Consumption and Pricing Influence Hotel Utility Costs

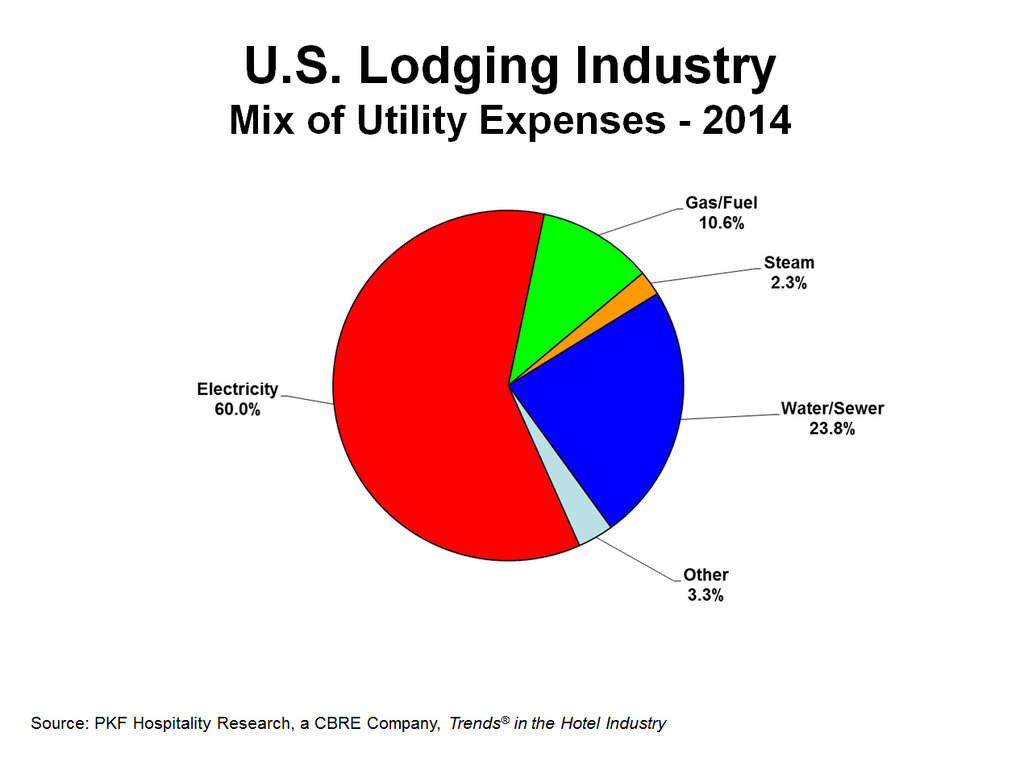

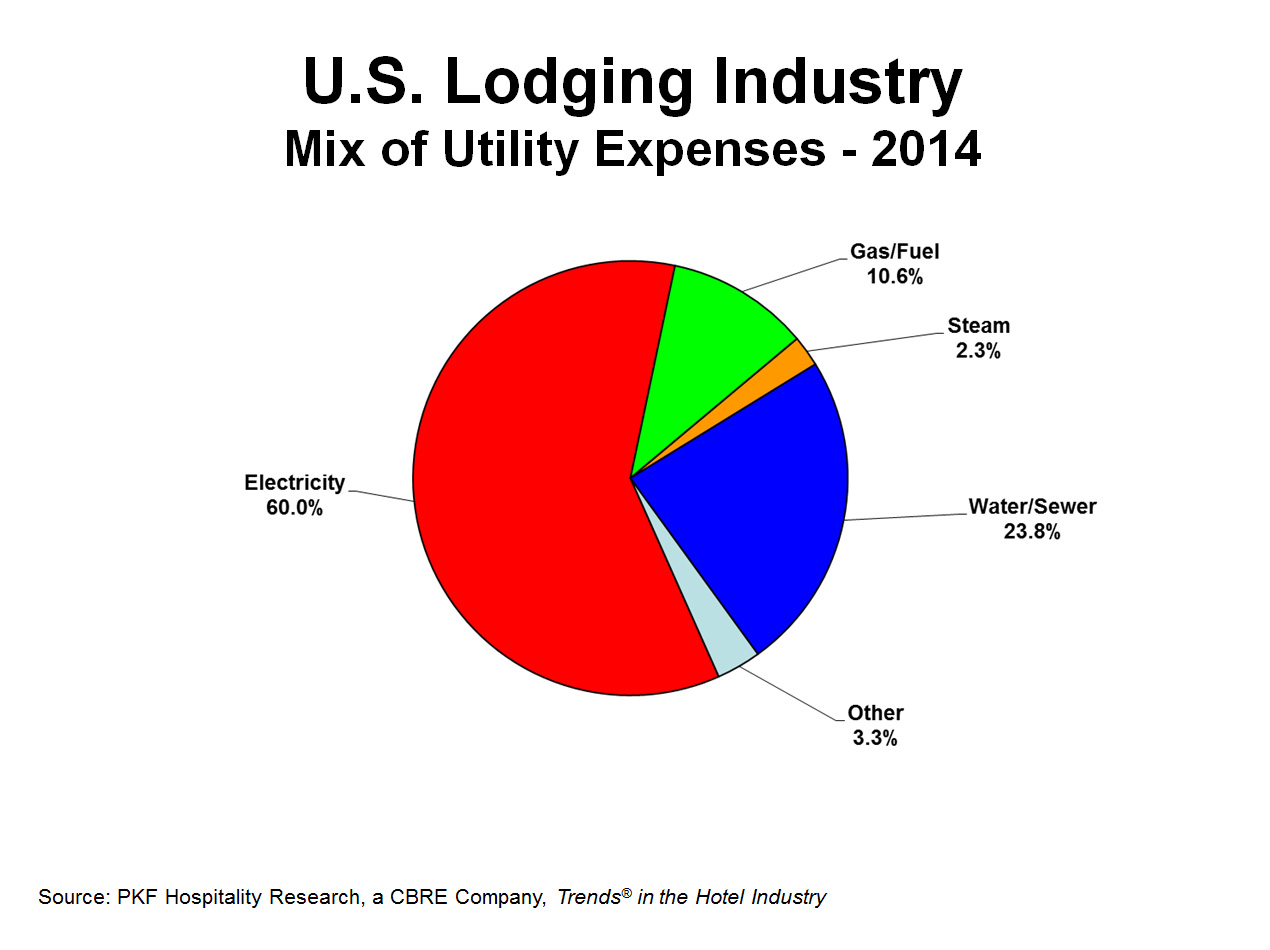

In hotels, utility costs consist of four major components. According to the 2015 edition of Trends® in the Hotel Industry, electricity is the largest utility expense comprising 60 percent of total expenditures. Water/service is the next largest utility cost (23.8%) followed by gas/fuel (10.6%), and steam (2.3%). Trends® in the Hotel Industry is the annual survey of U.S. hotel operating statements conducted by PKF Hospitality Research (PKF-HR), a CBRE Company.

Over the years, the energy component of the consumer price index (CPI) has been a good indicator of the direction of the change in total utility expenditures at hotels. In general, when the energy CPI has gone up, hotel utility costs have increased, and vice versa. The energy CPI measures the average change over time in the prices paid by urban consumers for gasoline, fuel oil, electricity, and piped gas service.

In the past three years we have seen a departure from this relationship. Starting in 2012, the energy CPI increased, while hotel utility costs declined. Conversely, in 2013 and 2014, consumer energy prices have fallen, but the total expenditures paid by hotels for utilities have been on the rise.

The declines in the energy CPI the past two years are consistent with recent headlines. Due to increases in domestic oil and gas production, the U.S. has become more energy independent. The price of gasoline at the pump has gone down, and consumers are implementing more energy efficient products and practices.

