Constrained/Unconstrained Forecasting is Obsolete

5 steps to build a forecasting strategy that is relevant in the new world

The traditional Revenue Management discipline revolves around four (4) pillars: Measure, Forecast, Optimize, and Collaborate (via actionable Insights). They’re further explained below.

- Measure: look at the right/relevant data (there are 2 types of data used in the Revenue Management discipline: internal and external, you can refer to this article for more details on this topic)

- Forecast: estimate true demand strength and market opportunity for every day in the range (at least 365 days out)

- Optimize: using the results from the previous steps (as well as additional data points), build the optimal pricing, restriction and segmentation strategy to achieve highest total revenue potential as well as maximize profits. This can (and should) also drive marketing strategy and sales strategy optimization and dictate the actions taken to manage the property as a whole across different departments (finance, operations, etc.).

- Collaborate (via actionable insights): Using internal and external data as well as intelligence gathered from the previous steps, provide insightful visualizations to support the decision making process of various stakeholders.

As you may be aware, traditionally the second (Forecasting) pillar assumes constrained and unconstrained demand forecasting. If you dig a bit deeper, you will notice that essentially, the whole Revenue Management discipline as we know it today is built on that concept and everything is derived from it.

Almost any Revenue Management book or guide refers to this concept as the foundation of the discipline.

For those who are not familiar with the terms:

- Unconstrained demand refers to the quantity of rooms in a hotel that could be sold if there were no constraints, no limits. So essentially, it is traditionally perceived as your hotel’s total demand for a particular date irrespective of your capacity.

This is the formula that is used to calculate unconstrained demand:

“On the Books” Transient Bookings (OTB) + Anticipated Unconstrained Transient Bookings (TBB) + “On the Books” Group Bookings (OTB) + Anticipated Group Bookings (TBB)

- Constrained demand is traditionally referred to as demand limited by factors that may reduce the potential revenue generation: hotel capacity, customized market segments, and any type of special parameters that may be specific to each hotel’s forecasting philosophy, such as whether to include out-of-order rooms in the availability count. The most common example would be to reduce TBB forecast to the number of remaining available rooms if the Unconstrained TBB exceeds that amount.

These forecasts are then used in the Revenue Management discipline for further planning of the optimal revenue strategy, as part of the Optimize pillar as well as generating Insights that are related to the strength of demand for further use by various stakeholders.

While this approach served us well for a few decades, it’s time to let it go and build a new one because it is no longer relevant. Because proper forecasting is the foundation of revenue and profit optimization, the discipline can’t continue evolving until we realize that we need a new way to forecast that reflects our new reality.

Essentially, what Revenue Managers are doing today (and what we’re still teaching the new generation) is using historical internal occupancy data (see formula of unconstrained demand above) to predict number of expected booked rooms for a given day in the future and then limiting it by (in most cases) hotel capacity if the result exceeds 100% occupancy. Let’s be honest with ourselves: with this approach, we’re not predicting demand, we’re predicting occupancy while absolutely ignoring the hotel’s pricing strategy, and this is a big problem.

True constraining of property's demand happens not only as a result of limited capacity (the old approach we’re still using) but mainly as a result of the price set by the hotel for the day in question. This is a basic principle that we’re ignoring for some reason.

Forecasting occupancy irrespective of pricing is irrelevant in today’s world. Further I will explain, in a few simple steps, why that is the case.

Step 1. Recognize that Demand forecasting is the key ingredient in deriving optimal Price (and overall RM strategy for that matter).

Why do we need to measure and forecast demand?

This is a simple concept that describes the relationship between Supply and Demand.

Supply and demand, in economics, defines the relationship between the quantity of goods that producers wish to sell at various prices and the quantity that consumers wish to buy. It is the main model of price determination used in economic theory. The price of goods is determined by the interaction of supply and demand in a market. The resulting price is referred to as the equilibrium price and represents an agreement between producers and consumers of the good. In equilibrium the quantity of a good supplied by producers equals the quantity demanded by consumers.

