How CDPs encourage direct bookings to boost a hotel’s NOI

How much are you paying in OTA commissions? We took a quick poll of the audience at NAVIGATE Miami, Revinate’s annual conference and the answers ranged from 10% to over 25%.

Yikes.

So it’s probably not surprising that OTA commissions take one of the biggest bites out of hotel profit margins. In fact, OTA commissions have been growing at more than two times the rate of guest-paid revenue, according to Kalibri Labs. This is a large contributor to the fact that while ADR and guest-paid revenue have been increasing, hoteliers’ take-home, or revenue capture, is on the decline.

As Jennifer Hill, Vice President of Commercial Strategy at Kalibri Labs, said at the same NAVIGATE event, Guests are paying more to stay in our hotels. We're keeping less.

That’s not good news for guests or hoteliers — but the OTAs aren’t complaining.

OTA commissions are a big drain on Net Operating Income (NOI), a number that hotel managers and operators need to pay close attention to. NOI is that line on the bottom of your P&L statements, next to EBITDA. NOI is calculated by taking the property’s gross operating income and other income, then subtracting operating costs among others. It’s a big deal to hotel owners because, in addition to being an important measure of profitability, it has a huge impact on asset value. And at the end of the day, asset value is what hotel owners care about the most.

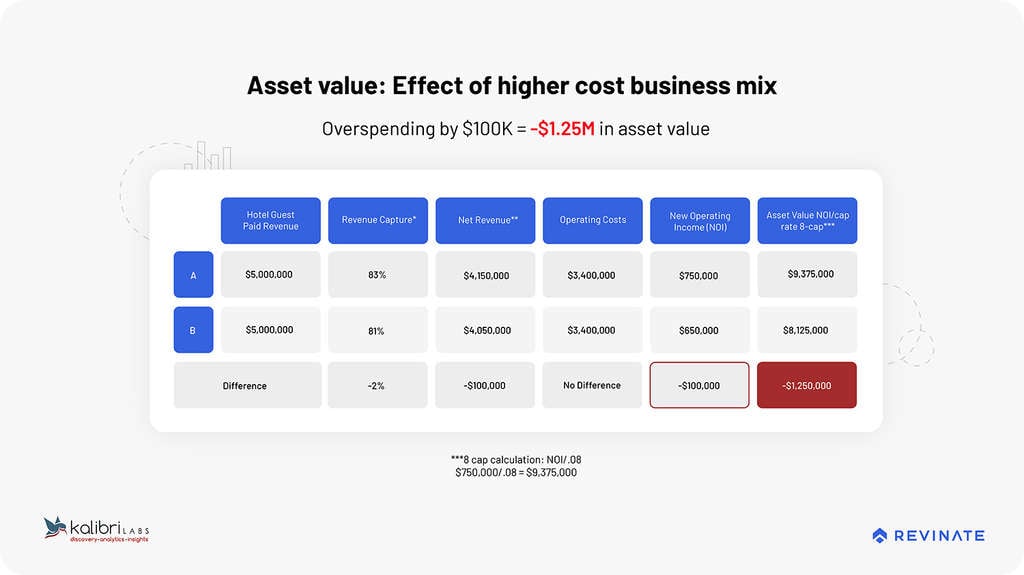

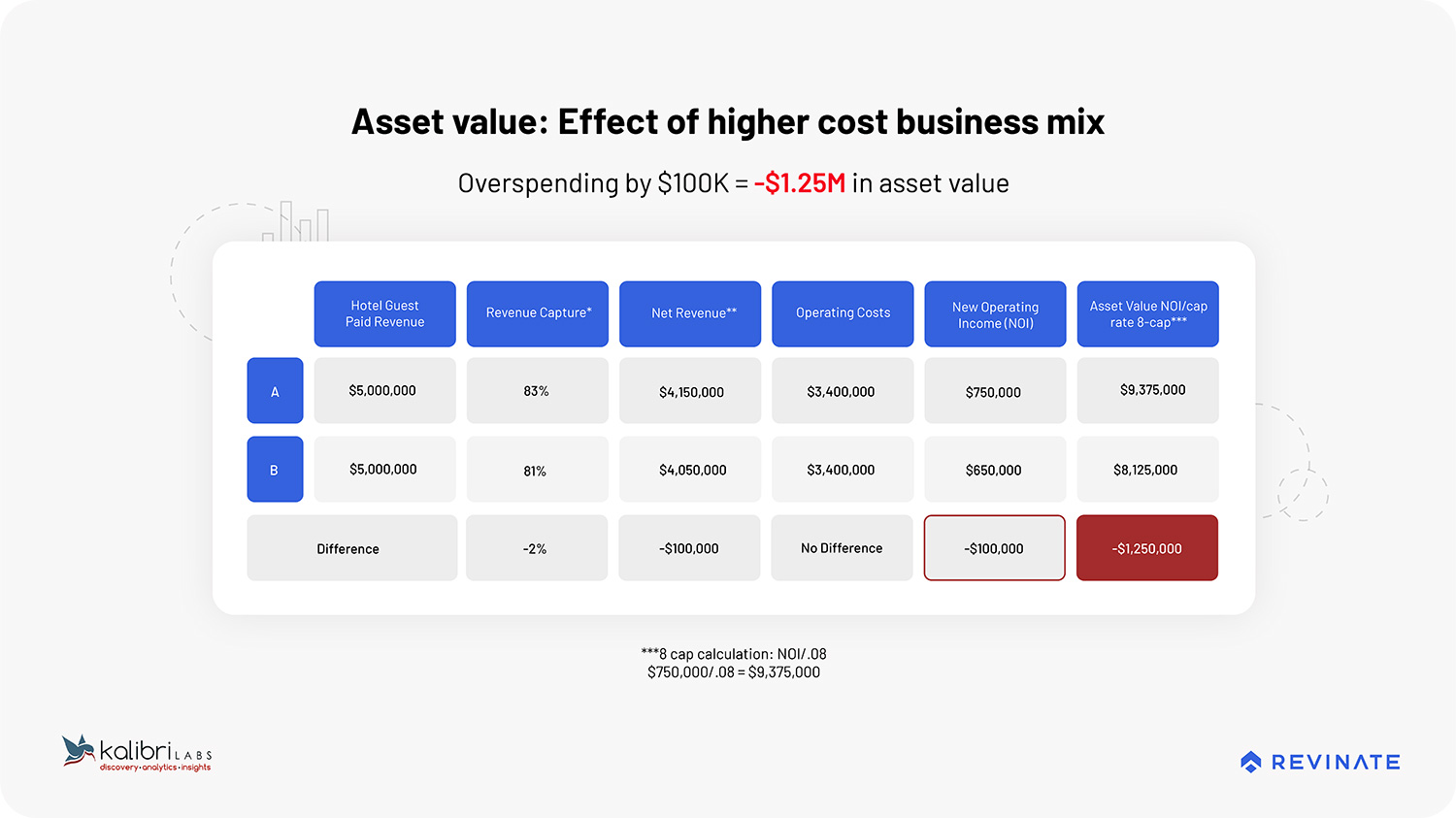

Here’s some fun math that Jennifer shared with us at NAVIGATE to show you what we’re talking about. (And if you want to learn more, check out my interview with Jennifer on the Hotel Moment podcast).

