What can we learn about digital transformation from the 2022 Hotel Distribution Study

In many sectors there is a concern that the digital transformation is leading to more concentrated markets. Economies of scale and scope are said to favor the big over the small, with digital gatekeepers monopolizing access to consumers. When it comes to European hotel sales, the opposite holds true.

It’s the small and medium-sized businesses — from family-run bed-and-breakfasts to inner city boutique hotels — that are the leaders in a diverse and fragmented market. This is the outcome of the latest European hotel distribution study by Hotrec, the umbrella association of hotels and hospitality providers. The study results are a strong testament to the diversity of the European accommodation ecosystem, where small and large businesses are engaged in coopetition — competing and cooperating at the same time to create joint value.

The results are also instructive when it comes to the regulatory initiatives for the digital economy currently pursued in Europe and other jurisdictions. Comparing hotel distribution to other segments of the economy yields insights as to why in some sectors concerns about increasing concentration and dependency might be justified, while in others they are not warranted.

European hotel distribution study: direct distribution dominates all other channels

Hotels have a large number of options when it comes to marketing and distribution. The European hotel distribution study, a bi-annual survey among hoteliers, offers respondents no less than 16 distinct choices — from people making reservations by email to those booking on social media channels.

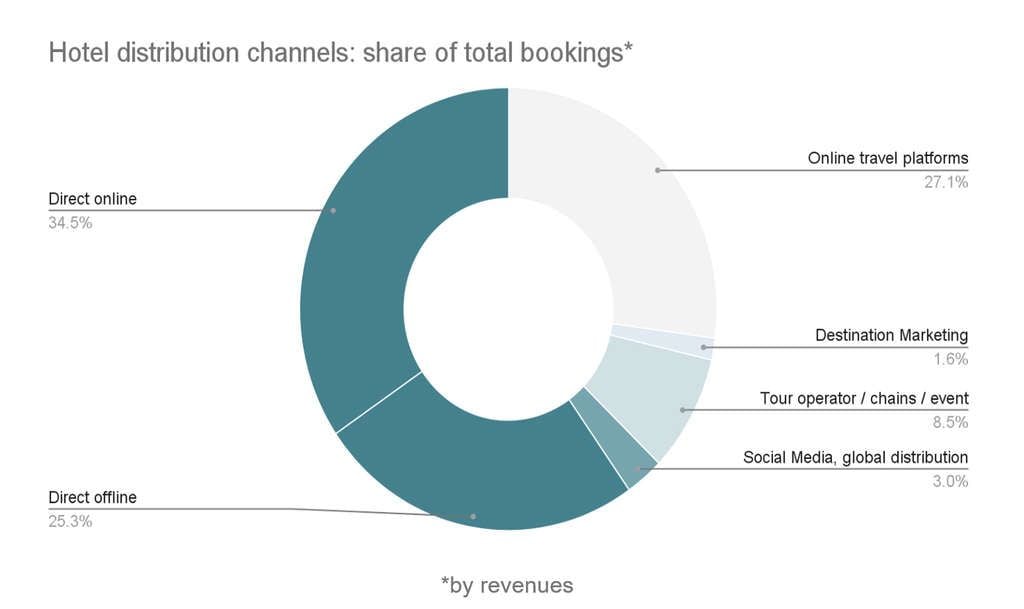

