Soft Brands – A Third Alternative

Historically, hotel owners have had the option to either affiliate with a known brand or operate independently. Affiliating with a brand provided access to a reservation system, loyal customers, communal marketing programs, a known identity among consumers, and a sense of stability within the finance and investment community. Brand affiliation, however, comes with costs. Owners pay a variety of fees for royalty, marketing, reservation, and guest loyalty programs, and need to conform to facility, service, and operating standards.

Operating independently relieves owners from the burden of the franchise-related fees and gives owners and operators greater flexibility with regards to facilities, services, and operations. However, without the benefit of national or global marketing assistance, independent hotels rely on their personal reputation and appeal to niche travelers.

History

Around the year 2000, owners were given a third option – the soft brand. Today, the soft brand segment has evolved into what is now referred to as the “lifestyle space” and spans most STR chain scales. In the formative days of the early 1980s and 1990s, swanky properties emerged, which were primarily independent hotels in high urban locations or luxury resort destinations. These properties were affiliated with stalwarts like Ian Schrager’s Morgans Hotel Group and Bill Kimpton’s Kimpton Hotels & Restaurants, a brand that today is synonymous with the soft brand space and the forerunner of the “branded boutique” pillars. Soft brand collections like Joie de Vivre launched by Chip Connely entered the market around the same time. Veteran brander Barry Sternlicht followed with the launch of the W brand in late 1990s and further catalyzed luxury lifestyle at scale with leading edge, design-forward hotels awash with personalized local experiences with a story to tell.

In the early 2000s, the larger brands such as Marriott, Hilton, Starwood, and IHG embarked on growth initiatives to expand product offerings directly in the soft brand space. They targeted acquisition and mergers as well as organically developed brands, all with the intent to spark system distribution growth while providing their more affluent and loyal customers more offerings within their brand family, thereby creating a competitive advantage and expanding market share. In 2004, IHG launched Hotel Indigo and in 2008, Marriott launched the Autograph Collection through a partnership with The Kessler Collection, further accelerating growth. Other brands soon followed1. By the 2010’s, most major brands had developed their soft brands, including Curio Collection (Hilton, 2014), Tribute Portfolio (Starwood, 2015), Tapestry (Hilton, 2017) Unbound Collection (Hyatt, 2016). Moderate-priced hotel companies have also entered the soft brand space, with Choice Hotels International announcing its Ascend Hotel Collection in 2008, and Best Western launching Best Western Premier in 2014.

Soft Brand vs Independent

Soft brands are a hybrid between independent and core-branded properties. In general, soft branded hotels enjoy the benefits of the marketing programs and reservation systems of the core brands, but have greater flexibility regarding facilities, services, and operating standards. Soft brands are frequently the choice of owners of hotels that have a historical reputation and identity of their own.

Soft brands also became an option for owners that wanted to develop “hybrid hotels”, or properties with elevated, but not extensive, amenities and services. Historically, the traditional core brands would not accept this type of property, so owners were forced to go the independent route.

In recent years, as developers question the cost/benefit of affiliating with a core brand, they must decide whether to sign up with a soft brand or operate independently. To provide some financial data for this decision process, CBRE analyzed the 2023 performance of comparable soft branded and independent hotels that are positioned in the upper-upscale chain-class and are operated by a third-party management company. Comparability was established based on room count, occupancy, averaged daily rate, and total operating revenue. Comparisons were made for comparable properties located in urban locations, as well as remote2 locations.

