The EU Digital Markets Act (DMA) is changing Google Search, but not how hoteliers had hoped

The Digital Markets Act (DMA) was expected to create a more balanced playing field for hotels in the digital marketplace. So far, it appears to be having the opposite effect.

In response to DMA regulations, Google introduced several significant changes to hotel search result pages in January. Our recent analysis reveals several concerning trends . Organic and unpaid traffic to hotel websites and booking revenue have fallen sharply while paid traffic and revenue have surged. As a result, direct distribution costs have become significantly more expensive for hotels in Europe and most probably for hotels advertising to a European clientele.

What Is the Digital Markets Act?

The Digital Markets Act is a new legislation from the European Commission aimed at curbing the power of online “gatekeepers” like GAFA (Google, Apple, Facebook, and Amazon) to promote fair competition and offer consumers more choices in the digital marketplace.

For hotels in Europe, the DMA was expected to create a more level playing field, increasing transparency about how to improve rankings and visibility on these platforms, giving more control over distribution, and reducing dependency on OTAs.

How Have Google Hotel Search Pages Changed?

Google has not disclosed any details, but we have observed several key changes to search result pages for hotel-related queries, including:

- Organic results are pushed further down the page, making them less visible.

- The introduction of a new bloc “ places” gives more space to OTAs and Metasearch.

Other notable changes that affect the user experience include:

- Stay dates can only be changed by clicking through to Google Hotels pages and clicking the Dates tab in the newly designed menu.

- Users cannot click Google Maps in the Knowledge Panel for a larger view.