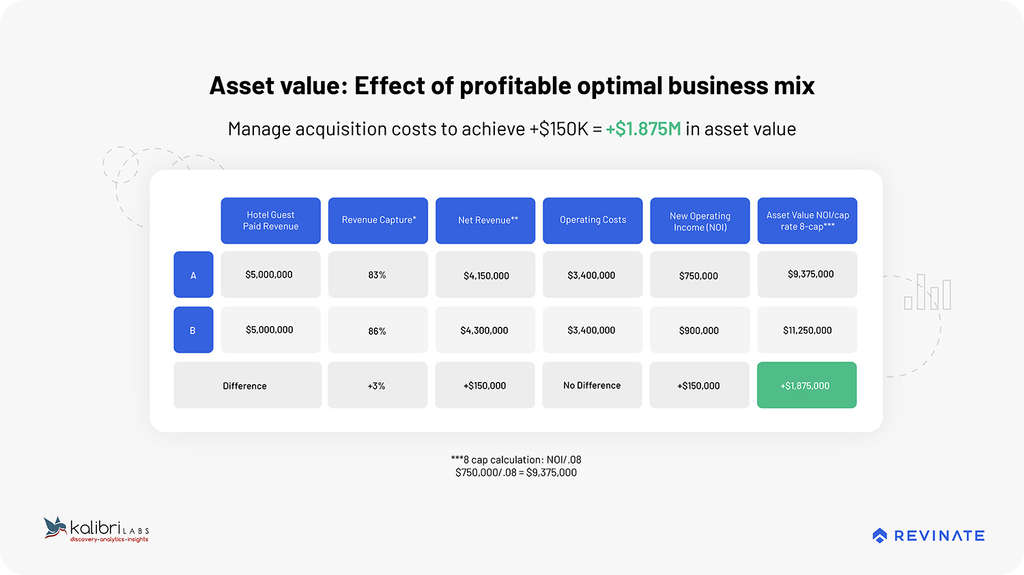

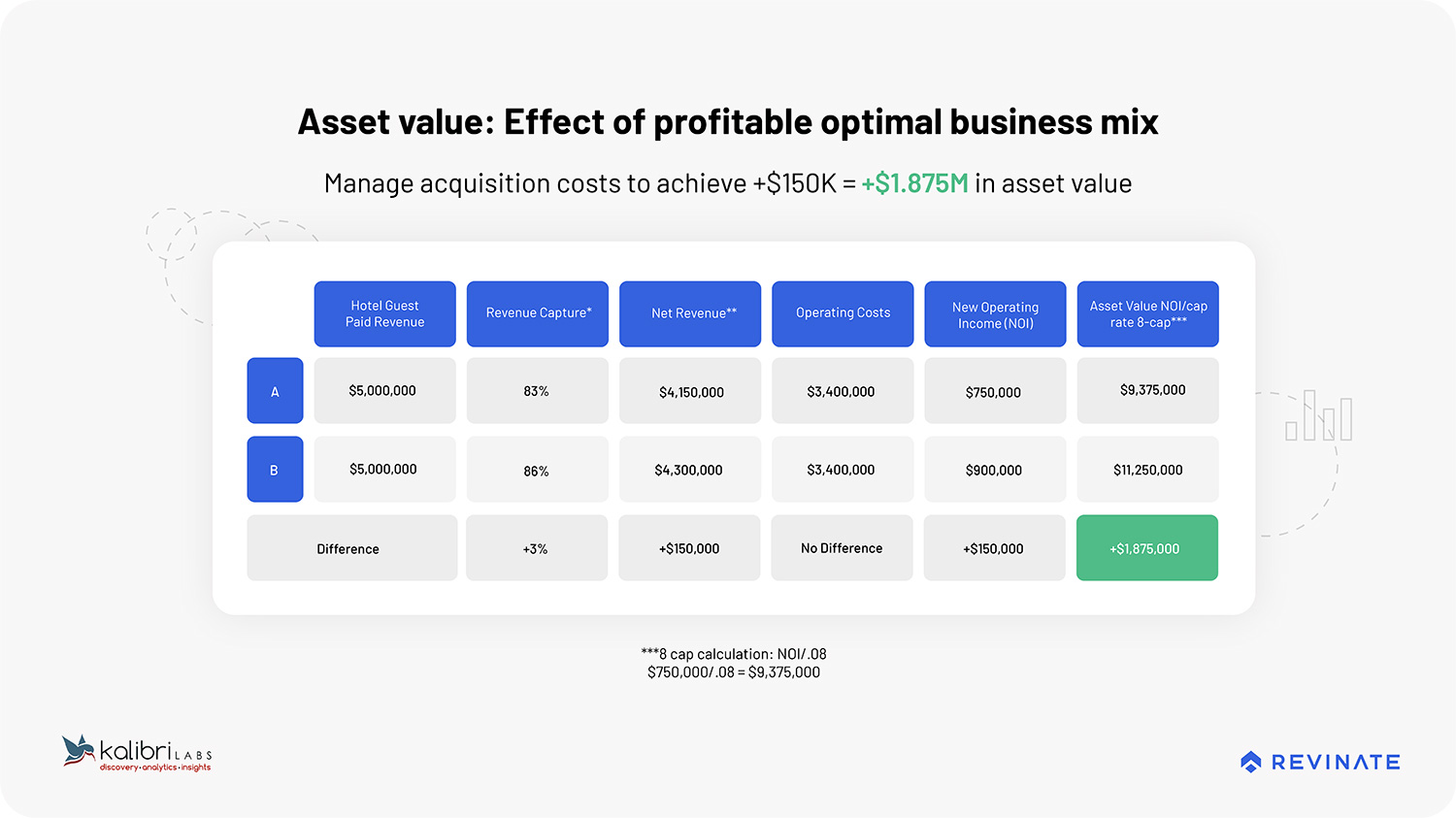

Let’s say your hotel generates $5 million in guest-paid revenue. Using benchmarks from Kalibri Labs, hotel revenue capture is at 83%, making your net revenue $4.15 million. Subtract $3.4 million in operating costs, and your NOI is $750,000.

