3 biggest myths about Occupancy

Occupancy is one of the three main indexes used in the science of

Revenue Management (along with ADR and RevPAR). It is the percentage of all rental units in the hotel that are occupied at a given time. Occupancy is calculated as: number of occupied rooms/number of total available rooms, and is expressed as a percentage.The three main misconceptions about occupancy that are still prevailing in the

hotel industry are:- Occupancy should be the target for maximization

- Occupancy should be forecasted

- Occupancy should be the indicator and trigger for price adjustments

Let's review these misconceptions.

Occupancy as the target for maximization

Many hoteliers still view increasing occupancy as the operational target, disregarding all

other aspects of Revenue Management. In reality, higher occupancy in many cases leads to lower profits, when the increased number of rental units doesn't offset the loss in ADR.Here is a simple example:

- Scenario 1: A 100 room hotel sells 90 units at a $100 rate, obtaining $9000 in Revenue.

- Scenario 2: The manager sets a goal to achieve 100% occupancy and drops the rate. The hotel sells 100 units at an $85 rate, making only $8500.

It is clear that occupancy itself should not be the goal, as it always has to be

looked at together with the ADR.In an elastic market (such as hospitality) increase in one parameter (number of rented

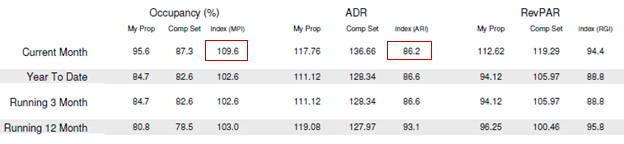

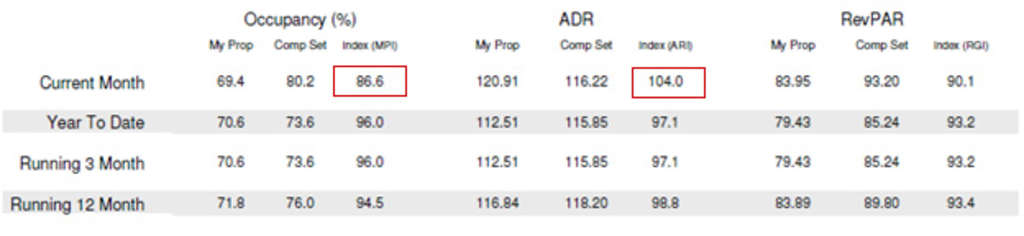

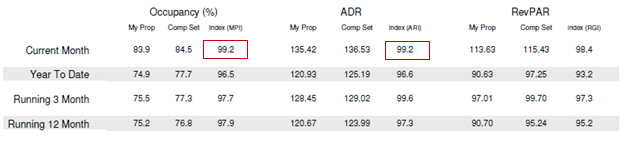

units) always leads to decrease in the other (average rate), and vice versa. The goal is to find the right balance between these 2 indexes in order to achieve highest potential profits.A quick review of your hotel's STR report will help you understand whether your ADR and

occupancy are balanced. MPI (occupancy compset index) and ARI (ADR complet index) should be close to each other, ideally at 100% or above.You don't want to see this:

Or this:

You want to see something like this:

(Note: it's OK if your ADR index is higher than your occupancy index, as long as you're

getting your fair share of bookings and your MPI is around the 100 mark).Now, let's review another interesting example.

- Scenario 1: A 100 room hotel sells 90 units at a $100 rate, obtaining $9000 in Revenue.

- Scenario 2: The same hotel sells 100 units at a $90 rate, making the same amount of money ($9000).

In the second case, the manager set a goal to reach 100% occupancy. While the drop in

the ADR was indeed offset by the increased number of rented rooms, the overall hotel profitability was lower, due to the increased operational expenses associated with renting more rooms.Let's assume that the CPOR (cost per occupied room) is $10. Then:

- In Scenario 1: overall profit is $9000 - $900 = $8100

- In Scenario 2: $9000 - $1000 = $8000

More is contributed to the bottom line when we concentrate on increasing ADR

rather than occupancy, again, assuming that the loss in occupancy is offset by the gain in ADR (as in our second example).Please note that this pertains to properties with no additional revenue-generating

departments (which most limited service and middle-tier hotels are). For hotels with significant banquet space, restaurants, spas, etc. additional revenue per room also needs to be taken into account in the calculations, which will offset CPOR.Thus, it is clear that occupancy itself is not an indicator of how profitable the

hotel is and should not be viewed as a goal for maximization. Managers should concentrate on increasing the Revenue or, rather, the actual profit – the bottom line.The hotel industry's focus needs to shift from high-volume bookings to high-profit bookings.