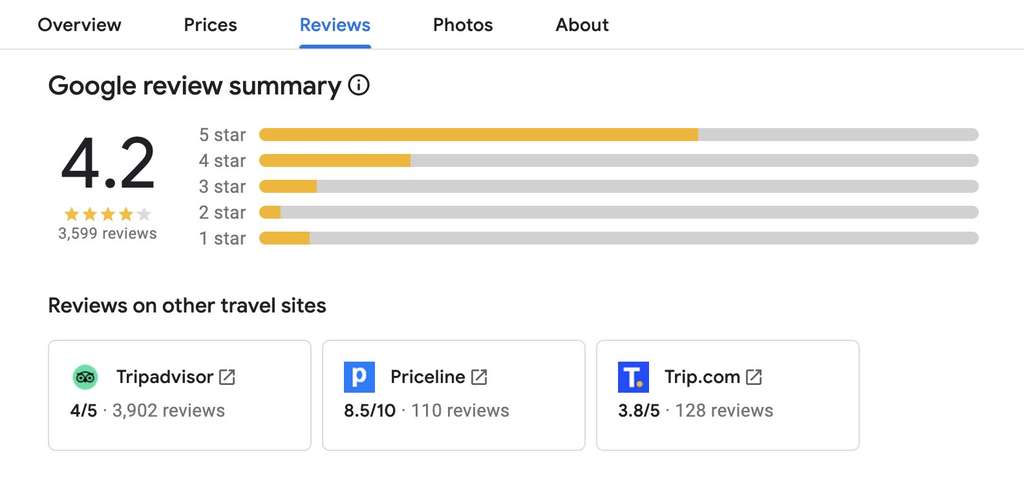

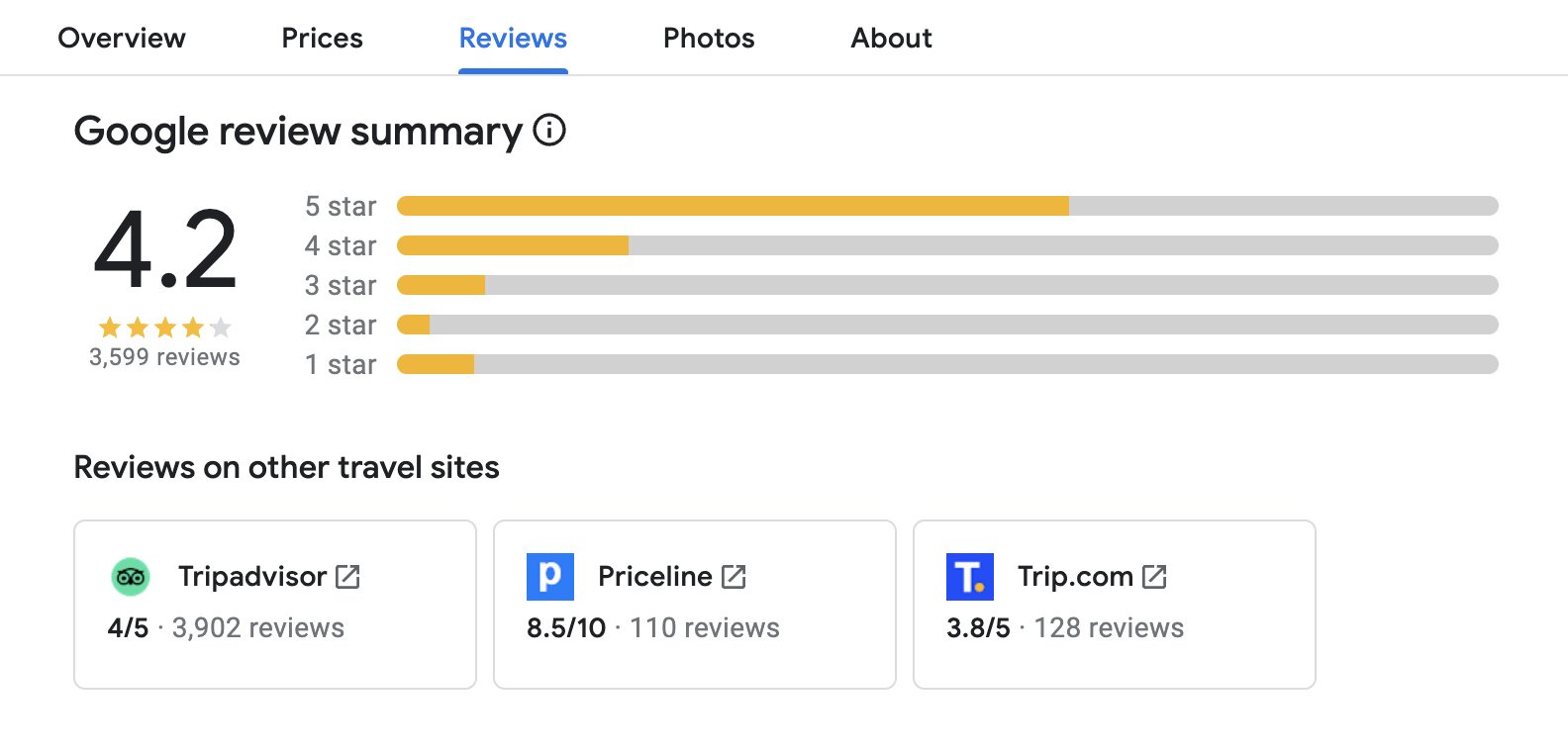

- Guest reviews from various sources are now included with Google reviews.

What Is the Impact of These Changes on Hotel Performance?

We analysed website traffic and digital booking data for a broad selection of independent hotels and small hotel groups in the EU. The data was drawn from the period January 1, 2024, when most of the changes took effect, to April 28, 2024, and compared to the same period last year.

