Golf Revenue Above PAR and POR for Hotels

Throughout the latter part of the 20th century, golf was growing significantly in the United States. Not only was participation soaring, but new golf courses were being built at a record pace. In some years, development activity exceeded 400 new courses.

The popularity of golf began to decline around 2000, as the tech bubble recession that began in 2001 slowed the pace of growth during the first few years of the decade. Annual declines in the number of rounds played started in 2006, and participation in the sport weakened further in 2007 and 2008 as the Great Financial Crisis sapped discretionary expenditure funds from the prototypical golfer. As a result, golf course closures began to occur more frequently than new course openings. Entering 2020, the number of rounds played on U.S. courses had dropped to 1995 levels.

Since 2020, however, golf has experienced a resurgence. In 2023, the National Golf Foundation (NGF) reported 26.6 million rounds of golf played on U.S. courses, up 9.5% from the 24.3 million rounds played in 2019. Of even greater significance is the estimated 115% rise in off-course participation, which is defined as driving ranges, simulators, and par-3 courses, during the same period.

While the desire to participate in outdoor sports during the pandemic has been identified as the catalyst for the increase in on-course participation, Topgolf has been credited as the “gateway drug” for Millennials, and the impetus for the rise in off-course participation. Fortunately for those who have invested in the golf business, research conducted by the NGF has found that off-course participation does not cannibalize on-course participation. In fact, increased business at Topgolf has generated additional on-course players.

The combination of new on-course and off-course golfers resulted in a total participation count of 45 million people in 2023. This represents a compound annual growth rate of 36% since 2019. According to the NGF, this makes golf the largest growing sport in America.

To analyze how the growth in the popularity of golf has influenced the U.S. lodging industry, CBRE analyzed the performance of 20 U.S. golf resorts that participated in our annual Trends® in the Hotel Industry survey each year from 2019 through 2023. In 2023, these 20 properties averaged 626 rooms in size, and achieved an occupancy of 63.7%, along with an ADR of $363.98. The average golf revenue for these 20 properties in 2023 was $6.9 million.

