Hotel Market Beat Q1 2024 - UK

UK Hotel Investment Hits Post-Pandemic High

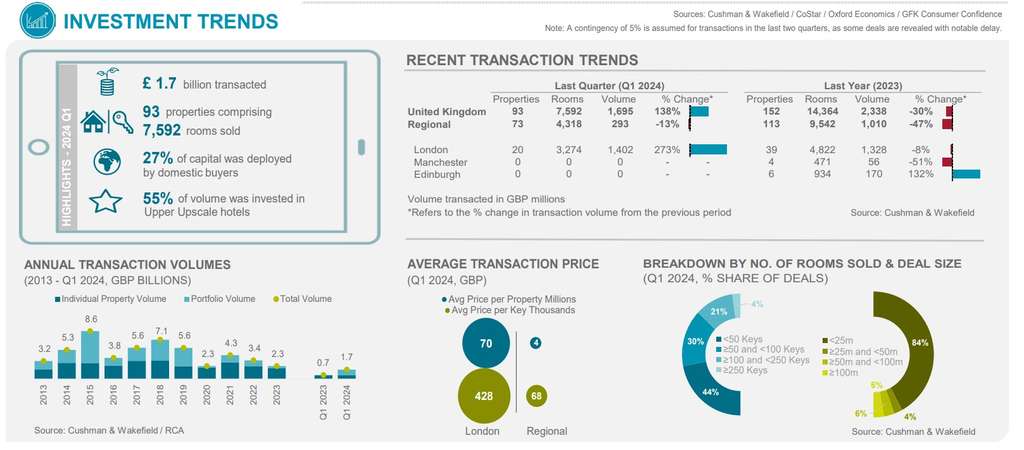

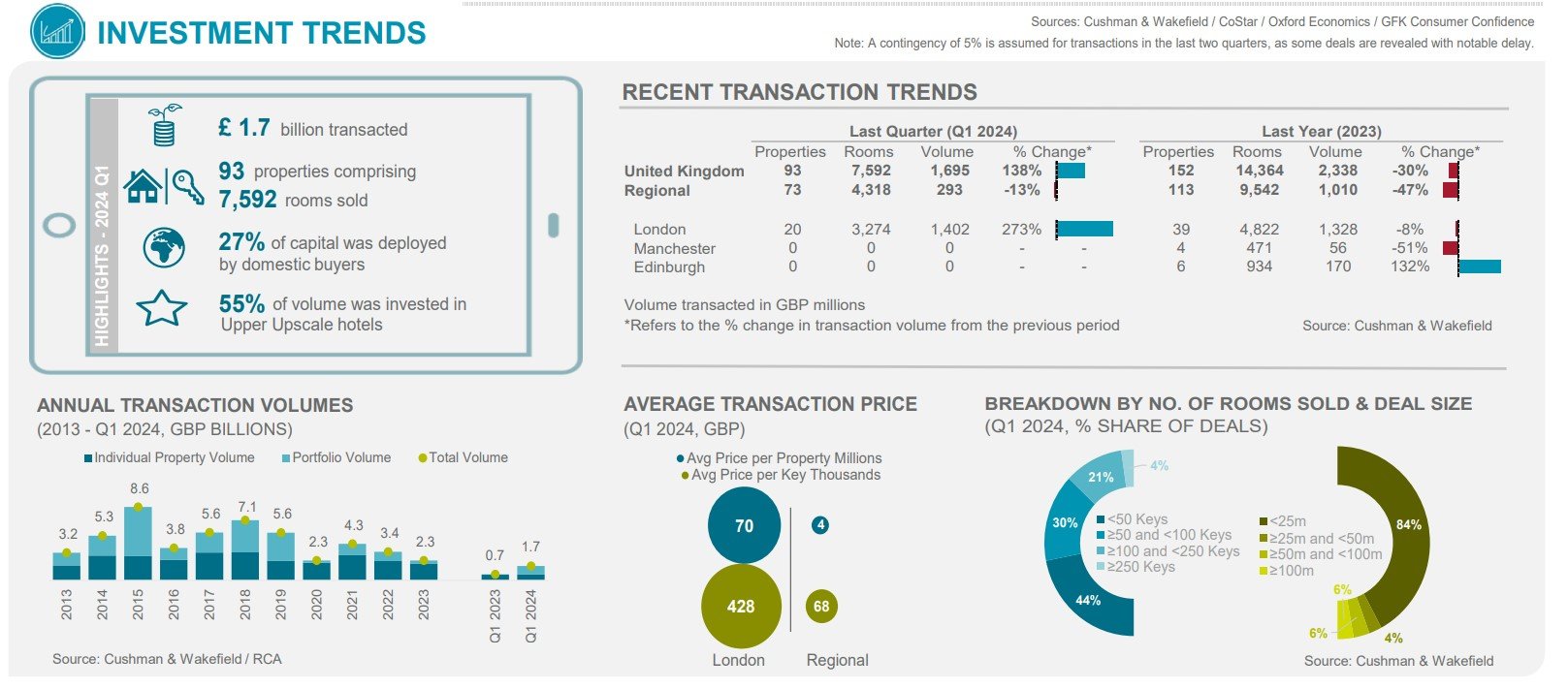

- First-quarter investment volumes surged to the highest levels since 2019, reaching approximately £1.7B in Q1 2024

- Two large portfolio trades at the beginning of the year accounted for 60% of volume

- Hotel performance is buoyant with overnight stays in hotels projected to surpass 2019 levels in 2024

Approximately £1.7bn of UK real estate was transacted by hotel investors in the first quarter of 2024, according to new data from real estate advisory firm Cushman & Wakefield. This represented a surge in activity to the tune of 138% versus Q1 2023.