Key findings

1- Significant drop in free traffic

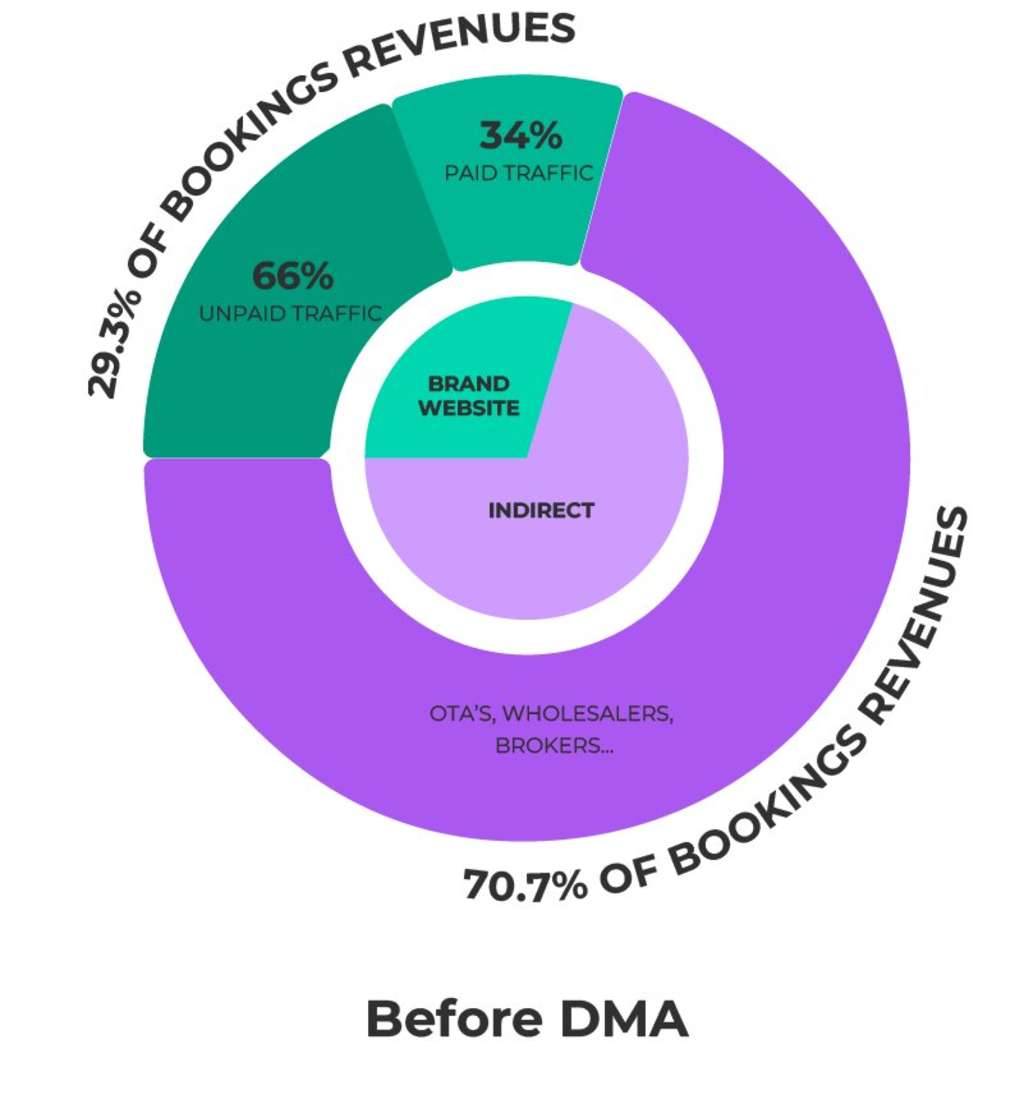

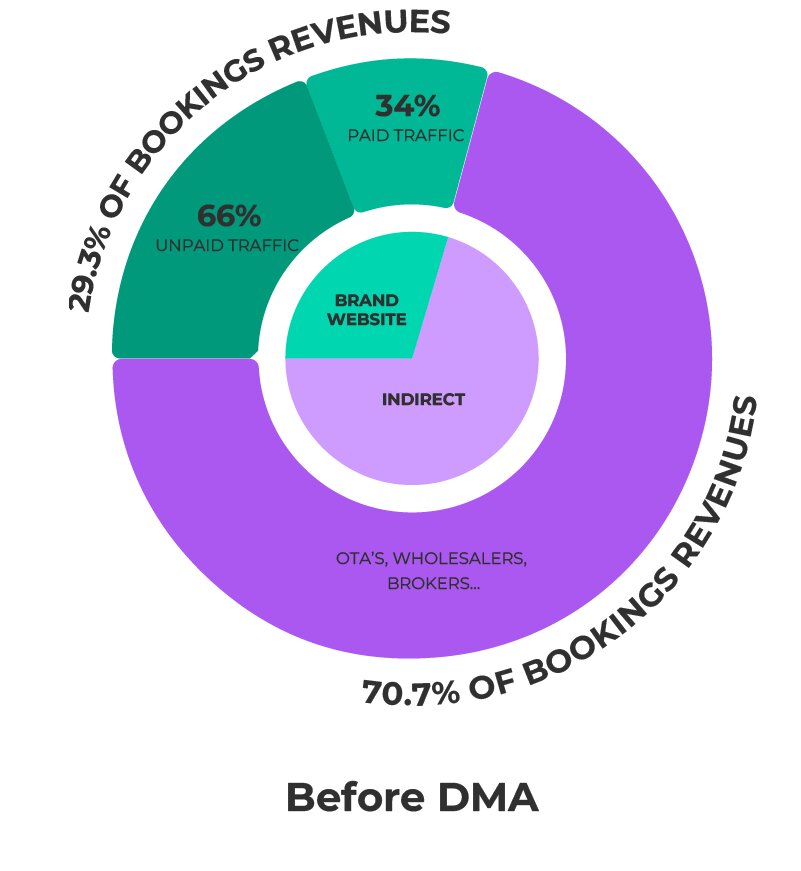

T he share of direct revenue from organic and unpaid traffic on Google has decreased from 66% to 57%

Organic Traffic Decline: There has been a 20% drop in organic traffic to hotel websites, likely due to organic links appearing much lower in search results.