Golf Revenue

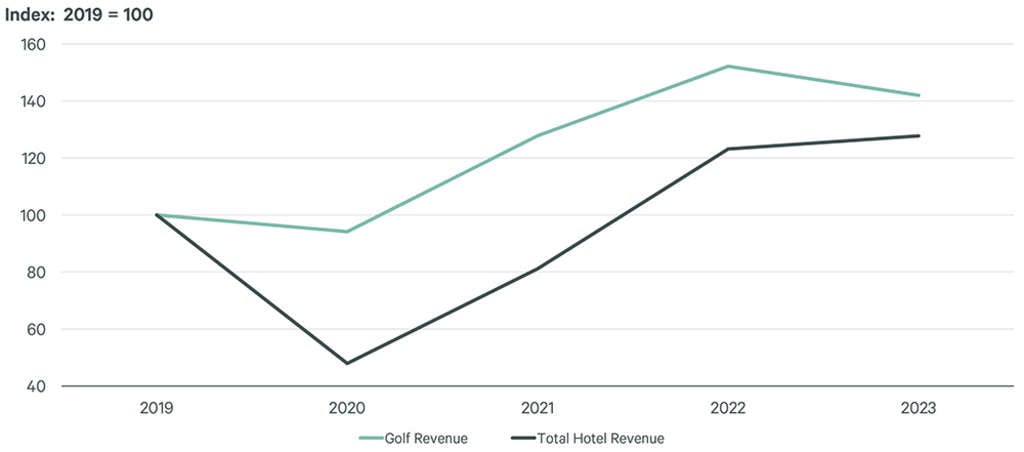

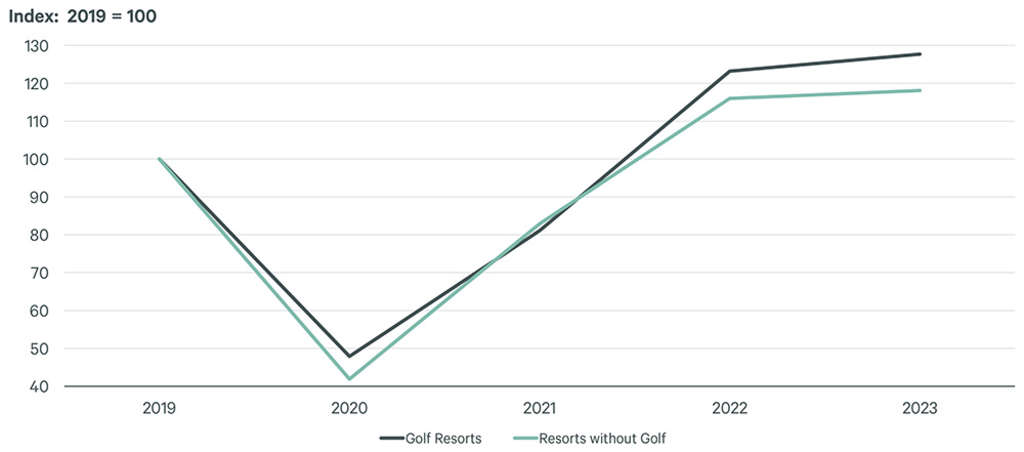

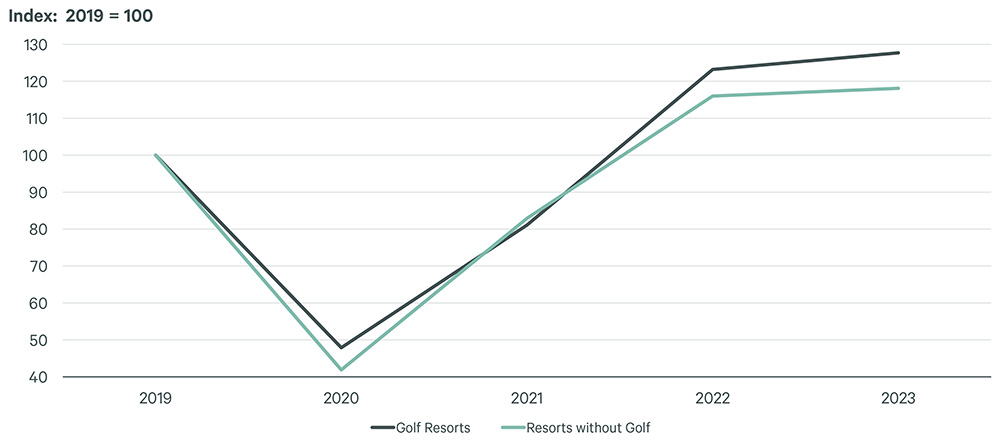

From 2019 through 2023, golf revenue at the properties in our CBRE sample measured on a per-available-room (PAR) basis increased by 42.0%, greater than the 27.7% increase in total operating revenue PAR during the same period. Golf revenue declined by just 5.9% in 2020, compared to the 52.1% falloff in total revenue, as the number of occupied rooms in the survey sample declined by 57.3% in 2020. The relative strength in golf play at hotels is consistent with the macro on-course patterns identified by the NGF during the depths of the pandemic.

