Hotels in Europe balance digital platforms and direct bookings for success

Hotel distribution dynamics: how European accommodations optimize booking channels

In many sectors, the digital transformation has sparked concerns about market concentration, favoring larger players over smaller businesses. Yet, the European hotel industry defies this trend, as evidenced by the latest findings from Hotrec, the umbrella association of hotels and hospitality providers.

With the help of open platforms like ours, not just large global chains but also small and medium-sized enterprises (SMEs), from family-run bed-and-breakfasts to inner-city boutique hotels, continue to thrive in a fragmented and competitive market.

Nearly 55% of all bookings in 2023 were made directly with hotels

The recent Hotrec study reveals that European hotels maintain a robust and diverse distribution strategy, with direct bookings still playing a critical role. Nearly 55% of all bookings in 2023 were made directly with hotels, either online or offline. This includes direct online bookings, which account for 33.8%, and direct offline bookings (via telephone, walk-in, etc), which make up 21.2%. This sustained preference for direct bookings highlights the sector’s resilience and adaptability, even in the face of digital disruption.

no single platform accounts for more than 20% of all bookings

In contrast, online travel platforms account for only 29.1% of all bookings. split across a number of platforms such as Booking.com, Expedia, HRS, Hotels.com, Trip.com, and many more. According to the study results, no single platform accounts for more than 20% of all bookings, putting it firmly behind direct online and offline distribution. Independent research (pre-pandemic) estimates this number to be even lower, with no single platform exceeding a 15% share of total bookings.

The Impact of the Pandemic and the Resilience of Hotel Distribution

While European accommodation sector has recovered in 2023, the global pandemic had an unprecedented impact, causing significant contractions and uncertainty. Despite these challenges, the structure of hotel distribution channels remained largely intact. The Hotrec study found that direct channel bookings continued to prevail during the pandemic.