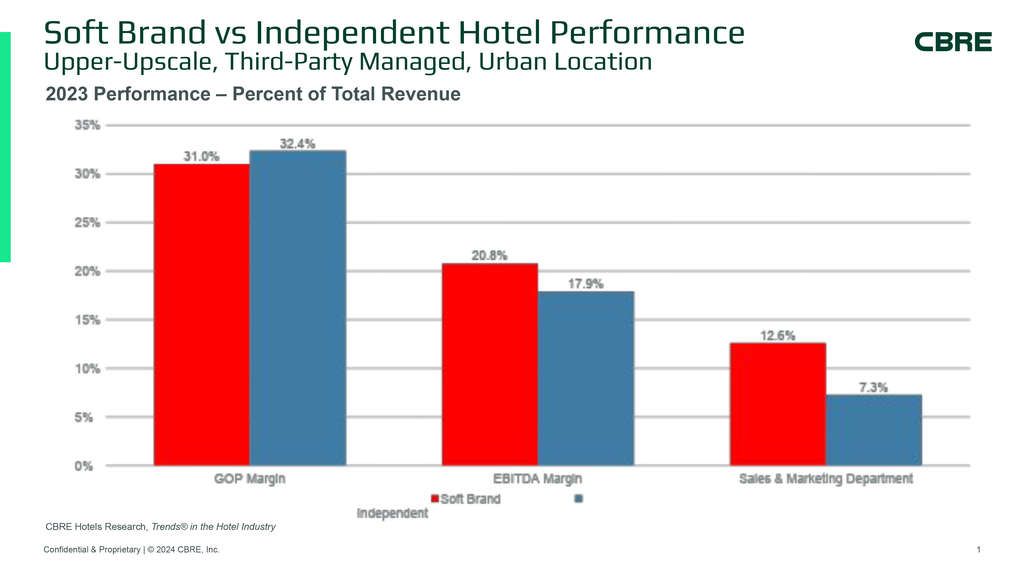

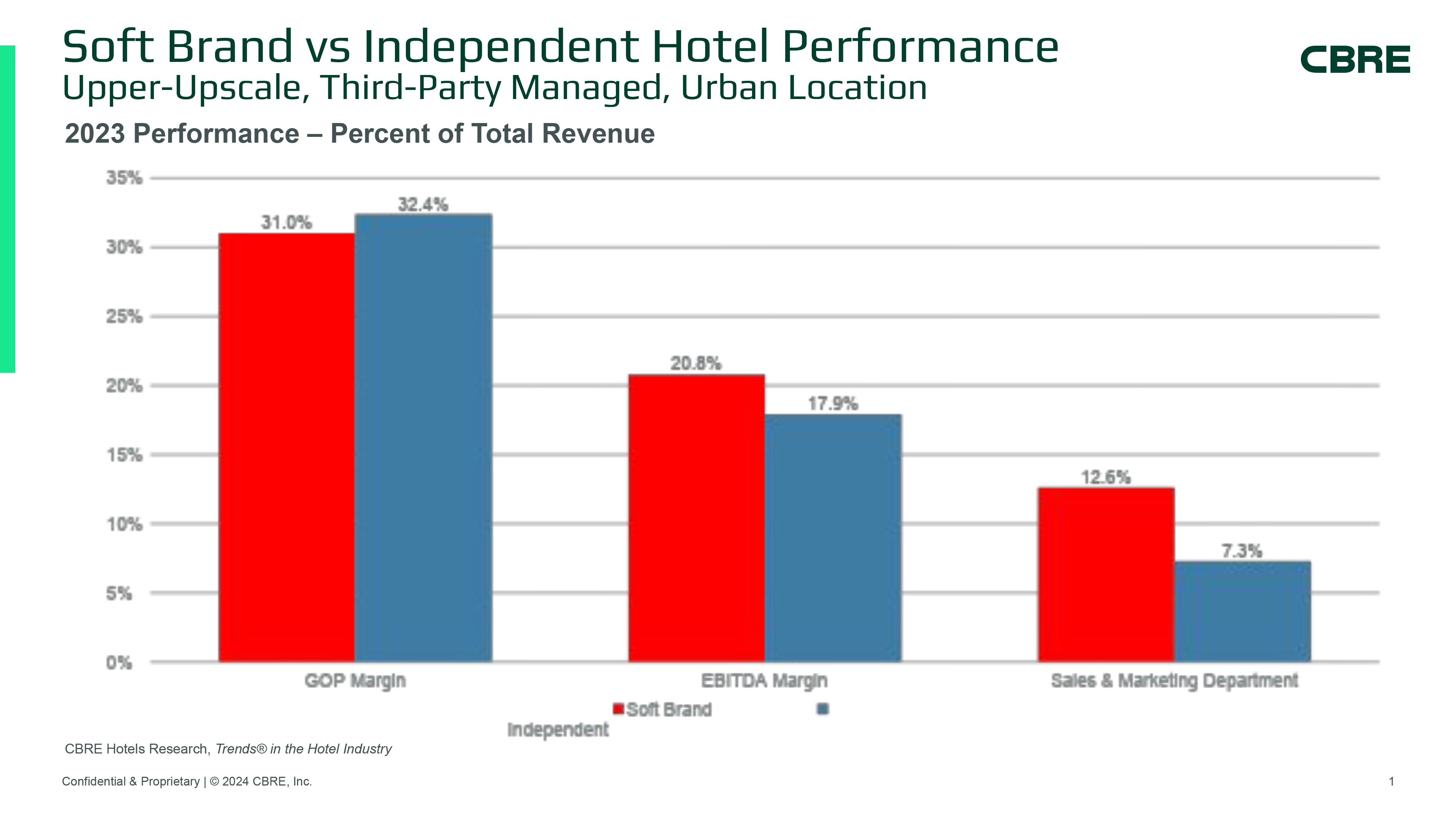

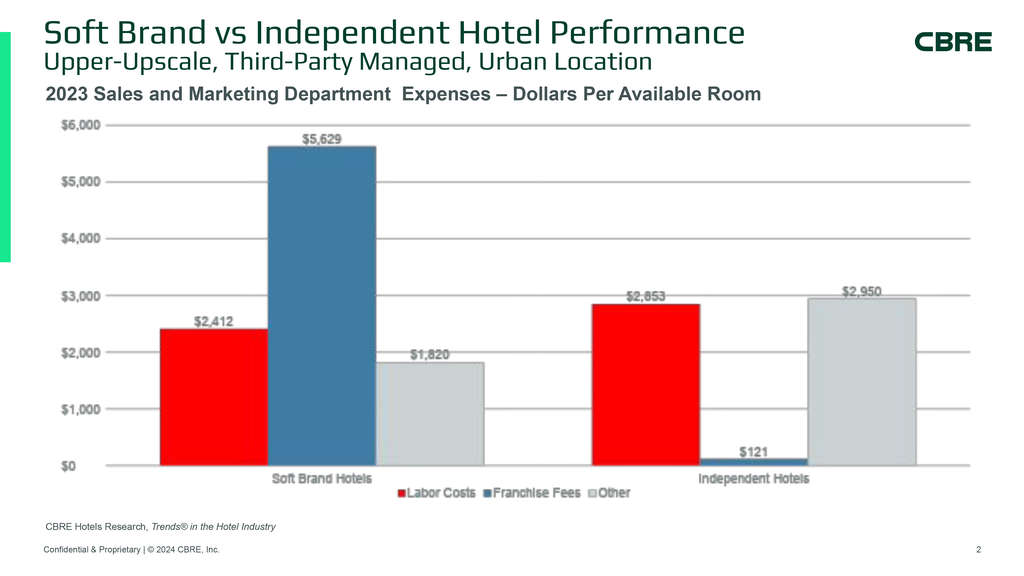

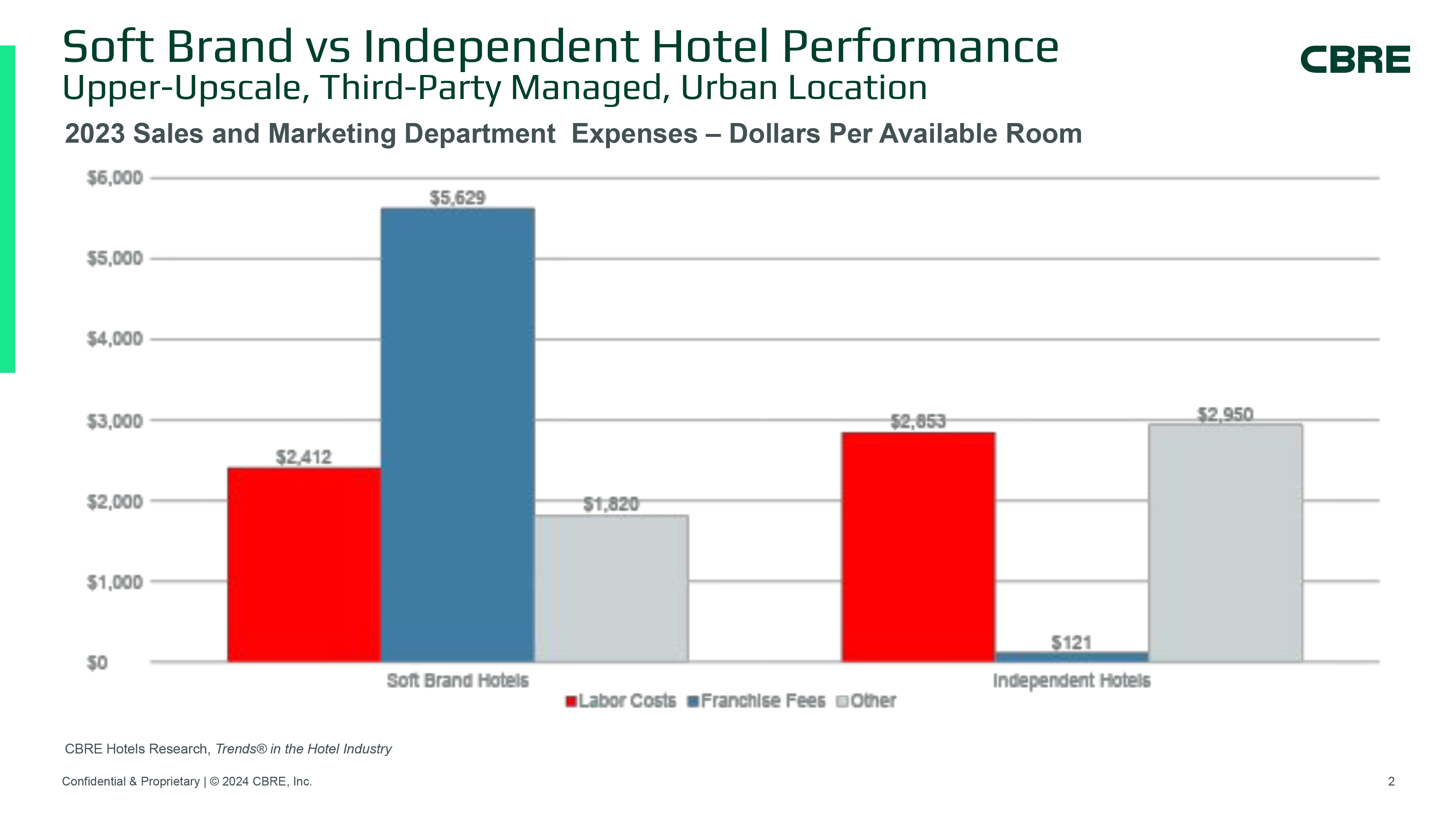

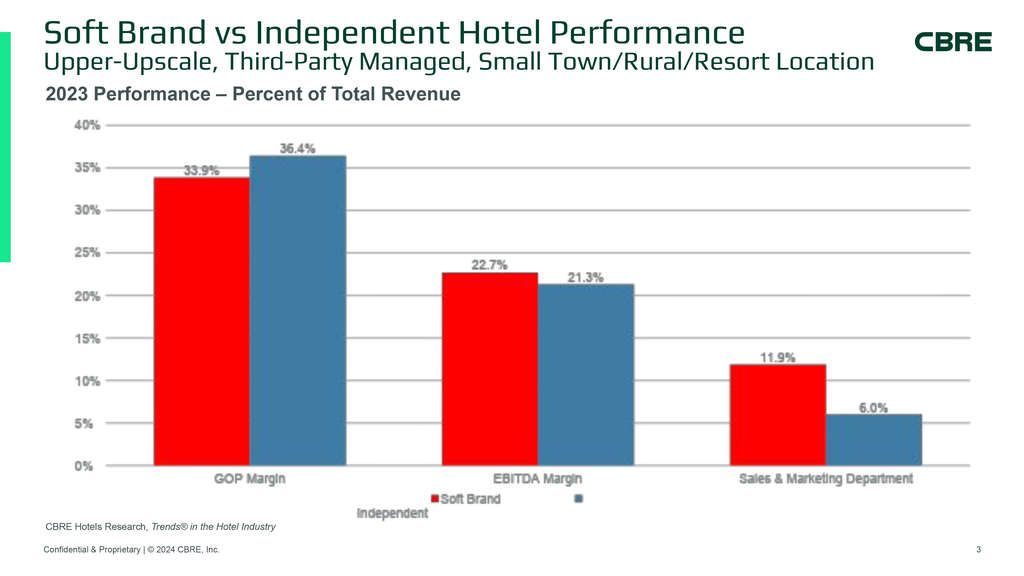

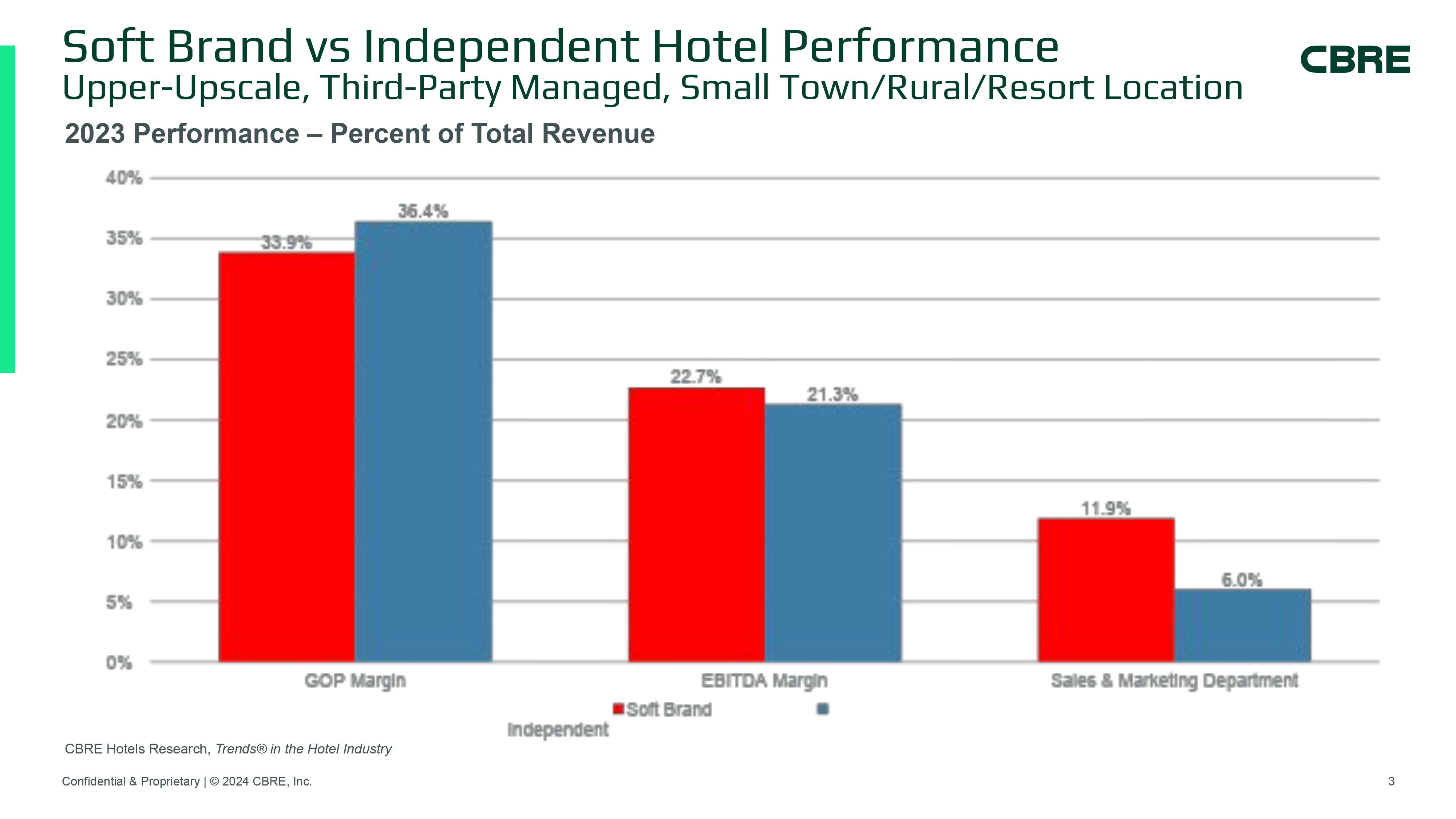

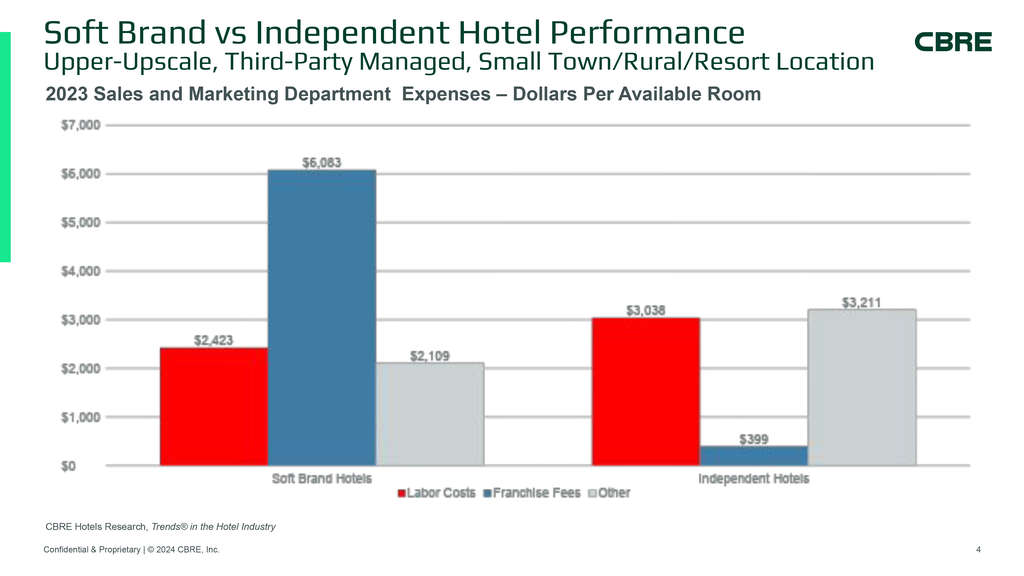

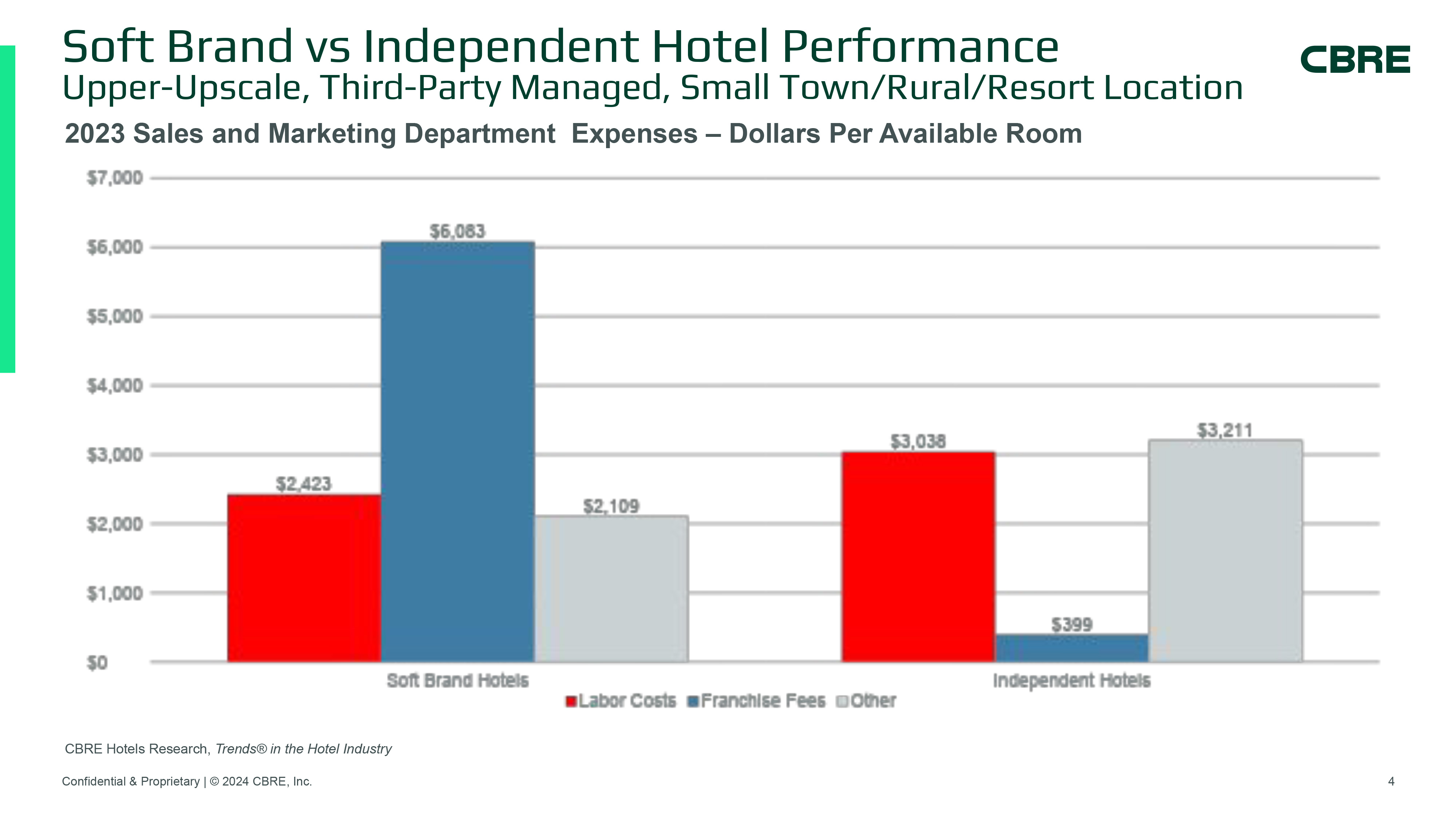

In both urban and remote areas, the independent hotels achieved a higher profit margin at the gross operating profit (GOP) level. As expected, the primary reason for the higher GOP