The Revenue Management Approach To Hotel Costs and Quality

Hoteliers juggle multiple factors in their room rates, including demand, costs, and the hotel’s current online visibility. Revenue management is the science of increasing your profitability every year and requires data from all departments. It’s not just about looking at the numbers: it’s about understanding why those numbers exist in the first place.

This article offers a guide to revenue management analysis to give you ideas on improving your hotel’s profitability.

How Do Hotels Price Rooms?

Those new to revenue management often ask questions about pricing. In the revenue management field, we consider multiple factors.

- Cost

- Competition

- Quality

- Market demand and trends

- Events

- Historical performance

- Forecasting

- Dynamic evolution of initial pricing

What Is Revenue Management?

It is defined as the art and science of selling the right room, at the right moment, for the right price, to the right guest, through the right distribution channel with the best cost efficiency. It’s a science focused on profit maximization.

If you’re used to pricing rooms based primarily on demand, it’s an entirely different and more profitable approach.

Consider your hotel; you have a fixed number of rooms, and you can’t magically expand or contract your inventory based on demand. You also have set costs. Revenue managers view hotel rooms as perishable inventory. Like fresh fruit, rooms that go empty tonight spoil, and you can’t recover that revenue.

Revenue management analyzes all the factors of fixed and variable hotel costs, including historical performance and forecasting, to find the right balance of pricing vs. quality.

Common Misconceptions of Revenue Management

The practice of revenue management is complicated and therefore brings up many misconceptions. Some hoteliers argue: “I cannot sell below a certain rate because I can’t cover costs, and I have huge costs.” Or “I cannot sell below a certain rate because I lose value and the guests will perceive a lower quality, and I will attract low-quality guests; I prefer to keep my room empty or stay closed.”

Revenue management doesn’t mean selling rooms at low rates every day. It also doesn’t mean selling the rooms at high rates every day to attract high-quality guests. Rather, revenue management’s goal is to sell the rooms at the best possible price daily.

First, you’ll want to consider your hotel’s fixed costs

Consider Your Fixed Costs

Every hotel has fixed costs that are unconnected to the number of guests you host.

For example:

- Rent/mortgage.

- Insurance and taxes.

- Fixed monthly costs, such as internet and TV.

- Staff salaries

- Marketing/advertising costs.

You can calculate your fixed costs, divide them by the number of rooms, and by the number of working days (e.g., $ 1.000.000 / 100 rooms / 365 days = $27).

You’re left with a 2-digit number representing the daily fixed cost of each room whether you have a paying guest or not. Everything after that goes to the variable costs and then, profits.

Sometimes, hoteliers think about “unsold rooms” when rooms are empty. Revenue managers think of “permanent loss of money.” That’s a different frame of reference.

Then There Are the Variable Costs

Variable costs vary with occupancy.

For example:

- The room courtesies: slippers, robes, pens, notebooks, etc.

- Bath toiletries and toilet paper, etc.

- Linens

- Utilities: water, gas, and electricity,

- Breakfast (if included in the room rate)

- Housekeeping costs if you use an outsourced service

- Sales channels commissions

With these variables in hand, tally them for the year and divide by number of rooms. Next, divide that number by the number of working days (e.g., $500.000 / 100 rooms / 365 days = $14). This total represents the variable cost per room per day.

If your fixed costs plus variable costs equal $41, what other factors do you need to consider for your room rates?

CostPAR vs. RevPAR

In revenue management, two big ones are RevPAR (Revenue Per Available Room) and its “twin” CostPAR (Cost Per Available Room.)

It’s easy to calculate CostPAR, and when you compare it to RevPAR, you can immediately see the hotel’s economic health.

RevPAR relates to the revenue generated by each room in a single timeframe. Whether empty or occupied in a given day, week, or month, you get RevPAR when you calculate the room revenues and divide it by the total number of available rooms and open days. On the other hand, costPAR represents the costs for a room in a specific time. For example, say you want to calculate your CostPAR per day. Then, you divide the total costs (fixed and variable) by the total number of available rooms and days.

That gives you the CostPAR of $41 (e.g., $1.500.000 / 100 rooms / 365 days = $41.)

You can calculate the CostPAR on a historical basis annually and use that data to forecast next year’s budget.

By now, you may ask another question. How do CostPAR and RevPAR influence pricing? This brings us to the bottom rate. This is the rate below where you won’t sell a room because you’d lose money. In the example above, it’s $41. You won’t sell below $41 because you’d lose money.

With that information, you’ll ask what your starting rate is for the coming year, and you can apply it to each room type.

