldwide skyrocket, reaching nearly 2.4 billion.2 But the research isn't just about numbers — it's also about strategic insights that can transform the travel industry; from pinpointing the next travel hotspots to understanding the evolving needs of travellers.

The rise of the Indian traveller and the growing impact of the U.S.

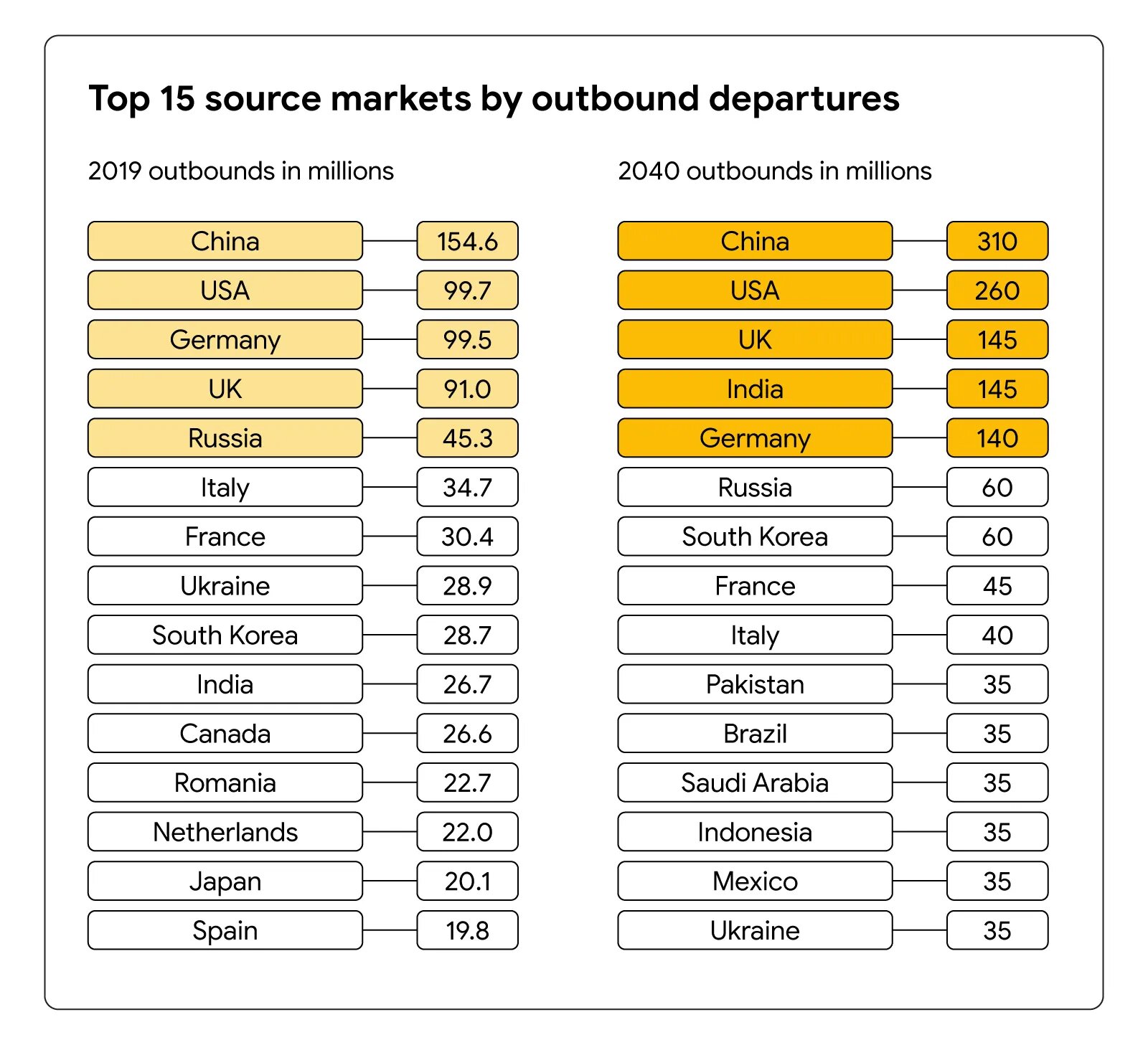

The travel landscape of 2040 will see new top source markets — the areas travellers come from — rise to prominence. And India, China, and the U.S. will be the fastest growing markets in the top 5:

Indian travellers, in particular, are expected to increase by 5X by 2040,3 fuelled by increased passport ownership and eased visa policies. They are digital-savvy and quick decision-makers, booking international flights with an average lead time of less than 50 days.4 (For comparison, the average global lead time is nearly 70 days.5)

The linguistic and cultural diversity in India demands a localised approach from brands. The country has many different languages, with 10 of them having over 30 million native speakers each. And the majority of Indians prefer to use their local language to search and carry out tasks online.

On the other side of the globe, the U.S. remains a powerful source market. U.S. travellers already drive 10% of demand for all European travel and make up 40% of all non-European travellers within the region.6 These are travellers who are extremely brand-conscious, with 78% of U.S. consumers willing to pay more for a brand they know.

Travel companies should focus on establishing — or increasing awareness of — their brand in these emerging and growing source markets now. By 2040 people should already know you when they’re planning their next holiday, rather than discover you for the first time.

Destination diversification: New hotspots emerge

The travel landscape of 2040 is not only shaped by where travellers come from, but also by where they're going. Spain is projected to overtake France as the world's most visited country — although it’s a tight race between both markets — and newcomer Mexico is set to enter the top 5 most popular destinations:7

European countries will continue to be a major draw for holiday go-ers, alongside Asia and North America.

The Middle East is also expected to see an influx of travellers, seeing the highest predicted annual growth rate in inbound arrivals between now and 2040.8 Two markets are doing the heavy lifting here: Saudi Arabia and the United Arab Emirates (UAE). Saudi’s surge in interest is fueled by updated infrastructure and entry visa reforms, powered by ambitious tourism projects, such as Neom and Expo 2030. The UAE’s popularity will be based on delivering high-end experiences and luxury offerings.

“Brands in growing destinations will need to adapt to different kinds of travellers,” says Raúl González, CEO EMEA of Barceló Hotel Group and co-author of the report. “When people booked a hotel 30 years ago, they just wanted a bed. Now they want a personalised and local experience. That’s why 92% of our hotel suppliers are local and we tap into new technology, such as for our virtual experience magic room. It's important to analyse your data to understand new customer expectations. We’re currently building our own CRM, so we can create even more personalised stays in the future.”

The research into the travel landscape of 2040 also shows us that destination diversification within already popular locations will continue to increase. In Indonesia, for example, search interest for emerging regions is rising faster than that of traditional destinations, such as Bali.9

When building out your strategy for the future, look at how you can cater to visitors from different countries. For example, consider whether there are payment options that overseas travellers expect to have access to that may not be mainstream yet locally.

The traveller of the future: Informed, exploratory, and ageing

With the rise of new source markets, we can split the traveller of the future into two distinct categories: emerging and mature. Interestingly, emerging travellers gravitate more towards mature destinations, whereas mature travellers are increasingly drawn to off-the-beaten track locations.10

“Emerging travellers — such as those from India — will initially be looking at markets to be both established travel destinations and close to home,” explains Patricia Ruiz Ramos, senior manager at Deloitte’s strategy consulting practice, Monitor Deloitte. “That's why surrounding countries will see the impact from emerging travellers first. Further away locations, such as those in Europe, will notice the effects as these travellers' spending power increases.”

The research also reveals that both types of travellers will be highly informed and conduct extensive research ahead of their trips. They're not simply booking; they're seeking confidence and reassurance in their decisions.

“As the global population ages and individuals enter retirement in better health, a new segment of travellers with distinct needs and preferences is emerging,” Ruiz Ramos said. “This, coupled with the increasing interest in cultural and historical experiences among travellers from countries like Japan and China, presents a significant opportunity for travel companies to tap into this growing market by tailoring their offerings to meet the specific demands of these travellers.”

Remember, 2.4 billion travellers are waiting. The future of travel belongs to the brands that are prepared.