So this is where it gets tricky when this concept is applied to our universe (I’m referring to the universe of hotel management). With hotel rooms, supply is a fixed variable, so you can’t contribute to increased revenues by increasing the amount of goods sold (meaning: you can’t go and build more rooms in your hotel for that Super Bowl weekend, as much as you wish you could). As a result: all you have left to do is fluctuate your pricing along with demand fluctuations, in order to maximize profits.

Thus, price should be determined entirely by the market demand conditions (and sometimes due to hotel constraints, e.g. reducing capacity due to labor shortages). This is called ‘Dynamic Pricing’ (the concept that I will be referring to again later in this article) where you raise prices when demand is strong and lower them when demand is weak, and the idea is about as basic as it gets.

Thus, demand forecasting is the foundation of any Revenue Management strategy. True demand forecast indicates overall market potential and is used to make tactical and strategic optimization decisions by a human or a machine with an ultimate goal to maximize revenues and profits.

Step 2. Recognize that Occupancy forecasts and Demand forecasts are really two different animals.

- Use occupancy forecasting for budget planning and reporting to various stakeholders within the organization (normally done once a year, along with ADR and Revenue budgets, adjusted periodically). One important characteristic of those is that in themselves they do not necessarily correlate with actual revenue (the end result). The primary purpose of those is reporting for further strategic decision-making done by various departments.

- Use demand forecasting for optimizing (for maximizing revenues and profits through daily tactical decisions related to pricing, channel optimization, stay restrictions management, sales and marketing campaigns, etc). This is the most crucial element of any Revenue Management daily routine because it ultimately affects how much money the hotel will generate at the end of the day.

To summarize, we need to differentiate between:

The latter is a crucial element in building a profitable revenue management strategy.

To visualize, this is how the traditional approach of Occupancy forecasts compares to true Demand forecasting.

The top portion of the iceberg (predicted and actualized occupancy) is largely dependent on the user’s actions, not only on the strength of demand (the whole iceberg).

Step 3. Recognize that Occupancy forecasts can no longer be used to build Revenue Management strategy

As we briefly discussed above:

- Occupancy is a result of the user's actions (pricing, restrictions, promotions, etc.)

- Occupancy data does not contain information about travelers’ price expectations (elasticity)

Here is a visualization of the reason why occupancy forecasting (or what we currently call “constrained and unconstrained demand forecasting”) is obsolete.