So, if consumer energy costs are going down, why are hotel utility expenses on the rise? To analyze recent trends in hotel utility costs we examined the 2014 utility expenses reported by 3,800 U.S. hotels for which we had two years of detailed expenditure data.

Consumption

Pricing is just one component of the total hotel utility costs. The other component is consumption. At this time, most U.S. hotels are not reporting energy consumption statistics on their operating statements. However, as noted in the recently released 11th edition of the Uniform System of Accounts for the Lodging Industry, the tracking of the financial impact of green and sustainable practices is becoming more commonplace. In addition, these statistics are frequently required by government authorities, as well as travel and meeting planners.

Because of the lack of utility consumption information, for this analysis we have relied on changes in utility costs on a dollar per-occupied-room (POR) basis. Measuring changes on a POR basis minimizes the impact of variances in business volume (i.e. occupied rooms).

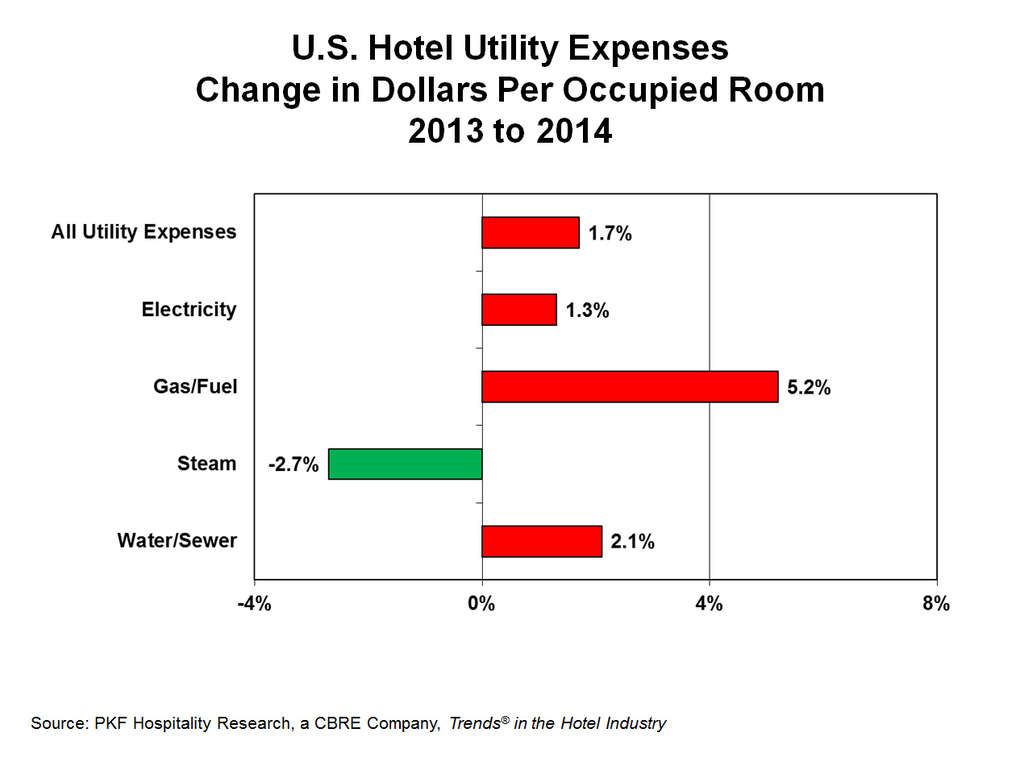

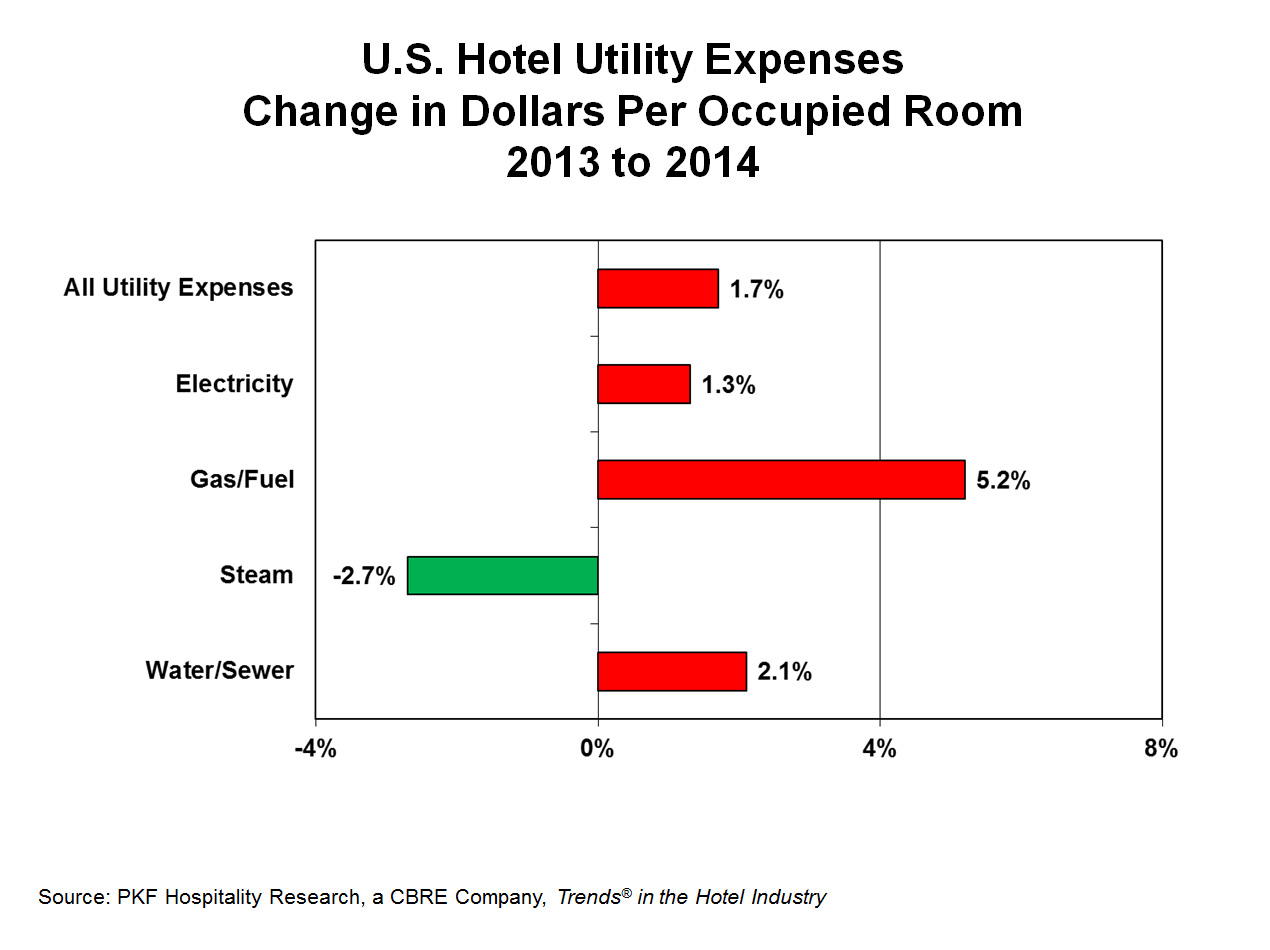

In 2014, total hotel utility expenditures increased by a relatively strong 4.8 percent on a dollar per-available-room (PAR) basis, but rose by just 1.7 percent on a POR basis. This indicates that the 3.0 percent increase in the number of occupied rooms had a greater influence on changes in hotel utility as opposed to variations in the costs of the energy components.