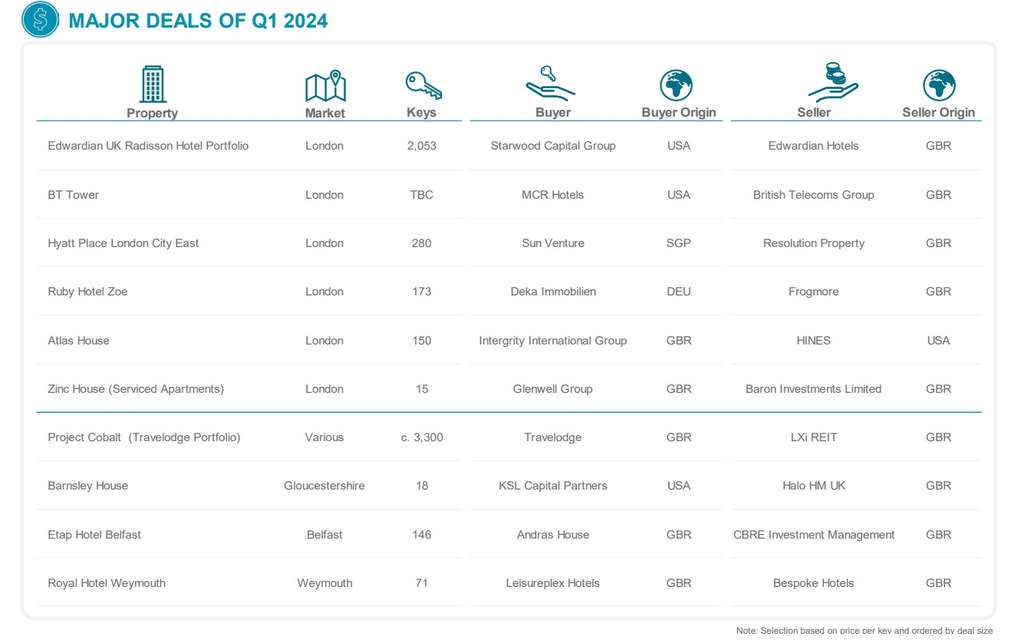

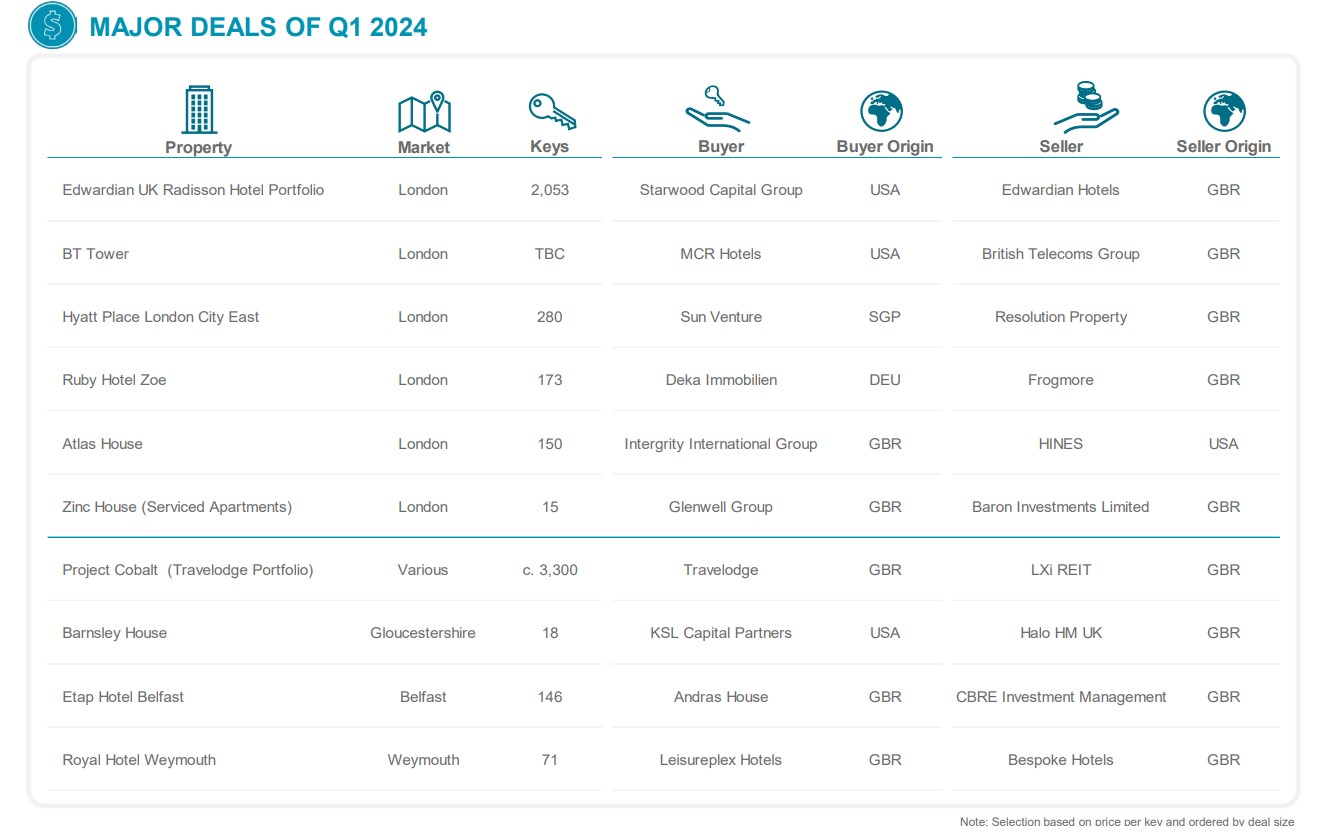

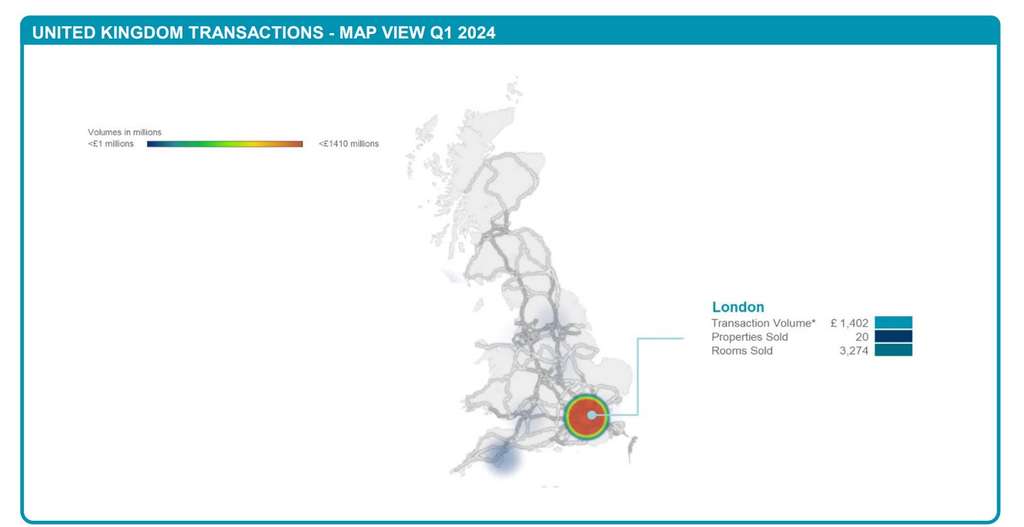