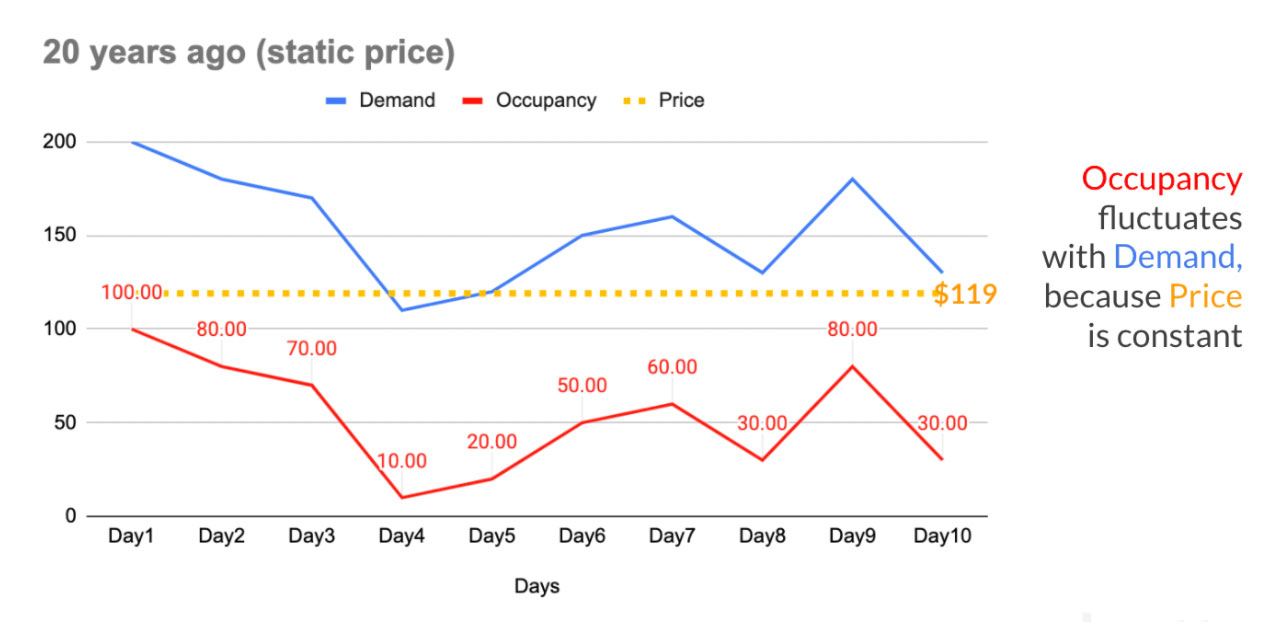

Long-long time ago, when dinosaurs were walking around the Earth, humanity didn’t know about the concept of Dynamic Pricing, which is reflected in the picture below.

As we see here, with the static price of $119 set for every single day, occupancy fluctuates between 10% and 100% following the fluctuations of demand.

So when the Revenue Management discipline was born, forecasting occupancy totally made sense because it was literally a direct reflection of the market demand.

But it was then.

Now… or, actually, more than a decade ago… The concept of Dynamic Pricing (which I briefly described in Step 1) emerged and revolutionized the discipline of Revenue Management (and the whole industry along with it).

This is what we see now:

In our current reality, when prices change every day (and in many cases, every hour) occupancy no longer correlates with market demand because it’s constrained by our pricing strategy. Most hotels will strive for higher occupancy numbers (due to the perishable nature of their goods) and drop the rate when demand is low (and vice versa). This is why we’re seeing examples of occupancy reaching higher values for days with low demand than days with high demand.

To better embrace this concept, let's examine a few of those examples.

Example #1: one demand level, different occupancy results

On a scale of 1 to 10, demand is estimated to be 7.

Possible outcomes:

User increases rates to $300 and reaches 10% occupancy

=> profit is minimal

User sets optimal price of $199 and reaches 85% occupancy with highest potential ADR

=> profit maximized

User drops the rates to $50 and reaches 100% occupancy

=> profit is non-existent due to variable costs

Example #2: different demand levels, same occupancy results

1. On a scale of 1 to 10, demand is estimated to be 3 (low)

User sets rates to $79 and achieves occupancy of 75%

2. On a scale of 1 to 10, demand is estimated to be 8 (high)

User sets rates to $199 and achieves occupancy of 75%

Moral of the story: it doesn’t really matter what occupancy we forecast. Humans (and machines) can build strategies to reach their occupancy targets.

My main goal here is to communicate to the readers that it simply does not make sense to continue forecasting occupancy, due to the reasons described above.

Step 4. Build optimal Revenue Management strategy using true market potential.

To get the most optimal portion of the “iceberg” (the one that drives the highest profits), hotel needs to build an optimal RM strategy through:

- Dynamic Pricing

- Stay restrictions management

- Booking channel management

- Overselling techniques

- Upgrading

- Room type performance and differentials management

- Ancillary revenue management

- Coordinating with marketing, sales, operations and finance

- Sales: managing Corp and Group business

- Marketing: promotions, packages, etc.

- Operations: reputation management, labor management

- Finance: cost management, profitability

Now, the million dollar question: “HOW do we measure true market potential?”

Well, I’m glad you asked! Certainly, not through historic internal booking curves.

1. First of all: Demand measurement and Demand forecasting needs to take into account price expectations and price elasticity.

2. Second: true market Demand measurements are only possible when external forward-looking market data is available.

And I’m not just talking about compset rates. In fact, I have another article dedicated to why you shouldn’t follow your competition. What I’m talking about is comprehensive market data that allows you to get as close to measuring market potential (and as far away from internal booking curves) as possible.

