The New Generation of Revenue Managers can make Big Impacts in Budgeting Considerations

Essay 6 – Bridging the GAP between the Revenue Manager and CFO

There were times when the hotel accountant would lock his/herself in a back room and not come out until the budget was done! Those days are long gone and today's budgets reflect the input of the entire executive team. A relative new comer to the budget process in the last decade has been the Revenue Manager (hereafter the RM), who adds a whole new dimension of depth to the analysis, enabling the exploration of possibilities and potential strategies that are within reach and that could measurably change hotel profitability.

First and foremost, many believe, as do I that "budget time" presents a golden opportunity for hoteliers to reflect and consider new hotel strategies. Never before in the history of hotels have so many sophisticated tools been at our disposal enabling us to project what the market is doing, what our competitors are doing, the effect different actions would have on our profitability as well on our reputations. Who better than the property strategist to provide the group with an in-depth look at analytics, channel attributes and productivity then the RM?

Unless your General Manager is springing for a vacation retreat, budget time is one of the few periods during the year that can be solely devoted to spending "quality" time between the Sales Director, General Manager, Revenue Manager and CFO (Controller). Like that old accountant described in chapter one; it is a good time to lock the door to the back room and become completely absorbed in revenues with colleagues with no outside distractions.

There are some who might like to discuss percentage increases, while others who wish to focus on hotel history and still others who have devised formulas and algorithms that anticipate and calculate revenue outcomes. Perhaps a combination of all of the above makes the best sense. The fact is that some of the hotels greatest talent sits in this room and everyone there qualifies to be a property evaluator and interpreter! So I'd like to present a few things to consider, from the perspective of a former RM and the CFO that can be very relevant to arriving at optimal results.

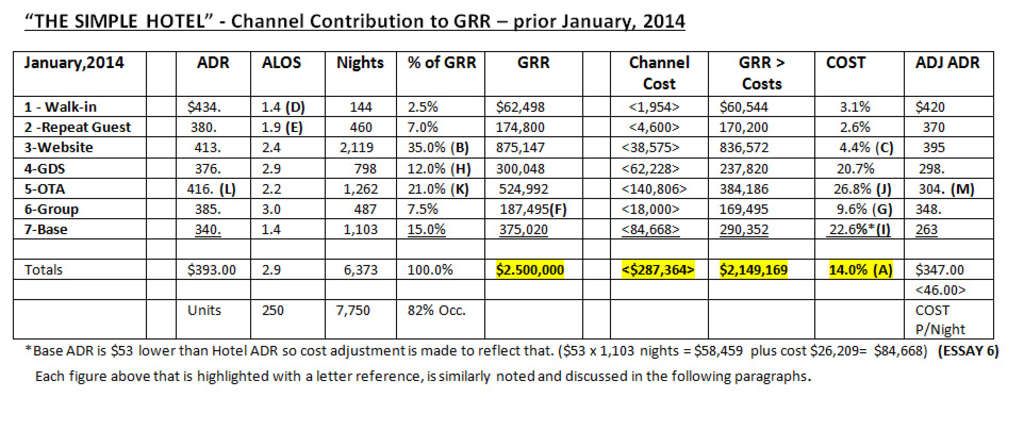

A good start and gauge to put everyone on the same track might be to have the Controller prepare a spreadsheet (as I've presented below) that shows the monthly contribution each channel or segment made toward Gross Reservation Revenue (hereafter referred to as "GRR") in the prior year. Next ask the Controller to apply direct costs (including payroll, direct expense and amortized prepaid and/or capital expenditures to each channel/segment) to arrive at TRUE net channel /segment profitability. The side-by-side presentation (below) will show you the "before and after" affect channel costs have on NET CHANNEL-BY-CHANNEL PROFITABILITY. The analysis below is a simple, seven channel property presentation, for the…."SIMPLE HOTEL".

What conclusions can be drawn from this information for the budget meeting?

Looking at the hotel as a whole, total cost of all channels is 14.0% (A) and that combined result is good. Let me quickly review each channel.

Channel 3 – Website - The low overall cost mentioned above is being driven by the hotel Website which accounts for 35.0% (B) of the hotels total revenues. The cost of this top producing channel is only 4.4% (C). The budget team would wish to keep as many rooms flowing through the channel as are possible, as a start. Look at the conversion ratios on your "Site Search Tracking Program" (i.e. – Google Analytics, StatCounter, ChartBeat, etc.). If there is any room to tweak the site, you may be able to bring even more business through. In the case of hotel websites, the more reservations that go through the channel the lower the cost becomes.