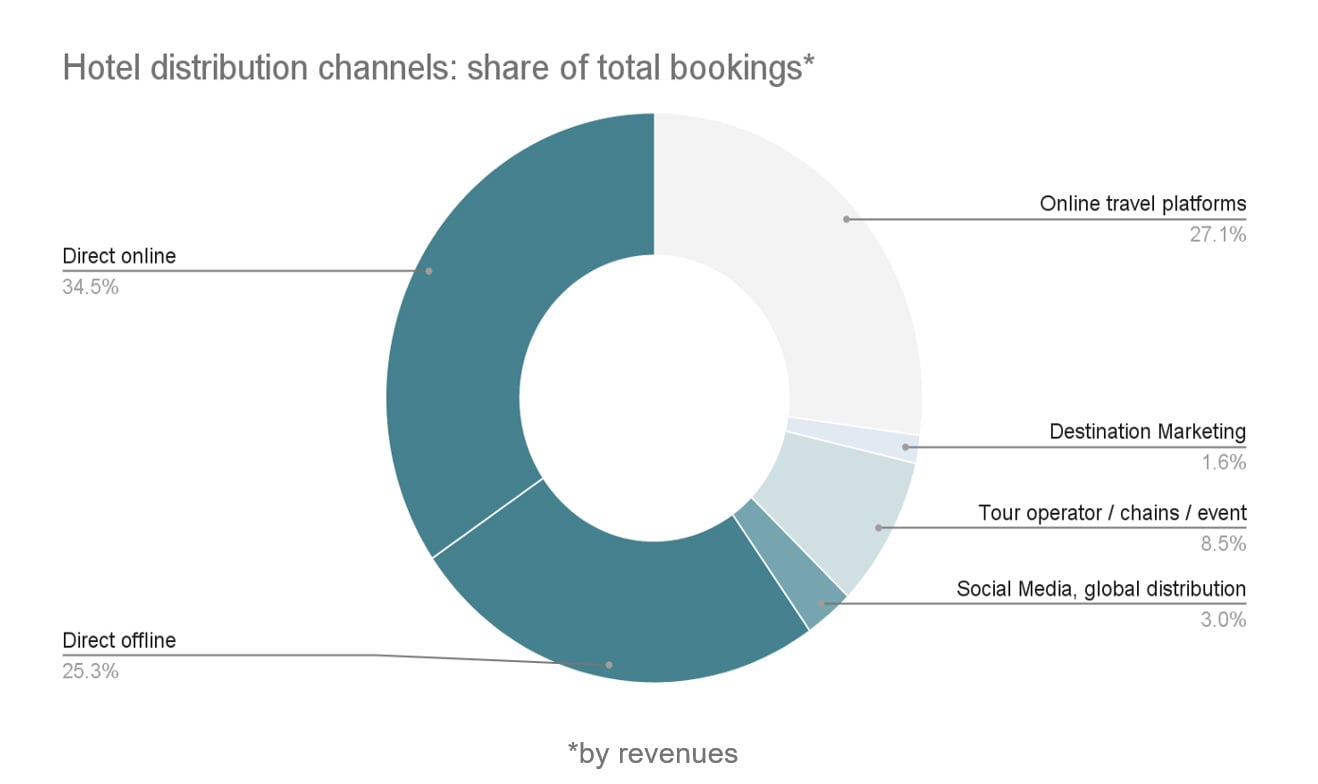

Direct distribution, i.e. a guest booking directly with a hotel, is the most important form of distribution, accounting for almost 60 percent of all bookings. This includes direct online bookings (per email, hotel website, etc) and direct offline bookings (per telephone, walk-in, etc). Even when one disentangles these two forms of direct distribution, direct online bookings remain the most important distribution form, accounting for 34.5 percent of all bookings. Direct offline bookings account for 25.3 percent of all bookings. Moreover, the direct distribution channel is growing, increasing its overall share by 4.7 percentage points since the last study. Independent market analysis expects this trend to continue in the coming years.

In contrast, online travel platforms account for only 27.1 percent of all bookings. These bookings are split by a number of platforms such as Airbnb, Booking.com, Expedia, HRS, Hotels.com, Trip.com, and many more. According to the study results, no single platform accounts for more than 19 percent of all bookings, putting it firmly behind direct online and offline distribution. Independent research puts this number even lower, with no single platform exceeding a 15 percent share of total bookings.

Looking at only the segment of online sales, as is sometimes done (even though it’s questionable why online sales should be a separate category given that consumers sometimes book online and sometimes offline, e.g. with a tour operator or by calling a hotel), the same picture emerges. Direct online sales dominate with about 56 percent of all bookings and the largest platform accounting for about 31 percent of sales (independent research puts this closer to 24 percent).