Asset value is calculated by dividing NOI by the capitalization rate. For the purposes of this example, we’ll use a standard real estate cap rate of 8%. 750,000 divided by 0.08 equals an asset value of $9.375 million.

Let’s say your revenue capture goes down to 81% — just two percentage points. Your NOI goes down by $100k. That might not sound like a huge deal, but now the owners are mad because their asset value just went down by $1.25 million. The general manager is stressed. So is everyone else.

Now imagine the reverse scenario: You add just $150k to your NOI — up to $900k — by increasing your revenue capture rate by 3 percentage points. This adds $1.875 million to the hotel asset value, which shoots up to $11.25 million. Everyone is much, much happier.

The bottom line is that a relatively small change to NOI (in this case, $100K) has a massive impact on asset value (over $1.2M). That’s not hyperbole; that’s the math.

Understanding these numbers is at the heart of commercial strategy, which brings together the disciplines of sales, marketing, operations, revenue, and digital. This gives everyone a seat at the table so that they can focus on finding the most profitable opportunities for hoteliers.

There are a lot of ways to optimize for more revenue capture, but perhaps the most obvious is shiting share away from the high commission rates of OTAs and driving as much business as possible direct.

Guests loyal to you, not a booking channel

I’ve said it before… OTAs are like meddling matchmakers, who set you up on a first date with your guest, but then keep showing up on every outing until you ask them to leave.

But the truth is that guests date around – I mean, shop around. Even if they’re loyal to your hotel and have stayed with you several times, if an OTA has a better rate or a more convenient booking experience, that’s where they’ll book.

We see this bear out in our data. Using identity resolution ,— which employs advanced AI-powered clustering models to identify and merge individual guests in real-time as profiles sync across systems — we’ve merged nearly three million profiles of OTA bookers with their real email addresses. Over 17% of these merged profiles had two or more OTA emails associated with them. Translation? You have repeat guests who are loyal to your hotel, but not the booking channel. These are guests that you should be able to turn into direct bookers — a perfect example of the profitable opportunities that a sound commercial strategy homes in on.

So how do you win them over? You need to make them the best offer — and sure, that can mean offering the best rates. But you can also woo guests with other benefits of booking directly, like exclusive promotions, a flexible cancellation policy, modern loyalty programs, or other perks.

However, you have to be able to identify these guests in the first place. That’s where having the right technology is critical. A basic CRM can’t unmask OTA email addresses or stitch together guest profiles from multiple data sources or send personalized direct booking campaigns — you need a Customer Data Platform for that. But before we get into the weeds on technology, let’s focus on hoteliers’ real advantage against OTAs.

Hoteliers should own the guest relationship, not OTAs

OTAs might seem like tech giants that you can’t hope to outcompete, but you have something that they don’t: a relationship with your guests.

Hotels own the guest experience, devoting time and attention to each moment, from the front desk greeting to the room service menu, to the spa packages, to the golf course landscaping, and beyond. You are likely collecting and acting on guest feedback and surveys to continuously improve your service and delight each visitor. This is where hoteliers shine. Why should OTAs command such a huge proportion of the booking revenue for all of that effort?

The challenge for hoteliers has always been how to take those one-on-one guest interactions and turn them into a scaleable way to generate bookings when working with limited resources — both in budget and in staffing.

We had another commercial strategy rockstar at NAVIGATE and on the Hotel Moment podcast weigh in on this challenge — Kathleen Cullen, Executive Vice President at PTG Consulting, a top-tier hospitality consultancy and a division of Preferred Travel Group, which manages and operates thousands of the world’s most innovating and inspiring hotel brands.

When trying to drive more top-line revenue, Kathleen told me that many hoteliers fall into the trap of prioritizing the highest volume opportunities instead of the most profitable ones. And so they turn to OTAs as an easy win. However, she explained:

Direct bookings are critical. Why not invest those marketing dollars, those same dollars that you’re currently giving to third parties, and shift that investment into your own website, into your own direct booking strategy, into your own communication with the customer database that you do have? ... A lot of these things don’t require huge amounts of funds. And if you just shift some of those dollars from what you’re investing in other areas over into your direct booking strategies, that can go a lot further.