Channels 1 & 2, Walk-in and Repeat Guest - Both the Walk-in and Repeat Guest Channels are low cost and account for a total of 3.3% of Simple Hotels business (1.4% (D) and 1.9% (E) = 3.3%). Draw backs are that the Average-Length-of-Stay (hereafter called ALOS or LOS) is low and typical reservations for are on weekends, which are your most profitable days so you may be displacing some higher LOS's and Rates. It's too small and too profitable to tinker with in my opinion and you're also dealing with priority guests in the case of Repeats. Another reason to leave it alone.

Channel 6 – Group - The Group Channel in this example supposes that there is a Sales Director, a Sales Person and one Support Staff member. The Sales Director and Sales Manager have wages for the month of $10,000 and with total Sales for the month of $187,495.00 (F) they have produced 18 times earnings in January. If it is determined that the range of production (See Essay 4 - http://revenuereportcard.com/articles/ ) should be 8 to 9 times earnings, they would seem to be on track to meet their annual budget. The cost, also is good at 9.6% (G). Would there be additional opportunities next January to displace some of the higher costing channels with Group Business? The day-to-day analysis can uncover these periods.

Channel 4 – Global Distribution System (GDS) - GDS channel costs will vary because hotels will from time to time choose to pay travel agents a higher fee in order to stimulate business or may wish to participate in other optional GDS programs for fees (consortia, etc.). 12.0% (H) of all business is a respectable contribution and perhaps with added options could be pushed a little higher next January to displace some of the BASE and OTA business. GDS could provide additional opportunities here.

Channel 7 – Base - BASE business is typically higher volume at lower price and, of course, is contracted. I've adjusted the cost factor to include the RATE discount of $53 from the ADR for the month. A 22.6% (I) cost is high, but other BASE alternatives in the market could be higher. Usually we would look to displace some of this business, but in the case of Simple Hotel they are seeing a higher OTA cost so OTA business logically would be the first they'd want to displace.

Channel 5 – OTA – Simple Hotel OTA business is running a cost of 26.8% (J); at times this can be even higher but even using a 24.0% vendor cost here, it is the highest cost channel for the hotel. Why? Part of it has to do with the purchase of banner space, in this case and the other part of course is the commission structure mentioned (usually 22.0% to 30.0%). This can be offset by using some of the less expensive OTA's available (15.0% - 17.0%). In this case the fact that 21.0% (K) of the hotels total revenue comes through this channel means, at face value, it appears to have had a detrimental overall affect. But if the hotel was incapable of filling certain times through other channels, even the higher cost OTA's would be considered a benefit. The ADR paid by the guest here is $416.00 (L) per night yet after deducting channel cost the TRUE ADR became $304.00 (M) after channel cost. Once again, pretty sobering at face value.

The RM has the ability to turn all these channels (except Group and Base) ON or OFF and/or adjust rates and restrictions in "almost" real time. His/her input in this meeting as to the structure of the next BASE contract or most appropriate times to entertain Group Business and at what rate, should be discussed. The Sales Director, in turn, needs to provide information on what is likely to materialize and how often.

So in "Simple Hotel" while the overall optimization at 14.0% is good, it would appear that there could be some room for tweaking the strategy involving the two highest cost channels. That would be a good discussion for the Budget Team to have.

To reiterate, as an RM it is expected that the necessary "reality check" in forecasting achievable rates would be provided by the Sales Director, Controller and GM. It is naturally expected that the Controller will pursue a more conservative approach and that the Sales Director will provide a presentation of what his/her team is capable of bringing in and when. The group can only function if all parts, all the executives, are involved in the discussion. It is for the GM and CFO to mediate and eventually arbitrate the end result.

For figureheads and dreamers, budget time can be a great time of the year! It's a time when the right-brained and left-brained meet to negotiate. And when it's over, written Action Plans follow to insure adherence. Budget time can be so much more than just crunching numbers. It should be a time for mental stimulation, thinking and seeing things perhaps in a different way. Open yourself to this, and you will feel whole and satisfied upon the budgets conclusion.