How does this relate to profit? Compare RevPAR (revenue per available room) to CostPAR (cost per available room.) Is the RevPAR higher on a per unit basis? Your hotel profits when room rates exceed costs. That may seem obvious, yet, not every hotelier understands CostPAR, RevPAR, and Bottom Rate because it gets complicated.

CostPAR vs. Bottom Rate

Many hoteliers hold a view that the bottom rate must be higher than CostPAR. They think even a $1 will make a difference.

At first glance, this makes sense. After all, you don’t want to lose money on your rooms. But revenue management thinking goes deeper.

The fundamental problem with this line of thinking is the assumption your hotel will reach 100% occupancy daily at that price or above. Yet, you know that’s not how hotels work.

Demand varies depending on the season, competition, and other factors. Most hoteliers face times when guests are only willing to pay well below CostPAR, and at other times, they’re willing to pay much more. Revenue management’s goal is to find the right balance for year-end profitability.

Here’s an example of two similar properties.

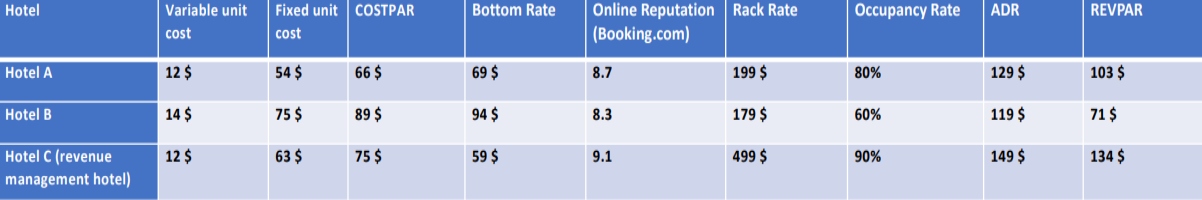

This table compares the CostPAR and Bottom rate of two hotels. The hotels are of similar size and quality. You can see Hotel B has a higher fixed unit cost and higher variable costs. Hotel B may have higher costs due to fewer rooms or poor cost rationalization, and its fixed costs may be less spread out than a bigger hotel.

This makes for a minimum $94 rate for Hotel B. That’s roughly $5 over the CostPAR. Since Hotel A has lower costs, they can charge less and that can make it challenging to remain competitive during the low season. The higher rates may be more than market value.

What should a hotelier do?

Variable Costs vs. Bottom Rate

Some hoteliers prefer to focus on the variable costs per room.

In Revenue Team by Franco Grasso’s experience, statistically speaking, in a 3- or 4-star hotel, the ideal variable cost should range between $10 and $20. When the variable costs are higher, there can be problems of cost rationalization. At the same time, you can’t compress costs too much either. That can lead to disrupted service and lowered perception of quality. Then guests leave poor reviews, and your hotel loses reservations and, thus, revenues.

You can improve your revenue by selling rooms above your variable costs.

However, don’t take this as a suggestion that you should sell rooms only $1 above the variable costs so you fill the room. It would be ok if you did, but it’s not necessary.

The important thing to know is, this balance between variable costs and bottom rates is not only working at specific times of the year with careful analysis. Hoteliers have to know the market and have the right data.

Every hotel faces low-demand and high-demand periods, and you want to remain profitable. Even at $1 or $2 above the variable costs during the low season, you still cover some of the fixed costs when selling a room. Better, it triggers higher online visibility that helps you maximize profits during the high season.

For example, consider a hotel’s shoulder season. The historic data reveals an occupancy rate of 50% at an ADR (average daily rate) of $80 and a RevPAR of $40 (RevPAR = ADR*Occupancy rate.) Imagine the hotel calculates its Bottom Rate at $59. This is a rate that is below the forecasted CostPAR of $75 yet it's above the variable costs of $12. That gives you some margin and you can apply this so-called bottom rate when there's low demand.

This helps the hotel improve its historical performance. It achieves an 80% occupancy rate and a RevPAR of $47 (RevPAR=ADR*Occupancy rate), and they’re still below the CostPAR (75-47=$28).

What else would you consider?

CostPAR, ADR, RevPAR, and The Property’s Online Reputation

Many hoteliers overlook a chief benefit of revenue management: a reputation boost and the online visibility that follows.

You can follow the variable unit cost model and improve occupancy rates in April and May. More guests mean selling more related services, such as restaurants and spas, and these ancillary expenditures make up for the lower room rates. More guests also mean more reviews.