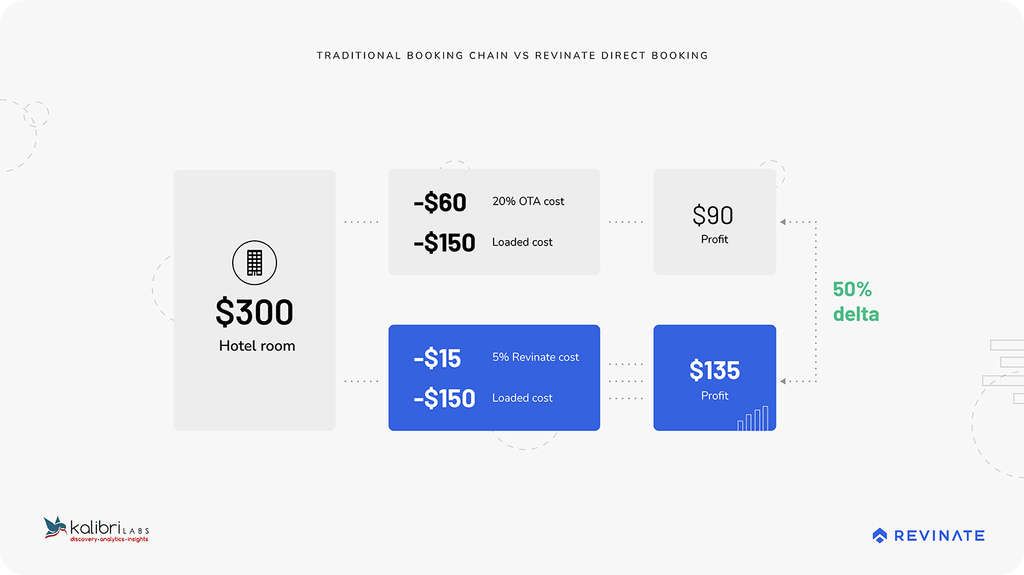

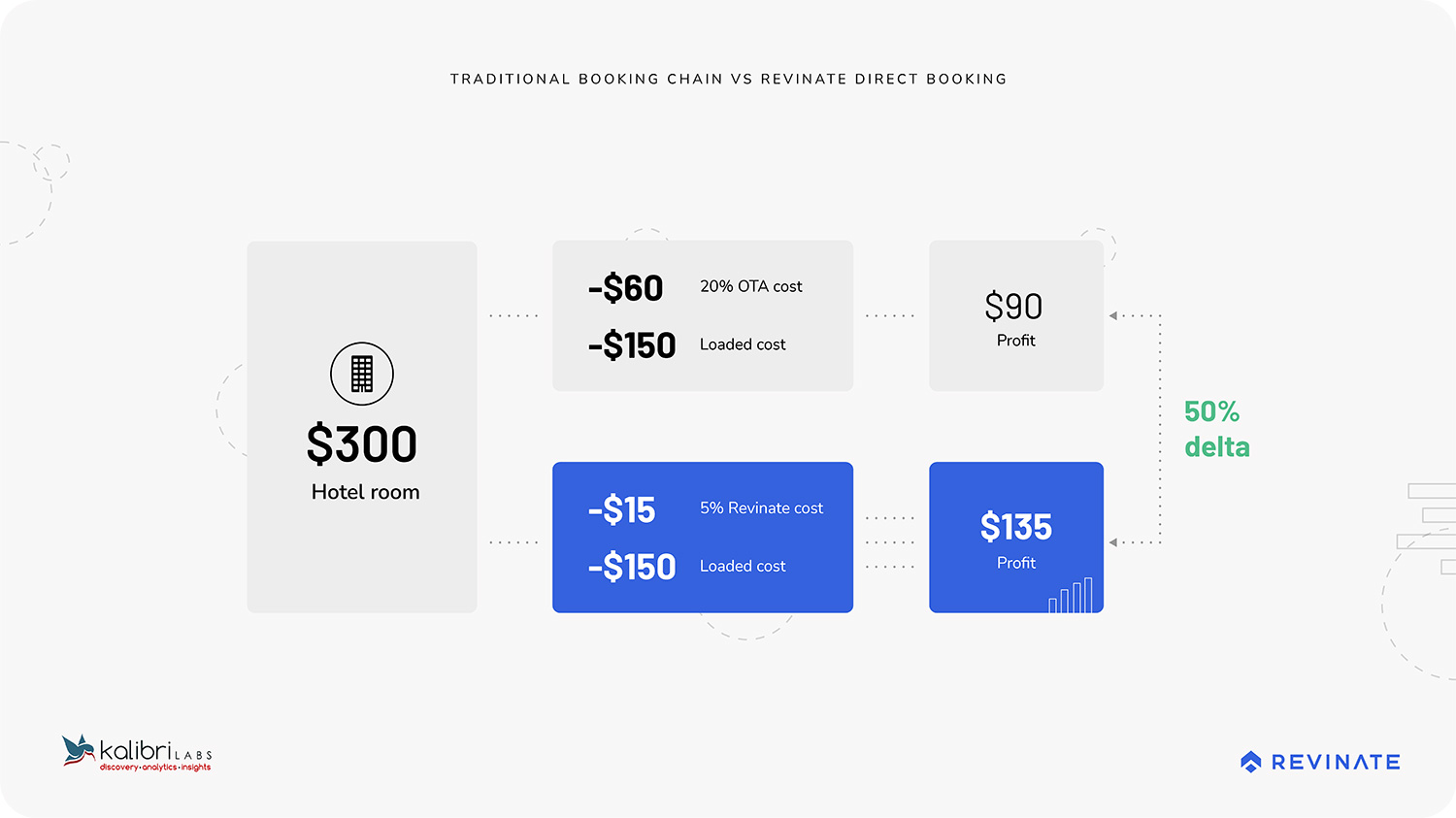

Shifting those investments from OTAs to direct channels increases your revenue capture rate. While OTAs are likely to cost you 20%, direct booking channels are likely to be closer to 5%. Consider this scenario – you’re selling a $300/night room and assume $150 in loaded costs. If the guest books with an OTA, you only net $90 in profit. If the same guest books the same room direct, thanks to your savvy email marketing, you take home $135 in profit. That’s a 50% shift to your bottom line.

Higher revenue capture means higher NOI and ultimately (stay with me here) increased asset value, ushering in all the benefits we outlined above.

Formulating a commercial plan that drives more direct bookings may sound daunting. Fortunately, all of the interactions with guests throughout their booking and stay journey are represented in data — data that you already own.

Your guest data is everywhere. There’s stay history and folio spend in your PMS, reservation agent notes in your call center software, survey responses, spending habits in your restaurant, spa, and golf systems, and more. But that data is often locked away in silos, either inaccessible to the teams that need it, or extremely laborious to isolate and export and import into different tools.

To unlock all of this precious guest data, you need a superpower. You need a CDP.

How a CDP lets you know your guests at scale

A CDP collects data from touchpoints across the guest journey, synthesizes that data into a 360-degree view of your guest, and enables you to activate that data across channels in personalized communication. A basic CRM can’t do that.

A unified guest profile is the entry point to personalization — the kind of personalization required to turn new guests into repeat ones and repeat, loyal guests into direct bookers.