All-suite (3.2%), limited-service (2.5%), and extended-stay (2.4%) hotels experienced the greatest gains in utility costs on a POR basis from 2013 to 2014. With limited or no food and beverage operations, changes in occupied rooms are the main driver of business volume at these property types. On the other end of the spectrum, resort hotels enjoyed the least (0.4%) increase in utility costs POR. Because of the extensive facilities and services they offer, resort hotels spend the most of any property type on utilities ($15.96 POR) and therefore have been at the forefront of implementing green and sustainable practices.

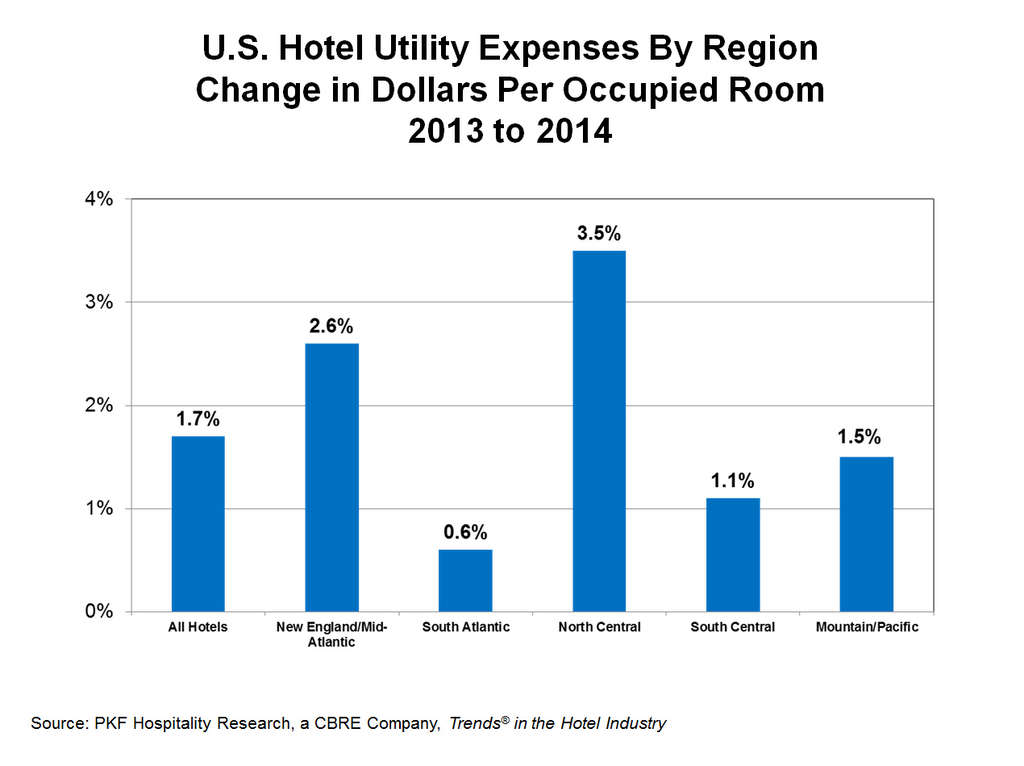

Weather and regional energy prices also have an influence on utility expenditures. When analyzing the data on a regional basis, hotels in the North Central region saw the greatest increase (3.5%) by far in utility costs during 2014, followed by hotels in the New England/Mid-Atlantic region (2.6%). The relatively warm climate in the South Atlantic region allowed hotels in that region to experience a utility increase of just 0.6 percent during the year.

Commercial Pricing

From 2013 to 2014 the greatest increase in utility expenses was observed for gas and fuel. In 2014, gas/fuel expenditures increased by 5.2 percent on a POR basis. Conversely, the amount spent by hotels that still use steam saw this utility decline by 2.7 percent.

As mentioned before, pricing is the other component of utility expenses over and above consumption. Given the aforementioned lack of correlation between consumer prices and hotel utility costs in recent years, we have analyzed the differences between commercial and residential prices for select sources of energy.