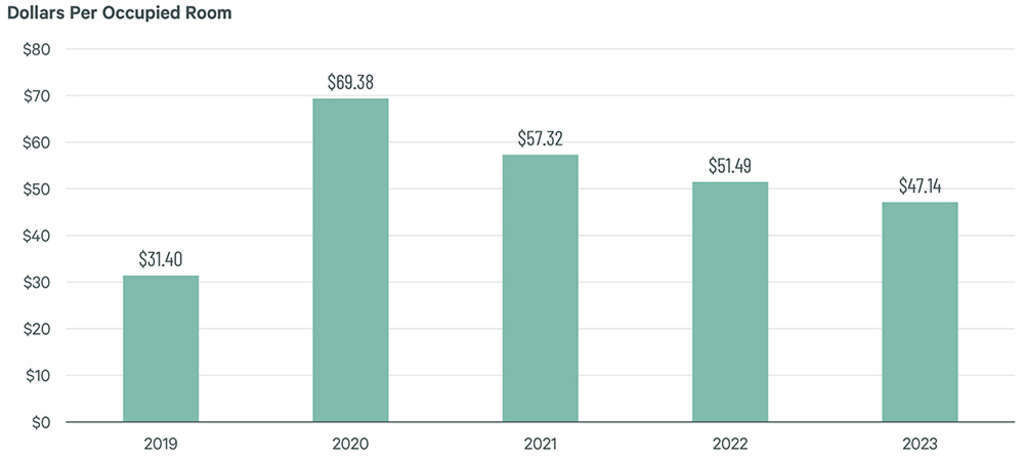

Figure 1: Indexed Golf Revenue vs Total Operating Revenue Per Available Room

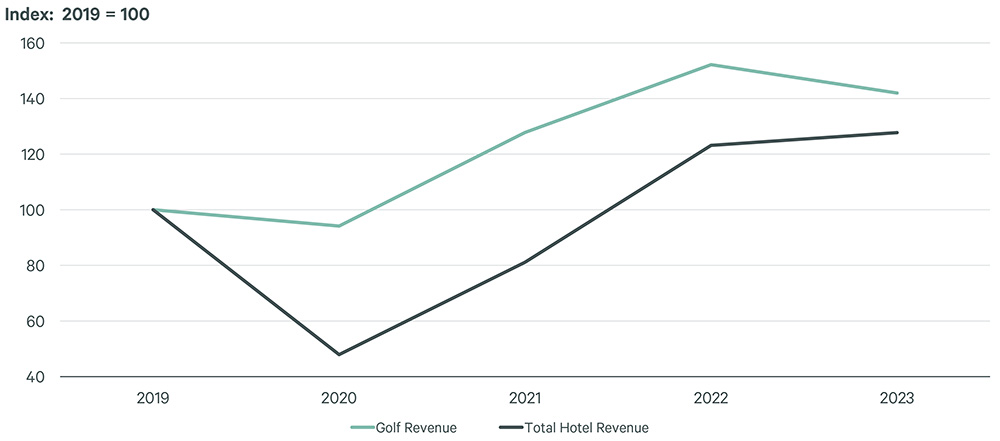

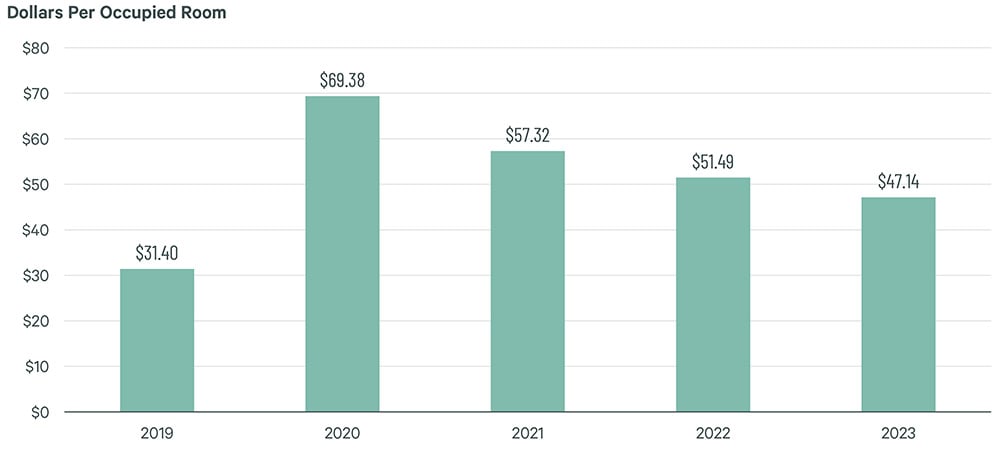

Measuring changes on a per-occupied-room (POR) basis, golf revenue increased by 50.1% from 2019 to 2023, compared to just 35.0% for total operating revenue. In 2020, golf revenue more than doubled 2019 levels on a POR basis (121% increase), while total hotel revenue POR grew by just 12.5%. The surge in golf revenue POR indicates that golfers made up a greater proportion of hotels guests in 2020, and/or an increase in non-guest on-course play from locals.

Figure 2: Golf Revenue per Occupied Room

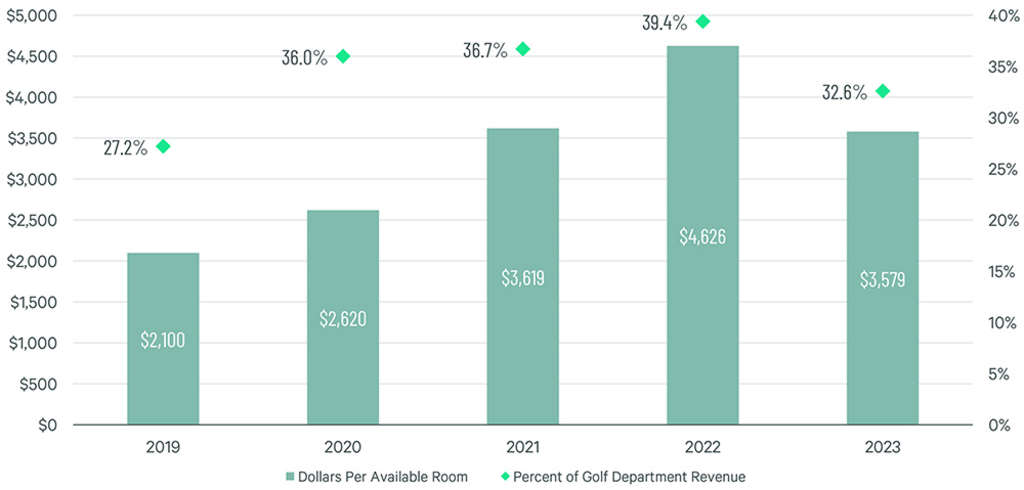

As has been noted in previous research conducted by CBRE, resort hotels in general performed relatively well during the pandemic and the subsequent recovery period. The isolated, low-density location of most resorts, along with the ability to enjoy outdoor leisure activities, was appealing to guests searching for a healthy environment.