Hotels everywhere are already adopting the technology needed to achieve true personalization and take back market share from OTAs — to great success. Hotel Wailea in Hawai’i is able to maintain 50%+ direct booking share by using advanced segmentation for personalized marketing communications. Triumph Hotels in NYC has reduced their OTA share by up to 20% with a similar strategy.

Developing the muscle for a direct booking operation takes time and practice, but the good news is that you can start taking small steps and grabbing that sweet low-hanging fruit without a lot of obstacles. One place to start is by automating as much personalized communications as possible.

And as you move into budget season, look for opportunities to shift investments away from OTAs and toward your direct business channels. The returns will go straight to your bottom line, your NOI, and ultimately improve your hotel’s asset value. Set the strategy, understand the math, and bring that up the next time you walk into a meeting with your hotel owners. You might get approval for the best in class platform you need to take your company to the next level. Or, you might even earn yourself a raise.

About Revinate

Revinate is a direct booking platform that leads the hospitality industry in driving direct revenue and increased profitability.

Our products and our people combine to give hoteliers the superpowers they need to crush their goals. With Revinate, hoteliers shift share away from OTAs and drive tangible results across an individual property or a portfolio. Our industry-leading, AI-powered, customer data platform collects, unifies and, synthesizes data giving hoteliers a foundational advantage.

Hoteliers gain critical intelligence – guest lifetime spend, stay preferences, ancillary revenue, and more. With our Rich Guest Profiles database, hoteliers don't need to guess who their most profitable guests are, or how to drive conversions across email, voice, messaging, and digital channels.

Revinate's direct booking platform and omnichannel communication technology powers 900+ million Rich Guest Profiles across 12,500+ hotels to drive over $17 billion in direct revenue.