In general, the price of energy for commercial establishments increased at a greater pace during 2014. According to the U.S. Energy Information Administration, the price of a cubic foot of natural gas rose by 9.8 percent in 2014 for commercial businesses. For comparison purposes, natural gas prices for residential users increased by 6.2 percent. This helps to explain the sharp 5.2 rise in gas/fuel expenditures for hotels.

Electricity, being the largest utility expense for hotels, was also subject to higher commercial pricing. Residential consumers saw a 3.1 percent increase in the cost of a kilowatt-hour of electricity in 2014, while commercial establishments paid 4.6 percent more than the prior year.

Controls

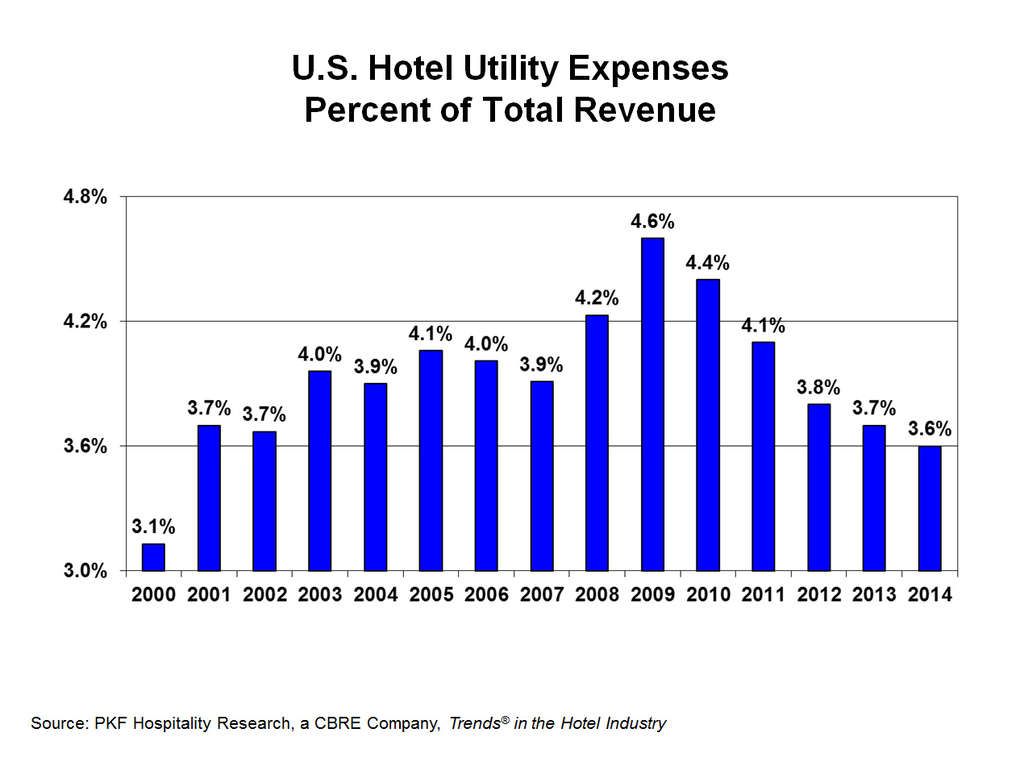

In 2014, utility expenses represented 3.6 percent of total hotel revenue. This is the lowest we have seen this ratio since 2000. The decline of this metric can be attributed to a combination of rising revenues, plus increased controls over utilities. It appears the most energy inefficiencies have been removed from hotel operations. Year-over-year changes in utility expenditures are now dictated by fluctuations in business volume and commercial energy prices.

For more information about benchmarking your hotel's utility costs, please visit store.pkfc.com. This article was published in the July 2015 edition of Lodging.

Robert Mandelbaum

Director of Research Information Services

CBRE Hotels