Free Booking Links Revenue Fall:

Revenue from Free Booking Links has dropped by 32%. Despite the placement remaining the same, changes in the overall page display could explain the 41% drop in clicks.

2- Increased dependence on paid traffic

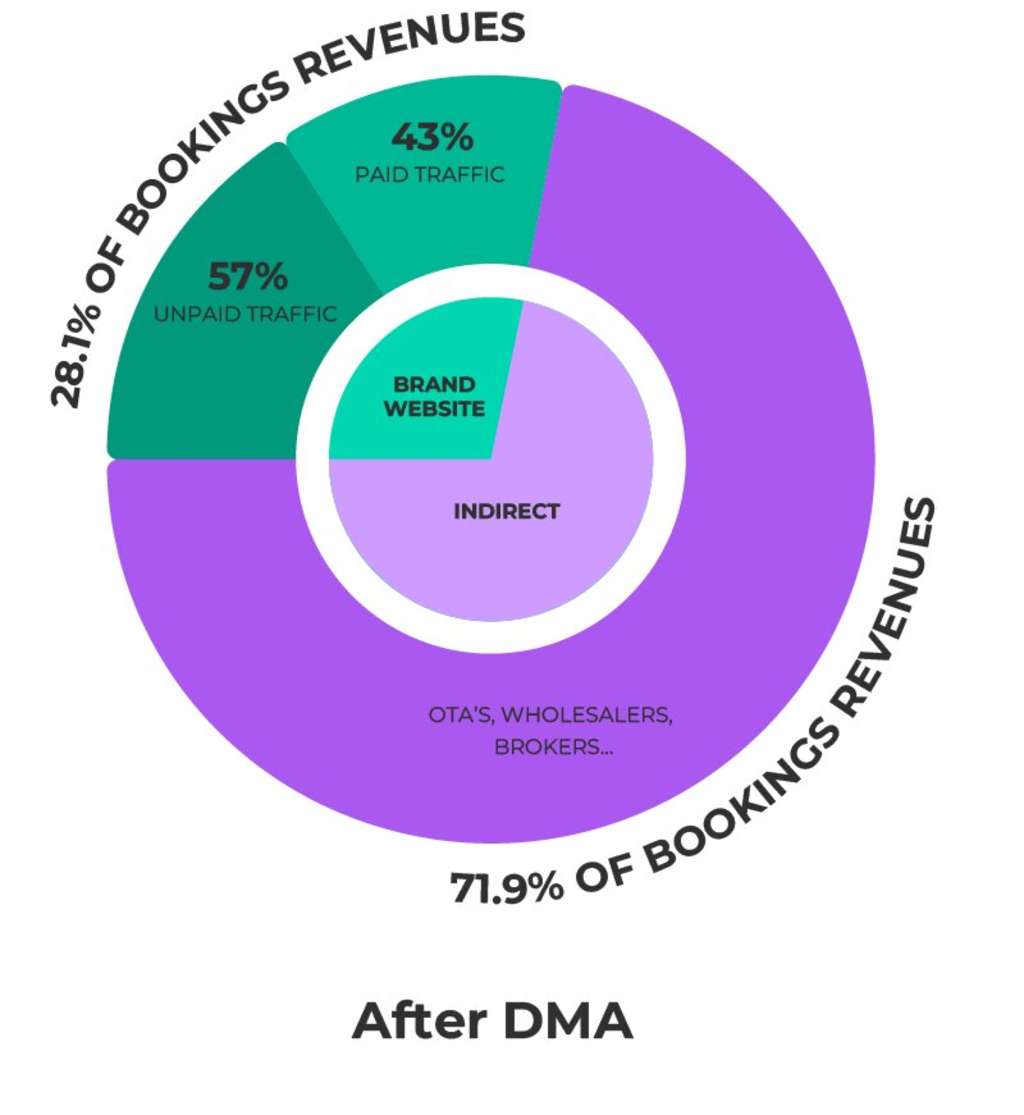

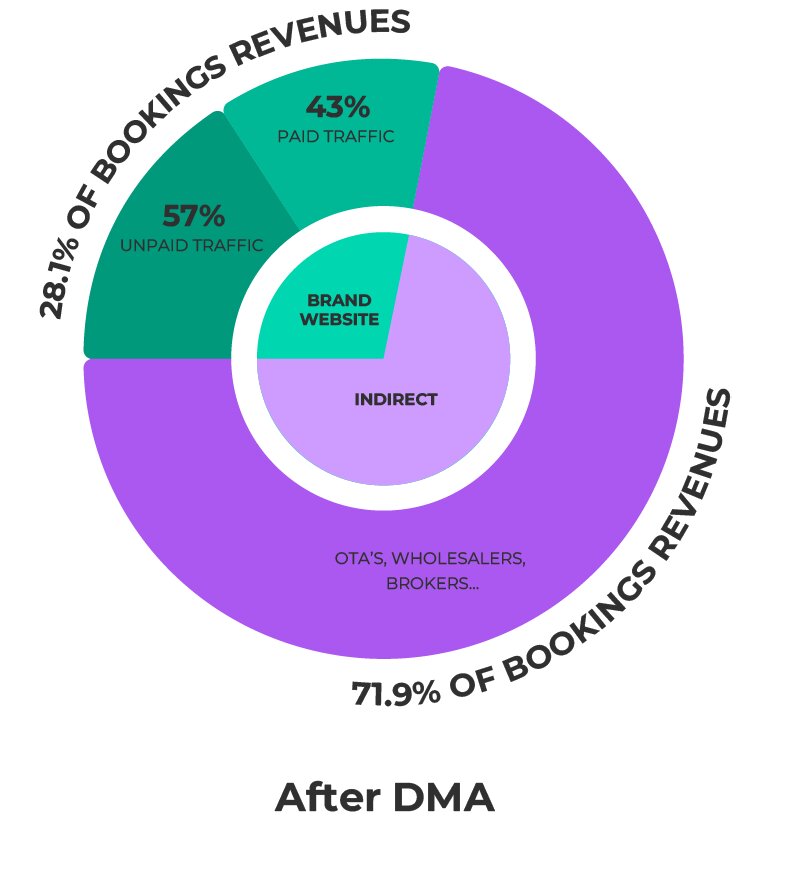

The share of direct revenue from Google paid campaigns has risen sharply, from 34% to 43%, with Google Ads (Search Marketing) accounting for 39% of clicks.

3- Rising distribution costs

This shift has led to a 18% increase in direct distribution costs, with average direct distribution costs rising from 3.3% to 3.9% of revenue. However, direct costs remain three times less expensive than indirect costs on average.

4- Unfavourable shift in channel distribution mix

Direct booking revenue share has fell by 4.3% to an average of 28.1%, while OTA revenue market share has grown to 62.7%, and other indirect sources (mostly Hotelbeds) have increased to 9.1%.

Given that total digital revenue was up by 11% during this period, some hotels may have missed these important shifts in traffic, revenue, and market share.

Breakdown of online hotel bookings revenues

What does this mean for hotels in Europe and hotels who advertise to a European clientele?

It’s still unclear at this time if these changes are the direct result of DMA regulations or if they are temporary or permanent. Google may still be testing these changes, with more adjustments to come.

Yet the impacts are real. As it stands now, the winners from DMA regulations are the gatekeepers, not hotels or consumers. Recent changes to hotel search pages have increased OTA visibility and Google’s ad revenue, while hotels have lower visibility, receive less organic traffic, and face higher distribution costs.

What can Hoteliers do?

While it’s too early to implement major changes to your strategy, consider the following

