4 Fake News about the State of OTAs post-COVID-19

With the slow reopening of international travel, most of the larger online booking platforms, led by Booking.com and Expedia, have finally decided to turn their billion-dollars marketing power engine back on. This thunderous comeback ought to put Online Travel Agencies (OTAs) back in the spotlight after a long, pandemic-induced, slumber. For the better but also for the worse.

Indeed, OTAs have been the subject of heated debates ever since their sector-wide adoption in the early 2010s. While some hotels see OTAs as a saving grace, praising the increased exposure and additional bookings, others consider them to be more of a necessary evil, with concerns being raised regarding the high commission rates and sometimes dubious customer acquisition practices. Although this age-old argument is far from being settled, the issue is worth revisiting in light of the new post-COVID-19 travel market trends.

In the past few months, multiple articles and studies have come out covering this subject often from a rather subjective standpoint, to put it mildly. These papers, sometimes directly backed by OTAs, have been spreading relatively debatable content (if not straight-up misinformation). In this article, we will cover and effectively debunk four misguided statements regarding the state of OTAs in a post-COVID-19 travel market, from their cost to their place in hotels’ channel mix, and more.

1) OTAs are just as, if not more, powerful than prior to the pandemic

Pre-coronavirus, it looked like nothing would be able to put an end to OTAs’ growing hegemony over the online travel market. Even though some hotels tried hopping on the “Return to Direct” train that emerged to win back some of OTAs’ market shares, the sheer power of Booking.com and Expedia’s marketing strategies was proving hard to compete with. Only an event of unprecedented magnitude could turn around what appeared to be an unstoppable tide. Enter COVID-19.

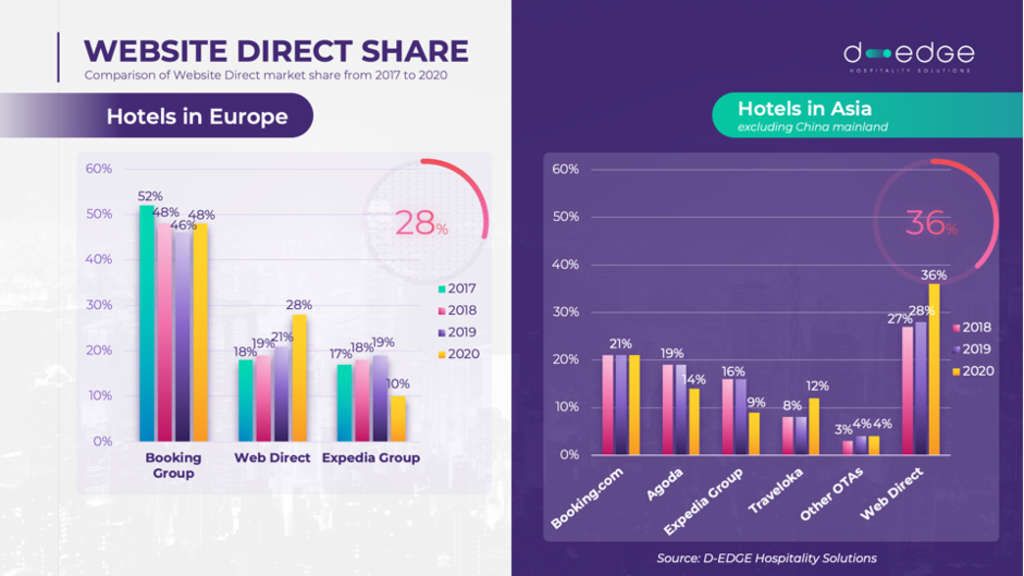

The outbreak fundamentally altered the relative balance of the online travel market. With OTAs cutting back their marketing budget, hotels had the chance to climb their way back up travel-related search engine queries. Moreover, Google recently changed their advertising features for hotels, allowing for a free listing on their travel platform as well as better chances to compete with big spenders through an improved algorithm. Finally, as lockdowns forced many people to travel within their own country’s borders, reliance on large booking platforms decreased while direct bookings surged. This trend is highlighted in the graph below from a recent D-Edge study.