Hotels use multiple channels and advertise their direct rates on meta-search engines

Given the fragmentation of the hotel distribution market, it is no surprise that the majority of hotels multi-home, i.e. use more than one distribution channel to reach consumers. In fact, about half of all hotels use channel management software to optimize their distribution strategies across different channels. More than 40 percent of hotels also advertise their direct booking rates (i.e. those offered on their own website) on comparison shopping sites (so called meta-search engines), with Google Travel being the most used one at more than 70 percent usage rate. This shows the large number of options available to each hotel to market and distribute their hotel rooms, even while direct distribution (consumers booking directly with the hotel) remains the single most important distribution channel.

What sets hotel distribution apart from other sectors

The diversity and fragmentation of hotel distribution stands in contrast to other parts of the economy, where online intermediation has become much more important, leading to new legislation to regulate so-called digital gatekeepers. The concern is that in particular small businesses have become dependent on online platforms to reach customers and this dependency might lead to unfair trading conditions.

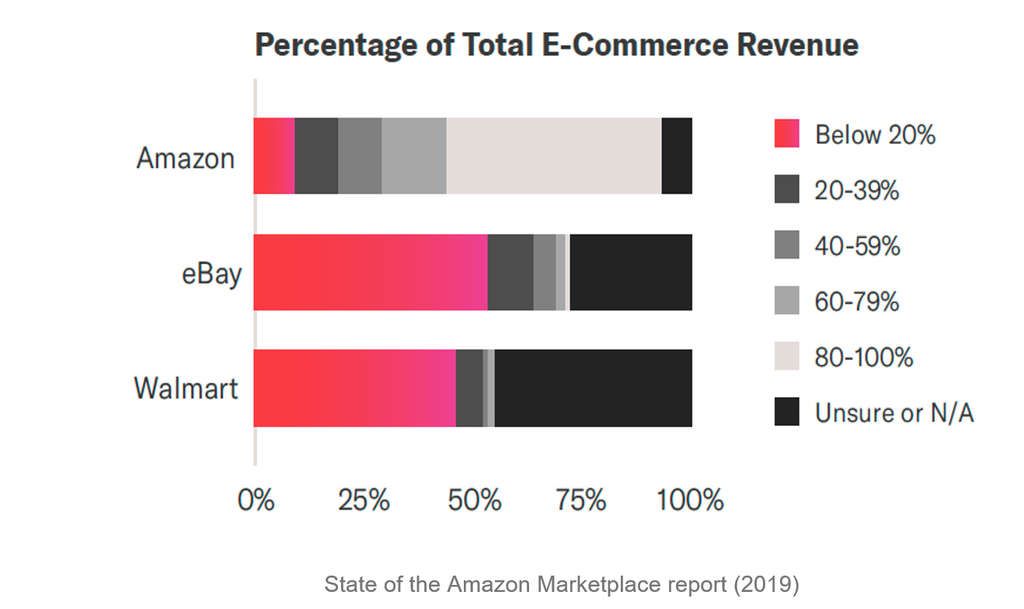

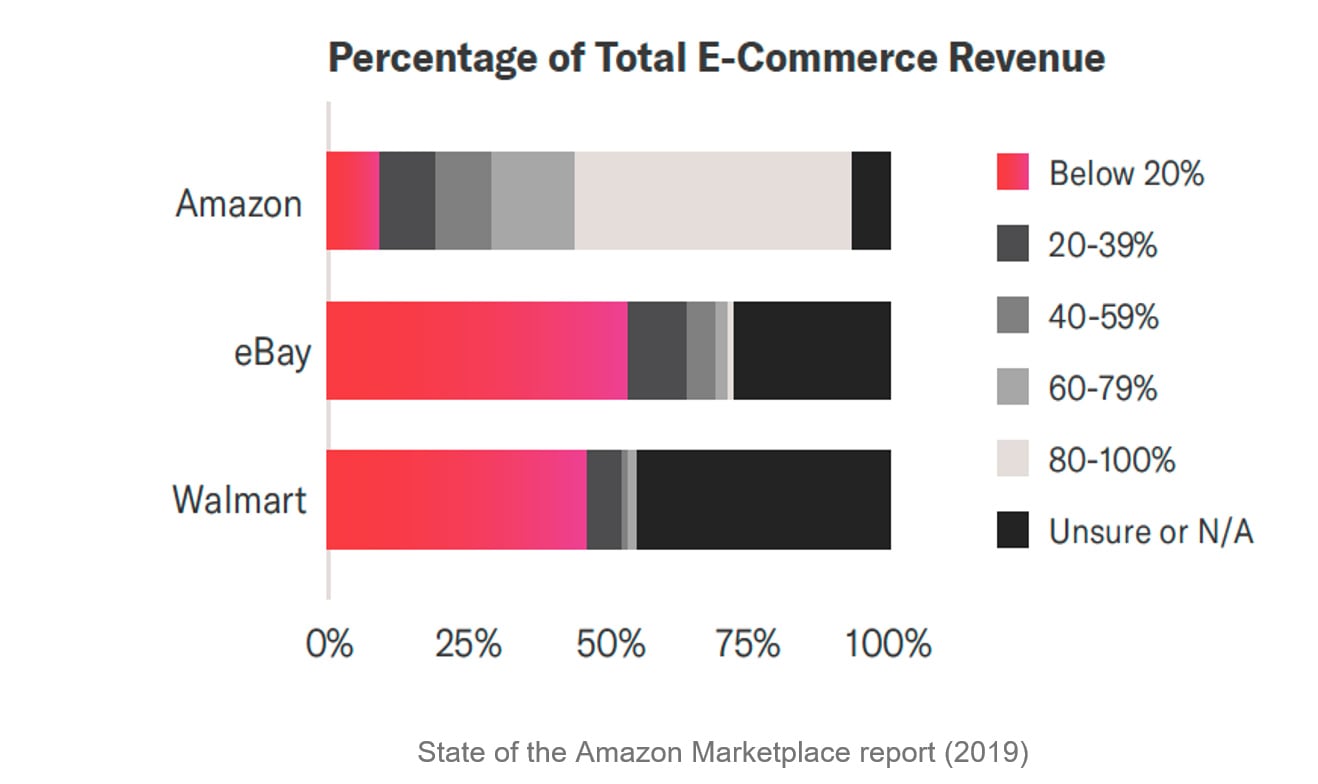

One often cited example of a digital gatekeeper is Amazon, which has become the leading online marketplace for a large number of product categories. According to the annual “State of the Amazon Marketplace” report, nearly half (49 percent) of respondents sell almost