- Monitor data closely. Analyse how changes affect website traffic, booking revenue, distribution mix, and acquisition costs.

- Increase your digital marketing spend. Investing more in paid advertising, especially on your hotel name for brand protection, may be necessary at the moment to enhance search visibility and drive qualified traffic.

- Partner with a digital marketing agency. Find expert partners who have access to first hand info (for Example Google Premier Partners), analyse your property’s performance across channels, and adapt as needed to optimise your SEO and the effectiveness of marketing and distribution strategy.

Expect More Disruption

The DMA recently added Booking.com to its list of gatekeepers. Given Booking.com’s dominance in Europe, its compliance with DMA regulations could also bring significant changes to hotel distribution.

Stay tuned as we continue to monitor developments and advise our hotel partners on the best strategies for success.

About D-EDGE

D-EDGE is a SaaS company offering leading-edge cloud-based e-commerce solutions to more than 17,000 hotels in over 150 countries. Combining technical excellence with digital marketing expertise, D-EDGE brings a holistic hospitality technology infrastructure under one roof. The integrated range of solutions covers all stages of hotel distribution which encompasses Central Reservation System, Guest Management, Data Intelligence, Connectivity Hub, Digital Media, and Website Creation. With a team of 500 experts located in over 25 countries, D-EDGE provides localised support, services, and tools. With its global network of 550+partners, D-EDGE’s ever-expanding ecosystem is a positive place to do business and grow. D-EDGE is a subsidiary of Accor, a world-leading hospitality group consisting of more than 5,300 properties and 10,000 food and beverage venues throughout 110 countries. For more information visit www.d-edge.com.