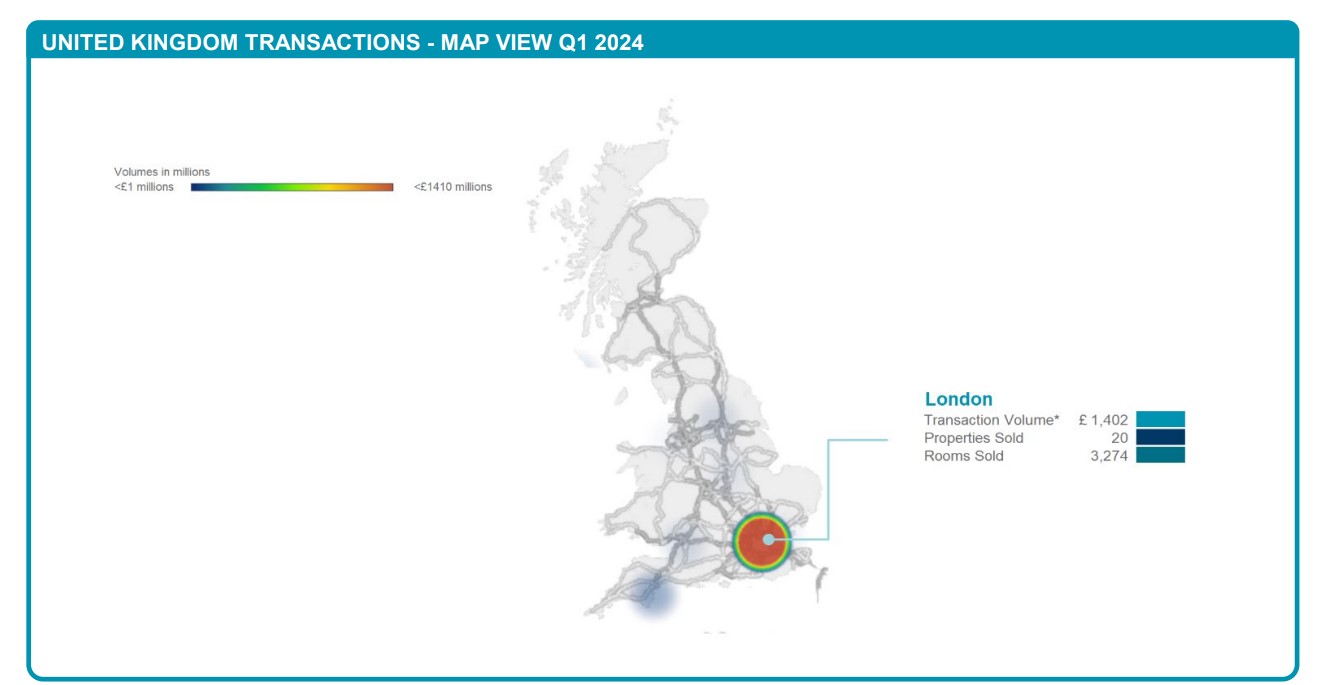

The Q1 2024 volume covered 93 properties across the UK, representing c. 7,600 rooms. Two major portfolio deals, the Edwardian UK Radisson Hotel Portfolio and the LXi REIT Travelodge Portfolio comprised 60% of transaction volume.