margin is the lack of franchise-related fees. Sales and marketing department expenditures at the urban soft brand hotels averaged 12.6% of total revenue compared to 7.3% at independent hotels. In the remote locations, the difference was 11.9% at the soft brand hotels and 6.0% for the independent hotels.

To make up for the absence of regional, national, and global brand sales and marketing initiatives, independent hotels are more reliant on their own sales professionals. Accordingly, sales and marketing department labor costs per-available-room (PAR) were 18.3% greater at urban independent hotels compared to urban soft brand hotels. In the remote sample, independent hotel sales and marketing department labor costs PAR were 25.4% greater than remote soft brand hotels.

While GOP margins were greater at the independent properties, the EBITDA3 margins were higher at the soft branded hotels. This could be indicative of the collective purchasing power soft brand owners receive for non-operating ownership costs such as insurance. In 2023, insurance costs PAR were 20% to 30% lower at remote and urban soft brand properties respectively.

Other Considerations

To evaluate the operating efficiency of soft brand versus independent hotels, we intentionally selected properties with comparable revenues. However, based on our experience in the marketplace, we have typically found that soft branded hotels do achieve higher, and more consistent levels of occupancy because of the access to the reservation systems and guest loyalty programs of the brands. Higher levels of revenue could offset the operating inefficiencies noted in our analysis.

Further, our analysis does not include the impact on capital costs. While the facility and service standards for soft branded properties are less restrictive compared to their core brand counterparts, the standards do frequently require greater capital investments compared to independent hotels.

Conclusion

Significant strides have been made since the early days of the soft brand movement and the segment has emerged stronger as an exciting trend for investors and consumers to consider. Independent properties and soft brands have expanded their offerings which has given both consumers and owners more choices.

1. Hotel News Now, September 2018, “Timeline: The Beginnings, Explosion of Soft Brands”

2. Remote locations include properties in small towns, rural areas, and resort destinations.

3. EBITDA = Earnings before interest, taxes, depreciation, and amortization.

Robert Mandelbaum

Director of Research Information Services

CBRE Hotels