exclusively on Amazon, which accounts for 80–100 percent of their total sales revenue. Two-thirds of Amazon sellers owe more than 60 percent of their total e-commerce revenue to Amazon. Only a minority generates less than 20 percent of their total revenue from Amazon. Even though about half of Amazon sellers have their own website and 23 percent sell in brick-and-mortar stores, these channels do not account for much revenue. For many sellers, Amazon simply is their business.

Contrast this to hotel sales, where the numbers are essentially reversed. The average hotel generates about 60 percent of its total revenue from direct sales and the largest platform, Booking.com, accounts for no more than 15 percent of total sales revenue. For hotels, online platforms are just one of many sales channels while the majority of revenue comes from direct sales to consumers.

This makes clear that while concerns about businesses becoming dependent on certain platforms might be warranted, hotel distribution is clearly not such a case. Hotels enjoy great entrepreneurial freedom and benefit from one of the highest direct sales rates of any sector. No one could reasonably argue that hotels depend on a single online platform for their business.

Whenever hotels cooperate with online platforms it is because they deem it the right choice and it makes them more successful. For example: Online platforms enable hotels to reach new audiences and achieve higher occupancy. At the same time, hotels and platforms compete online for travelers’ business, spurring innovation and fostering customer centricity. This coopetition is a win for everyone — hotels, travelers, and platforms. We should keep it that way.