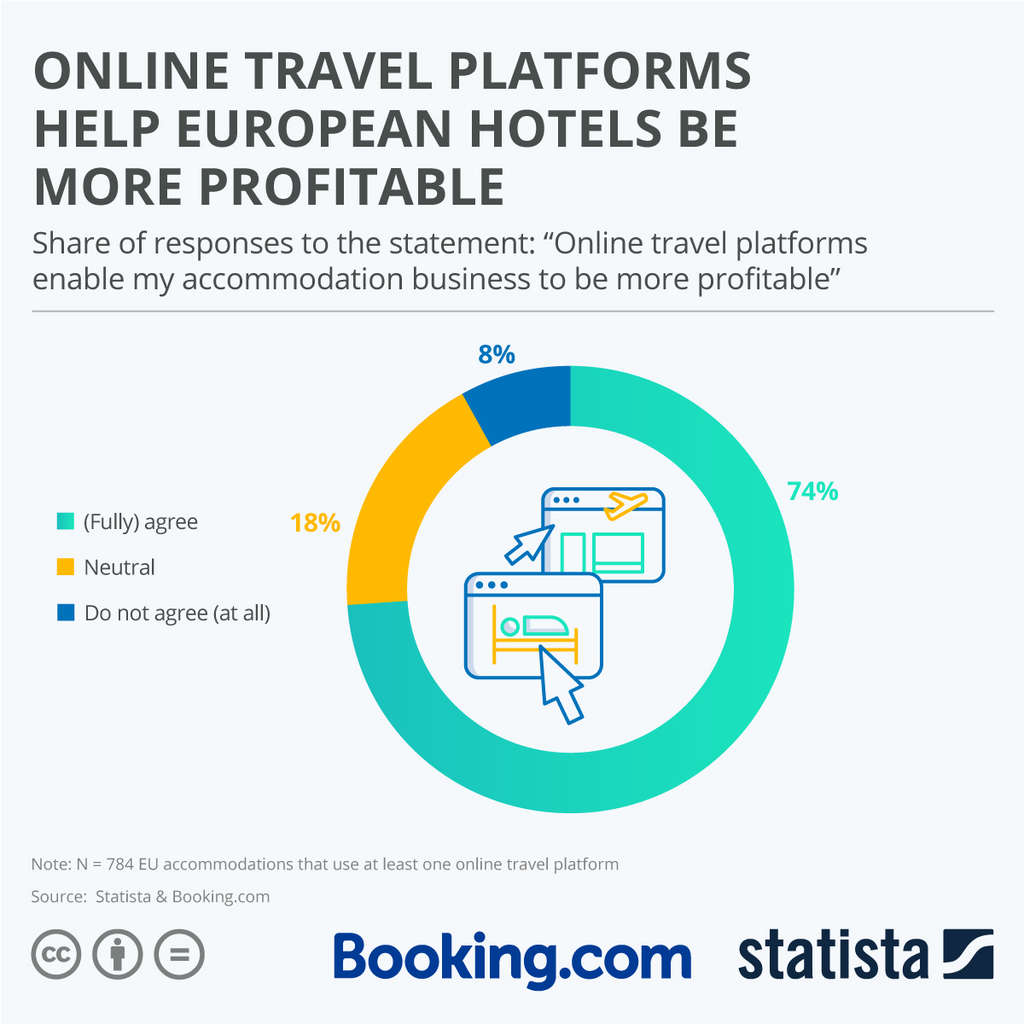

74% of survey respondents agreed that online travel platforms made their businesses more profitable only 8% disagreed.

Strategic Channel Management and the Role of Technology

European hotels are increasingly leveraging technology to optimize their distribution strategies. About half of all hotels now use channel management software to coordinate bookings across multiple platforms effectively. Additionally, over 40% of hotels advertise their direct booking rates on meta-search engines like Google Travel, maximizing their visibility and appeal to potential guests.