Before, our primary sources of external market data were:

- compset rates (“blind leading the blind” type of data if you use it directly for your pricing decisions)

- GDS search and booking volumes (tiny-tiny piece of the overall puzzle)

- STR benchmarking data (until recently, only retroactive, but now we’re starting to see the future)

- Demand360 benchmarking data (highly skewed towards branded hotels and represents a small portion of the overall market if you look outside of brands)

Thankfully, due to the development of cloud computing in recent years, more and more market data is becoming available from various providers.

One major source that is still very much underutilized is MSE (metasearch engines) upper funnel search volumes. Those who get their hands first on Google search volumes will win the forecasting battle.

In addition, there are many other types of external market data that have become or are becoming widely available: OTA search volumes, flight search and booking volumes, car rental search and booking volumes, Google traffic data, events intel, OTA ranking and visibility, parity insights, and more.

Clearly, there is no way humans will be able to digest all this information and come up with reasonable optimization decisions, so we will have to rely on automated RMS tools for that (but this is a whole separate discussion, which you can read in my next book, stay tuned).

That is not to say that every single one of the data types referenced above should be shoved into an RMS algorithm for forecasting purposes. In an ideal world, each should be run against an individual hotel’s historic performance (revenue, not occupancy! Or ideally, ARPAR, which is total revenues minus variable expenses) and added to the forecasting “formula” for that hotel only if a correlation is found. I’m using quotation marks for the world “formula” because I really hope that very soon there won’t be any RMS tools left that are not using ML algorithms.

The specific details of Demand measurement in the universe of hotel management and how exactly you formulate demand strength for any given day in the future (on a scale of 1 to 10, or in any other format) is a difficult question and should definitely be a topic for future research in academic circles.

Okay, that was a lot. But this is not all.

Here is the last but a very important aspect of the dawn of “constraint demand forecasting”.

Step 5. Recognize that forecasting accuracy is not as important as we thought it was.

The primary goal is performance (profit oriented goals) through proper adjustments of your strategy, not through accurate forecasts.

I’m ready to catch a few rotten tomatoes with this one. It’s okay, this is not the first myth I’m busting, so I’m used to that.

The industry has been talking about forecasting accuracy for too long and many strategies and tools are founded with that target in mind so I anticipate it to take quite a bit of time for the population of the Earth to grasp that concept (many have actually already caught up but they’re still a minority).

Forecasting accuracy is not our primary target. You can have an occupancy forecast that is 100% accurate (of course, because you can hit whatever occupancy target you like) and make less money at the end of the day, than having a less accurate forecast with more money as a result.

So, to clarify:

- Forecasts (budgets) help establish goals and provide alerts. They play an important role in decision making, but they are just an input and not a decision.

- Variations in occupancy are caused both by businesses themselves and by outside forces. Businesses create volatility in occupancy when they change prices and implement promotions to meet targets.

- Forecasts are always wrong. No one has a crystal ball. Nor do we have perfect vision.

Key takeaways

- the main goal of a Revenue Management strategy is to help hotels be more successful and profitable

- the main value of Demand forecasting is to assist with the above

- the best way to achieve that is not by accurately forecasting occupancy but by properly measuring demand and being adaptive

With that said, we can of course continue to attempt predicting occupancy for the purpose of budgeting (because that’s what we’ve been doing forever and that’s what asset owners and managers are expecting from us revenue management professionals), but we have to recognize that the balance between occupancy and ADR is totally up to the person (or the tool) that controls pricing. DORMs can hit any occupancy forecast they like through manipulating prices. So, if you need to plan your budget - the idea is to predict revenue (because that’s what has the highest correlation with true market demand strength) and then derive occupancy and ADR from that, and not the other way around.

The main moral of the story: never use occupancy forecasts for the purpose of optimization (the daily DORM routine of dynamic pricing and other optimization decisions), use the true estimation of market demand at any given point in time and then adjust at it changes. This leads to reaching your maximum revenue and profit potential, which you will very quickly notice on your STAR report in increased RevPAR share.

Remember, the goal of running a hotel business is not hitting occupancy targets. The goal is maximizing profit.

Ira Vouk

Co-founder at iRates LLC

Ira Vouk Hospitality 2.0 Consulting