All these elements combined put these once all-powerful actors in a position of relative weakness. Concurrently, several articles(OTA market share likely to increase due to coronavirus pandemic)went out of their way to show that the position of OTAs has remained very much unchanged and might fare even better than before the pandemic. For example, this study(Study reveals the increasing importance of OTA Travelers in Economic Recovery), unsurprisingly backed by Expedia Group, claims that hotels will become increasingly reliant on OTAs in a post-COVID-19 world. However, the abstract discloses that most of the surveyed travelers were interviewed prior to the pandemic (late 2019, to early 2020). Moreover, the same researchers boldly assert that “travelers are 57 percent more likely to book a hotel via an OTA than before the pandemic” mostly because leisure travel will be a big part of the recovery process. Although, as we saw when crunching the numbers for both OTAs and direct booking channels, reality tells a very different story.

2) OTAs's costs stop at the commission, which is well worth the money

Another study(Working with OTAs: The Indirect Distribution Dilemma) that recently gained a lot of traction analyzed the importance of relying on OTAs, especially Booking.com, to generate revenue. The main claim was that the volume of bookings generated by OTAs outweighed the cost of the commission. However, there are several apparent issues with this research.

In addition to being focused solely on pre-pandemic Belgian independent hotels, the study only accounted for the monetary cost of working with OTAs and failed to analyze incidental consequences. As hotels have grown to learn, the price of signing a contract with an OTA goes way beyond the commission and comes with a sway of hidden costs that indirectly weigh on hotels’ bottom line. Below is a non-exhaustive list:

- Cost of cancellations: hotels are basically forced to offer free cancellations if they want to rank well on OTAs. As a result, cancellation rates are much higher on OTAs than via hotel websites (see numbers below).

- Loss in customer loyalty: One of the main ways OTAs took over the online travel market is through their loyalty program. Indeed, in order to stifle hotels' own loyalty strategies, most OTAs do not share customer data with the hotels, even after the booking.

- Reduced image control: Within the closed environment of OTAs interfaces, hotels have drastically reduced control over their content as well as the guest experience they want to provide as compared to their own website. This can translate into a poor representation of what your hotel is trying to convey and a mismatch between customers’ expectations and reality.

- Rate parity: While it has been forbidden in some countries, rate parity is still effective in most parts of the world. This clause forces hotels to always disclose the best price available on OTAs. This obligation weighs heavily on hotels pricing flexibility and ability to promote direct bookings over third-party bookings. Especially since this rule is a one-way street, with OTAs being free to offer better rates on their platform (by cutting on their commission) to capture more sales.

We can also highlight the inherent bias related to the way the study is set up. Indeed, By 2020, most hotels with the budget and resources to have their own digital strategy are already present on Booking.com. This means that the only hotels left to compare are most likely very small hotels that mostly depend on local customers and very regional or sporadic tourism. What would be more interesting would be to compare the profits margins of the different channels of sale, accounting for all costs. (including the cost and risk management of free cancellations)

To be clear, the main takeaway from this list is not that hotels should stop working with OTAs altogether. In fact, most hotels would still benefit from the increased exposure and extra bookings that these platforms can offer. The objective of this argument was to shed light on the reverse side of the coin which is often left behind when analyzing the pros and cons of hotels partnerships with OTAs.

3) Using online marketing to drive direct bookings is more expensive than getting bookings from OTAs

Another point that is often raised to promote OTAs over direct bookings is that advocating for the former is actually pricier than simply relying on OTAs' advertising power. For example, in this short article(Direct is Not Always Best – Hotel OTA Commissions in Comparison to the Benefits They Provide), the author claims that marketing costs to drive direct bookings can be as high as 15% of the value of the sale, which is not much lower than OTAs’ commissions when accounting for the time and resources needed to run such campaigns.