When comparing the performance of resort hotels with golf to those without golf, once again we observed the positive influence of the sport. Golf resorts suffered less declines in occupancy, ADR, and gross operating profits compared to their non-golf counterparts in 2020 and have since exceeded pre-COVID levels of performance to a greater degree in 2023.

Figure 3: U.S. Golf Resorts vs Resorts without Golf Indexed Total Operating Revenue

Golf Profits

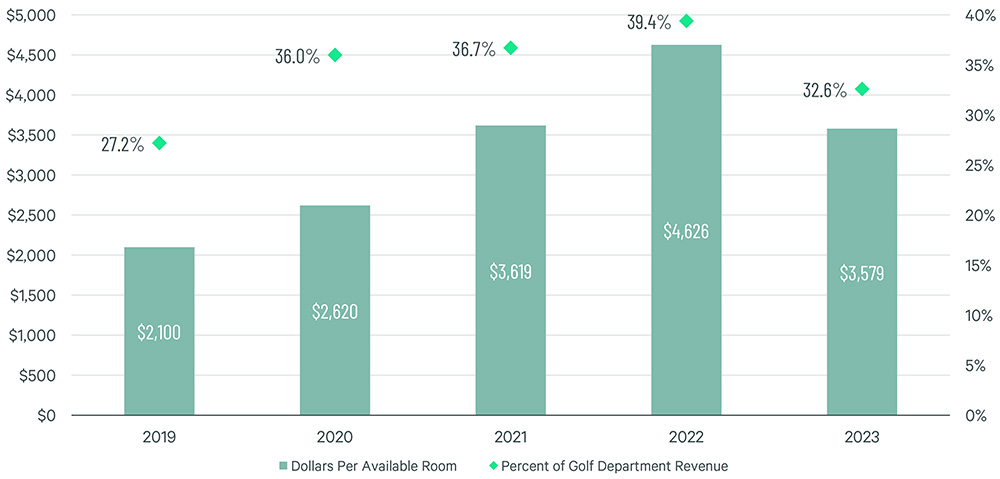

Fortunately for the owners of U.S. golf resorts, the rise in revenues has also translated into a sizeable boost in profits. While golf department revenues for the sample have increased by 42% from 2019 to 2023, golf department profits have grown by 70.4%.

With golf department revenues rising faster than direct department expenses the past five years, golf department profit margins have increased from 27.2% in 2019 to 32.6% in 2023. The increased efficiencies in operations were most evident in 2020 when golf department profits increased by 24.7%, while revenue declined by 5.9%. Such a profitable trend implies that golf resorts took advantage of the increased demand for the sport and were able to charge some price premiums during the year. There was some reversal in operating efficiencies in 2023, as the growth in golf revenues began to moderate, the cost of labor and operating supplies was on the rise.

Figure 4: Golf Department Profits

Ownership Considerations

Since the 2008 Global Financial Crisis there has been very little debt available for golf course acquisition. Therefore, when interest rates went up in 2023, golf course sales remained strong even though the resort market struggled compared to prior years. That said, during the first half of 2024, we have seen a slight slowdown on golf course sales. We attribute this to a “wait and see” attitude that real estate investors have adopted lately to counter high interest rates and the upcoming presidential election as it relates to the future of the economy.

Another trend we have seen is hoteliers considering selling off the golf component of their resort to a savvy golf course operator, but with a covenant to allow access to tee times for their guests. Resort owners are finding that they don’t have to operate the golf, they just need access to tee times, and selling off the golf component allows them to monetize a part of the property that takes a lot of time and effort to generate profits.

The Future

Looking forward, the continued growth in golf bodes well for hotels. Not only are more people expected to participate in the sport, but high barriers to entry (ex. construction costs, environmental restrictions, water considerations) will mute new course development. Standalone golf courses have always sold for below replacement cost so they must be built as an amenity to a residential development or a resort. Even with golf’s new popularity, we don’t see that trend changing.

Another trend benefiting hoteliers is the expanding diversity of golf participants. According to the NGF, 60% of all new golfers since 2019 were women. Further, growth participation levels are increasing among Black, Asian, and Hispanic golfers. In all categories, the Topgolf effect is driving more millennials, Gen-X, and even baby boomers to participate. As noted earlier, off-course participation does lead to on-course play, which in turn will result in growth in the demand for golf resorts.

Robert Mandelbaum

Director of Research Information Services

CBRE Hotels