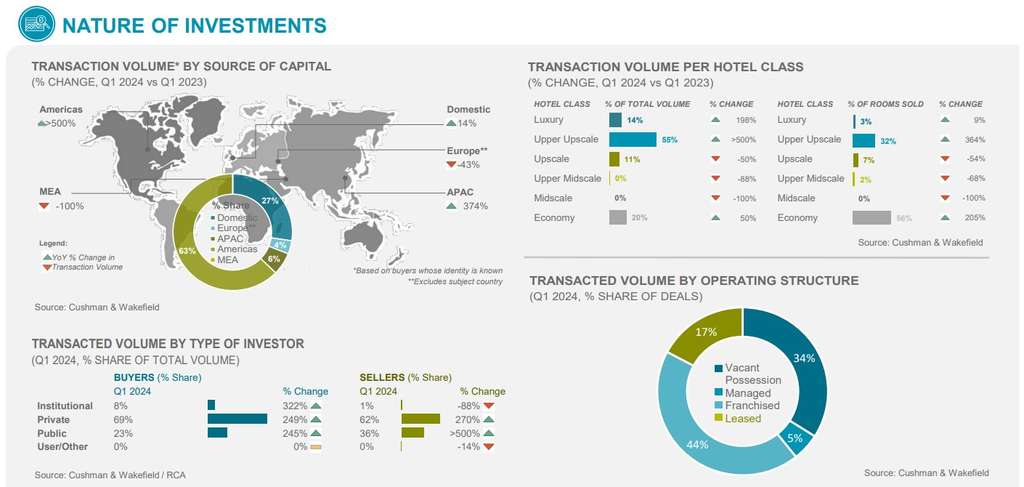

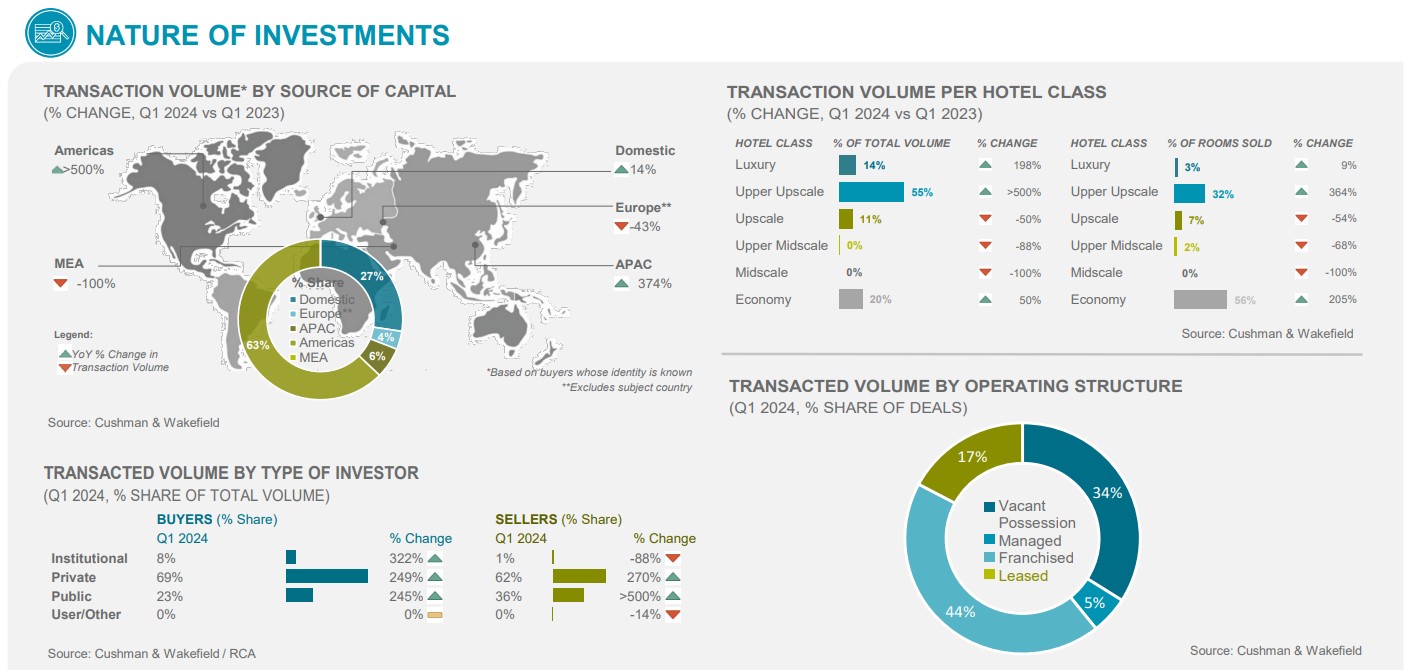

In terms of capital deployed, private buyers were the dominant force in deals completed at 69%, followed by public investors (23%), and institutional-backed capital (8%) slowly reinvigorating interest in the sector.

Across the quarter, London accounted for 60% of major deals by volume. This also included the sale of Atlas House to Integrity International Group and the iconic BT Tower to MCR Hotels – underscoring sustained interest in development projects that focus on office-to-hotel conversions, which continue to contribute a significant proportion of deal flow.

Notwithstanding buyer hopes, limited distress is evident in the market buoyed by sustained hotel performance and lender support for the sector.

Looking forward, the market points towards a sustained positive sentiment for the sector bolstered by improved consumer confidence, alongside the projection that leisure demand for hotel nights in the UK will grow a further 6% this year.

However, while hotel supply growth is anticipated to persist, it is expected to proceed at a decelerated rate relative to the past two years. UK-wide room supply grew 0.2% since the beginning of the year with c. 24,000 rooms still under construction (3.4% of inventory).

A slowdown in new-build construction can be attributed to increased costs of materials, labour, and financing. As a result, conversion activity is expected to be a primary driver of hotel pipeline growth in the upcoming months, especially in key cities.

The last 18 months have seen the UK sustain elevated levels of hotel performance, which now appears to be stabilising as the new standard. The bid:ask spread continues to slowly narrow. There is strong capital interest in the sector, yet deal flow remains constrained by a lack of product on the market whilst buyers are adopting a wait-and-see approach anticipating base rate cuts in H2 2024, against the backdrop of an impending UK election.

From a yield perspective, we see that they remain stable against those established at the close of 2023. Toward the back end of the year, a slow and steady sharpening in line with the gradual reduction in base rates can be expected, although reversion to historic lows of the 2010s is unlikely.

The enduring 'flight to quality' continues to dominate the UK hotel investment, with 69% of deal flow amongst luxury and upper upscale hotel classes. This serves to heighten competition for opportunities in prime locations and maintain a consistently stringent yield environment for premium assets. Ed Fitch, Head of Hospitality UK & Ireland at Cushman & Wakefield