Surely if this were true, there would be exactly 0 need for hotels to invest in any kind of digital marketing-related campaigns. However, the numbers reported in the aforementioned article are very much on the higher end of what hotels should aim for in terms of acquisition cost. Other studies put the numbers more around 30/40 cents per click and the cost of acquisition closer to 5%. Furthermore, even if one agrees on the 15% marketing cost, generating direct bookings would still be much more valuable than third-party bookings as it will allow the hotel to grow its customer base and eventually build customer loyalty. Besides, it is worth reminding that the cost of retention is almost 10x lower than the cost of acquisition of a new guest.

In light of this, one might ask why many hotels are still relying so heavily on OTAs to generate bookings. Probably either because of a lack of time, skills, or all of the above. Although it is almost assuredly not because it is too expensive. As Cory Chambers, VP and chief revenue officer at Hospitality Ventures Management Group puts it: “relying heavily on OTAs is the lazy person’s way out of it”. […] I just look at the OTA expense, and that’s putting a lot of money out there that you could be realizing if you did your own direct sales effort”.

4) OTAs have hotels' best interests at heart

A common pattern that we have been observing in all of the aforementioned studies is that they are trying hard to paint OTAs in a good light; as hotel’s best friends, doing everything to support them in a time of need. In reality, notably because of the pandemic, OTAs made some radical changes to their platform, often detrimental to hotels.

Mirai released a piece(What Booking.com was doing to gain market shares while we were all in lockdown) covering the latest changes Booking.com made to their platform post-COVID-19. Below is a summary of the new “features” the platform is implementing and what they mean for hotels:

- Push toward online payment: By moving towards a merchant model, Booking.com will be able to generate more cash and be given more opportunities to undercut hotels' direct rates by playing with their margin.

- New Preferred Plus Membership program: hotels can decide to offer more discounts to premium members for an extra 5% commission. This change implies an additional charge for hotels that agree to the program and less visibility for those unwilling to pay the extra fee.

- “Risk-Free” reservations: By default, hotels have risk-free reservations enabled on their account. This option gives Booking.com the option to reallocate your rooms to other guests after a cancellation while freely changing the prices, which is likely to outcompete your direct rates.

- Global sharing of your opaque (Genius) rates: By disclosing the price genius guests can pay upfront to book your hotel on Booking.com, you undermine your direct booking channels on aggregators.

Recognizing the threat direct bookings have become during the COVID-19 outbreak, Booking is actively trying to get an edge over hotels' direct acquisition strategies through these new "features". The main takeaway here is that hotels should not take everything OTAs is pushing as genuinely helpful advice. For example, notice the language used in the image below clearly promoting the sharing of your genius rates and setting it by default on hotels’ profiles. Booking.com and the likes are primarily looking after their clients and bottom line, everything else, including hotels, comes as an afterthought. Make sure you keep your eyes peeled for any new changes implemented by OTAs and always defend your interests tooth and nail.

Parting Thoughts

By drastically disrupting the state of the online travel market, the COVID-19 outbreak has given hotels a unique opportunity to take back control over their acquisition channels. With OTAs’ grasp over the industry weakened, direct bookings are slowly but surely climbing up hotels' distribution mix. However, OTAs have recently come back out of the woods seeking to reclaim these lost market shares, with little to no concern for hotels’ interests.

While OTAs will remain an important acquisition channel going forward, hoteliers should strive to keep up the momentum and continue to grow their direct bookings. Even though this might prove harder than simply listing a property on OTAs and waiting for bookings to come in, the reward will be worth it both in terms of revenue and freedom of action.

Moreover, you are not alone in the fight for a return to direct bookings. Multiple online solutions, ranging from widgets to upselling tools and personalized pricing systems can help increase conversion and convert the user traffic coming from OTAs. By complementing this technology portfolio with a solid digital marketing strategy, hotels will be more than ready to stand tall next to these giants of online distribution.

About PrivateDeal SA

PrivateDeal SA is a Swiss company created in partnership with Ecole Hôtelière de Lausanne and providing a Smart Negotiation Solution for hotels. As a cloud based system setup directly on hotels" website, PrivateDeal allows guests to propose a price for a stay in response to which it will either accept or negotiate the offer through an AI-powered algorithm. The platform assists hoteliers in increasing direct bookings while better monitoring their pricing strategy through a demand-driven approach.