Imagine all the reviews are positive. They gush over the excellent service and perceived value. This raises your online scores. For example, your hotel might see a boost from 8.9 to 9.1 on Booking.com or from 4.7 to 5 on Tripadvisor.

Such a reputation boost can result in more guests year-round because they boost your hotel’s online visibility. Since future guests often rely on reviews to choose hotels search engines reward hotels with higher review scores on Google, Booking.com, etc.

It’s like a virtuous cycle. More positive reviews lead to more bookings, which leads to more positive reviews, and so on.

Many potential guests filter their search results by score. For instance, they’ll use Booking.com and only want to see the hotels with a 9+ rating or 4+ on TripAdvisor. Or they’ll filter by 4-star hotels with breakfast, free parking, or other amenities.

These online scores directly impact the number of bookings, conversion rate, and the ADR (average daily rate), especially in high-demand periods. Your future guests will accept a higher rate when your hotel scores high. When it comes down to two comparable rooms within a similar price point, more than 80% of people will pay a bit more for the highest-scoring property.

For instance, imagine your hotel historically has a 100% occupancy rate in July and August at an ADR (average daily rate) of $140 and a RevPAR of $140 (with 100% occupancy ADR and RevPAR coincide). Thanks to the boost in online reputation earned back in April and May, your hotel has greater visibility, and you can sell rooms at an ADR of $200 in July and August with full occupancy.

Hopefully, you see the connection. Because you used revenue management practices in the low season, you covered some fixed costs and boosted the hotel’s visibility in the search engines. This heightened visibility and reputation mean you can increase room rates in high season and increase profitability.

This example shows the partnership between selling rooms at the $59 bottom rate in the shoulder season to maximizing the room rates at $200 during the high season. You can compare that $200 RevPAR rate to a $75 CostPAR resulting in a $125 surplus that more than makes up for the shoulder season bottom rate.

Revenue management makes these kinds of numbers possible.

Revenue Management is a Long Game

Revenue management focuses on annual rewards rather than short-term thinking. When focused on the whole year or opening season of a hotel, you can see that a rate on one specific day means nothing in the profitability potential of the year.

Revenue management also goes beyond season or market conditions and considers the hotel’s online visibility. Recent high-quality reviews are essential for increased bookings, and by recent, we mean in the past few days—these boost visibility in the algorithms.

Revenue management is big-picture thinking partnered with strategic tactics. As you can see, an excellent reputation can garner more guests, higher prices, and ADR.

Bottom Rate vs. Rack Rate

Before we wrap up, let’s compare the bottom and rack rates. Since the rack rate is the highest rate the room sells for during peak times and the bottom rate is the lowest, revenue management means your hotel’s rack rate can be extremely high. That’s partly thanks to managing pricing to achieve online visibility and a high reputation.

Consider this example. We’ve added a hotel to the previous comparison table. Along with an additional hotel, we’ve added a few other annual stipulations like rack rate, online reputation, the occupancy rate, ADR,and the RevPAR. For the sake of simplicity, we assume the sample hotels have rooms as only revenue and cost center.

Hotel A is a great example of how not having proper revenue management can impact your business. While they had the lowest CostPAR, they also had a lower annual ADR and RevPAR vs. Hotel C which means they lost money compared to other hotels in this area.

If you look at Hotel B, you can see that their GopPAR (Gross operating profit per available room) was still negative despite having a higher bottom rate than Hotel A. This is because their RevPAR ($71) was lower than their CostPAR ($89), which means that even though they had a better bottom rate, they still lost money due to low occupancy rates. They also had lower reputation than Hotel A, which means that guests weren’t enjoying their stay as much as those who stayed at Hotel A.

Finally, Hotel C has the best reputation, RevPAR, GopPAR and cost-performance ratio among all hotels in this area. This means that guests enjoyed their stay here more than any other hotel (based on reviews), and hoteliers could generate more revenue from each guest than any other hotel (based on other metrics).

You can calculate GopPAR by dividing gross operating profit by the total number of rooms available. This makes for a solid indicator of overall business performance across revenue streams.

This example shows that when a Bottom rate exceeds the CostPAR, it does not mean the hotel is profitable and doesn’t reflect a better ADR and RevPAR than other hotels. Hotels that improve their review quality and quantity can improve their online ratings, which can make a difference in the hotel's profitability at year’s end.

A property like Hotel C practices proper revenue management, which includes an enhanced online reputation. Such properties tend to remain profitable and outperform competitors.

Download the ebook 10 Things to Know About Revenue Management to discover ways to implement revenue management principles in your hotel.