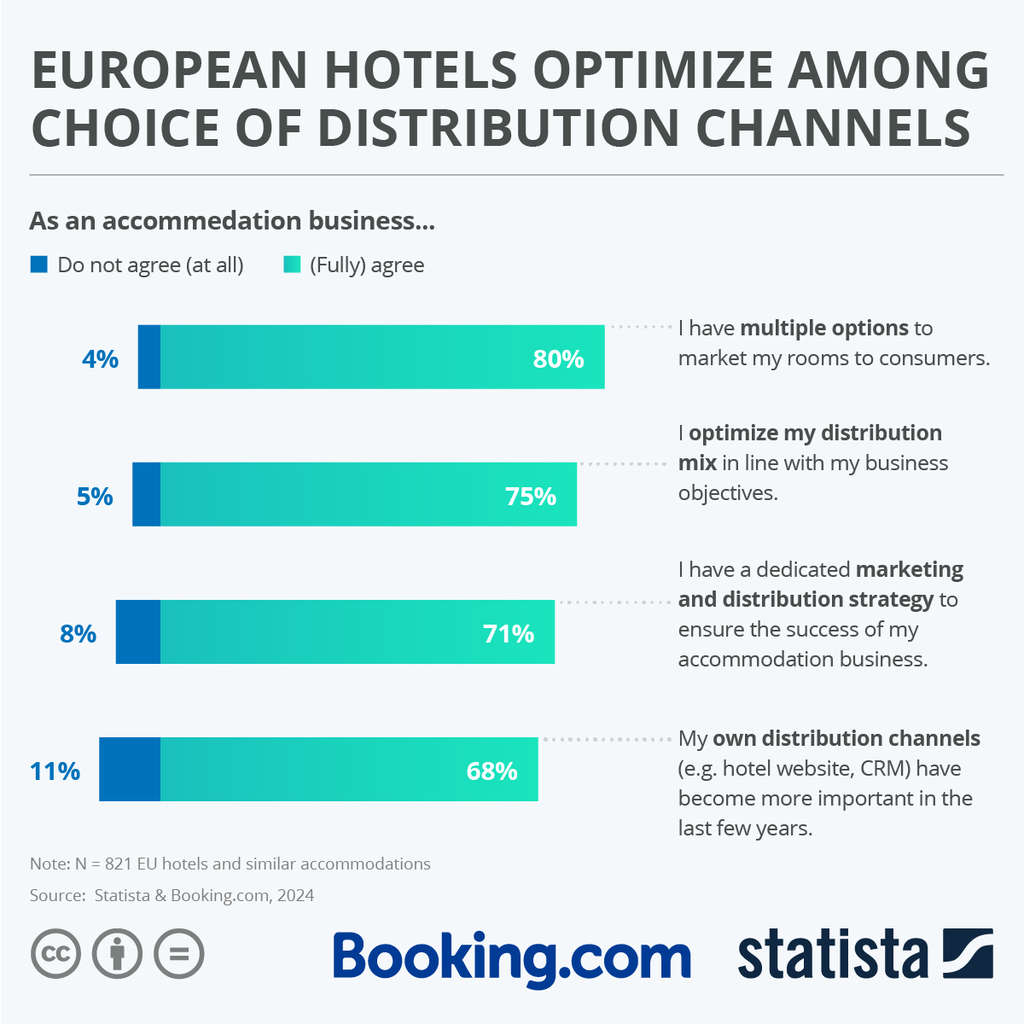

This flexibility in combining different distribution channels not only broadens market reach but also aligns with business goals, helping hotels stay competitive and agile. A recent study by Statista Inc. and Booking.com in 2024 revealed that 80% of EU hotels recognize they have multiple marketing options for their rooms, and they don't shy away from using them.

diversity in distribution channels ensures that hotels can maintain entrepreneurial freedom while leveraging the advantages of digital platforms.

The ability to blend sales channels is a crucial aspect of most hotels’ marketing strategies, with two-thirds of respondents indicating they adjust their distribution mix to meet their business objectives. Additionally, 71% have a dedicated marketing and distribution strategy to ensure the success of their accommodation business.

Promoting Trust and Authenticity in Hotel Bookings

A personal connection is a unique advantage that direct bookings offer over OTAs. However, digital platforms like ours also play a critical role in nurturing trust through the extensive review systems and customer support services, which help bridge the gap for travelers unfamiliar with a destination.

Platforms like Booking.com provide a reliable intermediary service, offering 24/7 support and authentic reviews, which are particularly beneficial for small and independent hotels. This reciprocal relationship between OTAs and accommodation partners fosters a healthy competitive environment, driving innovation and enhancing customer satisfaction. Afterall, hoteliers themselves confirm that such partnerships make them more profitable. At a remarkable rate of nine to one, European accommodations concur with this statement.

Online platforms enable hotels to reach new audiences, deal with seasonality, and achieve higher occupancy.

Conclusion: A Balanced and Competitive Market

The European hotel market exemplifies a balanced and competitive landscape where direct bookings and OTAs coexist harmoniously. This diversity in distribution channels ensures that hotels can maintain entrepreneurial freedom while leveraging the advantages of digital platforms. The ongoing competition and cooperation between direct channels and OTAs ultimately benefit hotels, travelers, and the market as a whole.

coopetition is a win-win-win for all — hotels, travellers, and platforms. Let’s keep it that way

While concerns about businesses becoming dependent on certain platforms might be warranted, hotel distribution is certainly not the case. European accommodations enjoy great entrepreneurial freedom, choice and flexibility. They benefit from one of the highest direct sales rates of any sector. In this context, no one could convincingly argue that hotels depend on a single online platform.

Whenever hotels partner up with online platforms it is because they assess it to be the right choice and it, ultimately, makes them more successful. Online platforms enable hotels to reach new audiences, deal with seasonality, and achieve higher occupancy. At the same time, travel accommodations and platforms compete online for travellers’ business, spurring innovation and fostering customer centricity. This coopetition is a win-win-win for all — hotels, travellers, and platforms. Let’s keep it that way.