Occupancy should be forecasted

Occupancy forecasts were widely spread (and were effective) years ago when hoteliers

set the same price for the whole season (or even the whole year) without fluctuating it to adapt to changing demand. Forecasting occupancy, setting an occupancy target, and measuring hotel's performance based on achieving this target, was a reasonable technique at the time, since occupancy was the only variable that was affected by demand and that directly influenced the amount of the final revenue generated.Forecasting occupancy is useless in the current dynamic market conditions. The resulting

occupancy level is dependent on the revenue manager's strategy. To be exact: on the price fluctuations, stay restrictions and channel management decisions.In addition, a particular occupancy target (forecast) does not indicate the profitability of

the hotel as there's at least one more variable involved, which is ADR. As explained in the examples above, reaching 100% occupancy does not necessarily mean being more profitable if this leads to a greater decline in ADR. There's also the reverse correlation: due to market elasticity, setting prices higher will lead to lower occupancy, and vice versa.Thus forecasting occupancy is no longer effective in the current dynamic pricing

situation. Instead, hoteliers need to concentrate on revenue potential based on forecasted level of demand, and select the most optimal strategy to maximize the bottom line.

Occupancy as the indicator and trigger for price adjustments

Many independent and brand hotels are still viewing occupancy as an indicator for

increasing or decreasing room rates. A typical PMS alert would look like this:"On July 4, 2014 your occupancy reached 70%, you need to increase your rates by

$10".Making pricing decisions based on occupancy alone is absolutely incorrect and

can lead to great revenue losses.First of all, occupancy % needs to be viewed along with the number of days remaining

before the event in question. 70% occupancy tomorrow is very different from 70% occupancy 90 days from now, and thus should be treated differently, and trigger different Revenue Management decisions. In the first case you will most likely lower your price to put more heads in the remaining 30% of available beds. The second case obviously indicates high pick up outside of the standard booking window, which should logically lead to increasing the room rate in order to capitalize on the high demand.

Thus, "occupancy alerts" (that for some reason are still widely used in Property

Management and even some Revenue Management systems) are meaningless if they are not taking into account the number of days out, which is the key in making an informed pricing decision.Second, along with the number of remaining days, a manager should pay attention to

the pickup (booking pace), which will provide better insight into the real demand conditions.Let's look at another example.

A manager is reviewing the upcoming weekend in order to make a pricing decision.

Occupancy is at 70%.- Scenario 1: during the last 7 days occupancy for the weekend has been picking up at a steady pace, about 5% a day, with a jump of 10% since yesterday.

- Scenario 2: no reservations have been booked for the weekend during the last 7 days, and the hotel received 3 cancellations yesterday, thus the occupancy dropped from 73% to 70%.

We can see that in the 2 cases above, with the occupancy and the number of remaining

days being equal, Revenue Management decisions should be opposite. Scenario 1 describes high demand with strong pick up, which allows for a price increase since the pickup indicates early sell out at the current price. Scenario 2 describes a situation when either the demand is very weak or the hotel's room rates are too high. Thus the most logical decision, in this case, would be to lower the rate to stay competitive.Again, this confirms that occupancy alone cannot provide enough information for

effective Revenue Management decisions. Price adjustments that are based only on occupancy while ignoring other parameters are in many cases incorrect and can lead to significant losses.To conclude, Revenue management is based on supply and demand. In general, room

rates should be increased when demand is strong (in order to capitalize on ADR) and lowered when demand is weak (in order to increase occupancy). Proper pricing adjustments, which take real existing demand into account, are the key to increased profitability. Occupancy is not the sole indicator of true demand. Various parameters need to be taken into account in order to make the correct decisions that lead to profit maximization.